Chennai: The five Southern states of Andhra Pradesh, Karnataka, Kerala, Tamil Nadu and Telangana will together get about 16 per cent share of the common tax pool designated for the 28 states in the country.

Presenting the Union Budget 2021-22 earlier this month, the Union Finance Minister Nirmala Sitharaman said that the Centre is accepting the recommendations of the Fifteenth Finance Commission and therefore will transfer 41 per cent share of the Centre-State divisible pool to states and the remaining 59 per cent flow to the Centre.

Out of this 41 per cent share, allocations between states will be made using the ‘horizontal devolution formula’ recommended by the Finance Commission, say the Budget documents.

As per this formula, Andhra Pradesh (4.047 per cent) gets the highest share in the Southern region and Kerala (1.925 per cent) gets the lowest share of the sub-pool.

The Fifteenth Finance Commission headed by N K Singh submitted its report to the President of India Ram Nath Kovind last November with recommendations that govern Centre-State financial relations for a five-year period starting from April 2021.

For the uninitiated, the Constitution of India directs the Finance Commission to make recommendations to the President of India on the manner in which the tax collections need to be divided between the Centre and State and also between the States.

The divisible pool of taxes includes all central taxes like Income Tax, Corporation Tax, customs duties, etc.

Horizontal Devolution Formula

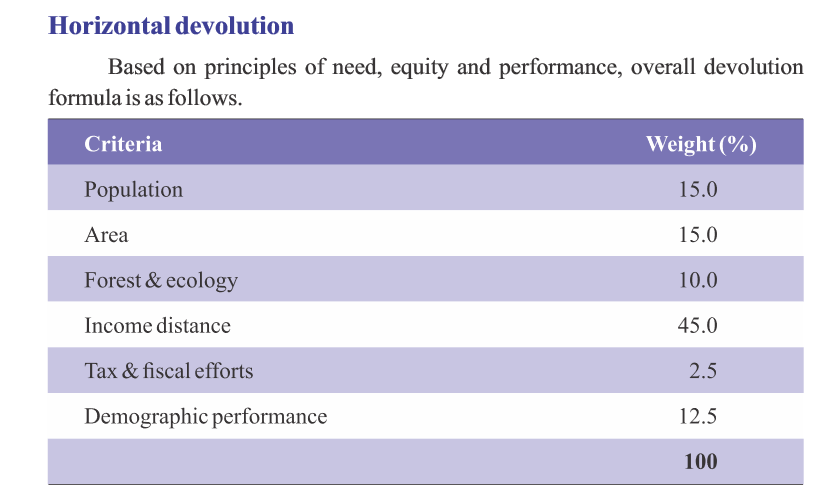

According to the Finance Commission recommendations, the horizontal devolution from the divisible pool is worked out under the formula of need, equity, and performance with the weightage for population and area being 15 per cent each, while forest and ecology accounting for 10 per cent, tax and fiscal efforts carry 2.5 per cent and the highest weightage of 45 per cent being accorded to the income distance.

Income distance is calculated as the distance of a state’s income from the state with the highest income.

Just as the report asserts, that it agrees on the fact that the Census 2011 population data better represents the present need of States, to be fair to, as well as reward, the States which have done better on the demographic front, and that it had assigned a 12.5 per cent weight to the demographic performance criterion.

To put things in perspective, the Terms of Reference(TOR) of the Commission required it to use the population data of 2011 while making recommendations.

It is pertinent to note that the previous one – Fourteenth Finance Commission used 1971 census and 2011 as its base for devolution and carried a weightage of 17.5 per cent and 10 per cent respectively for the population criterion.

The demographic performance criterion has been used to acknowledge the efforts made by states in controlling their population, and to reward the same.

States with a lower TFR (Total Fertility Rate) were scored higher on this criterion. TFR refers to the average number of children per woman in a population.

Horizontal devolution vs GDP contribution

As per the official data available for 2018-19, the five states of South India together account for nearly 30 per cent of India’s GDP.

While Andhra Pradesh contributes 4.55 per cent of the total GDP, Karnataka contributes 8.14 per cent, Kerala 4.12 per cent, Tamil Nadu 8.59 per cent and Telangana 4.54 per cent.

Whereas, as per the latest horizontal devolution formula, Andhra Pradesh gets 4.047 per cent, Karnataka (3.647 per cent), Kerala (1.925 per cent), Tamil Nadu (4.079 per cent) and Telangana (2.102 per cent) accounting for 15.8 per cent of total tax pool dedicated for states.

Top Gainers

The report recommends as much as 17.93 per cent for Uttar Pradesh which is the most populous state in the Country and the second in line is Bihar which gets 10.05 per cent share. These are the only two states across the country to get a double digit share and also accounts for nearly 28 per cent of the devolution. As per the 2018-2019 data, Uttar Pradesh contributes 8.7 per cent to the country’s GDP while Bihar contributes 2.8 per cent.

(Written by R Prince Jebakumar )