Jammu: To revive the business sector and boost investor confidence with a business-friendly environment, the Jammu and Kashmir administration has approved a series of measures for simplifying business establishment process, an official spokesman said on Sunday.

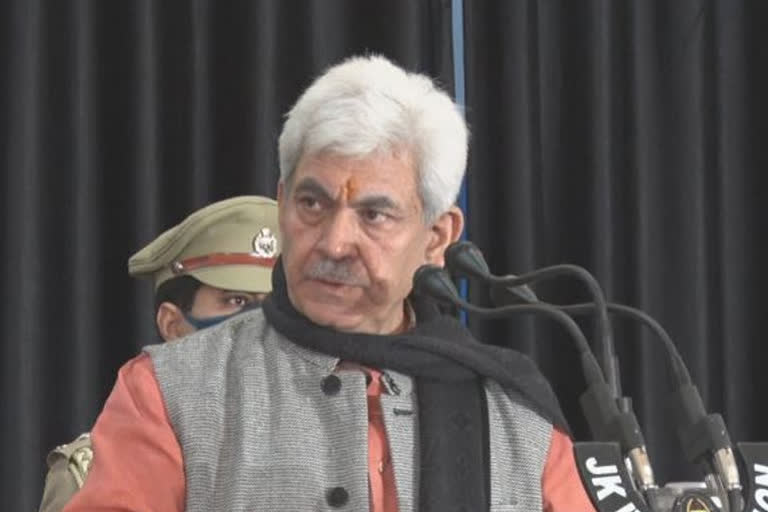

As per the decision taken by the Administrative Council (AC), which met under the chairmanship of Lieutenant Governor Manoj Sinha here on Saturday, the pre-requisite 'no objection certificates' (NoCs) or approvals have been relaxed for setting up of a business unit, the spokesman said.

He said the Udyog Aadhaar memorandum as per the condition of the Government of India would be the only requirement for a business unit to be set up.

Earlier, as many as 15 NoCs or clearances were required for a business unit to be established, which have now been reduced to a bare minimum.

"These bare minimum NoCs/approvals shall be required subsequently, for which two sets of single-window committees have been established one for business units coming up within industrial estates and another committee for units outside the industrial estates," the spokesman said.

He said these committees would ensure time-bound issuance of the NoCs or approvals pertaining to power connection, water connection and building plan as per specified timelines on a case-to-case basis.

Further, the spokesman said a divisional-level committee has been approved, which would periodically monitor the working of the committees and address issues, if any, related to issuance of NoCs or approvals.

"No pre-requisite approvals shall be required as a general rule except for NoCs/ approvals from departments like pollution control board (CTE/CTO), NoC from fire and emergency department, change of land use from revenue department, etc, wherever applicable," the spokesman said.

The lieutenant governor said consistent policy actions are being taken to encourage large-scale investment, innovation, restoring Jammu & Kashmir's advantage in resources and skilled workforce to create a business-friendly environment and drive economic growth.

"The recent decisions taken by the government in business sector including new Industrial Developmental Scheme will give a fillip to Jammu and Kashmir's economy.

"These ambitious structural reforms will not only improve J&K's ranking in the Ease of Doing Business Index but also create an unshakeable foundation for business entities, industries planning to invest in the Union Territory," Sinha observed.

The spokesperson said the UT government is consistently making efforts with reforms, and soon planning to launch end-to-end online services for the businesses.

"The regulations are being made simpler and business-friendly by the government," he said.

Also read: J&K joins hands with UK space agency's project

Last month, the Centre had approved a new Industrial Developmental Scheme with an outlay of Rs 28,400 crore to give a major push to the economy of the region and providing huge employment opportunities to the people.

The scheme is being implemented with the vision that industry- and service-led development of J&K needs to be given a fresh thrust with an emphasis on job creation, skill development, and sustainable development by attracting new investment and nurturing the existing ones.

The new Industrial Developmental Scheme will provide major support to local industry, besides creation of new business opportunities.

The scheme aims to take industrial development to the block level in the UT of J&K, which is for the first time in any industrial incentive scheme of the Government of India, and attempts for a more sustained and balanced industrial growth in the entire UT.

The new Industrial Developmental Scheme has been simplified on the lines of ease of doing business by bringing GST-linked incentive that will ensure less compliance burden without compromising on transparency.

The scheme is made attractive for both smaller and larger units. Smaller units with an investment in plant and machinery up to Rs 50 crore will get a capital incentive up to Rs 7.5 crore and a capital interest subvention at the rate of 6 per cent for a maximum of 7 years.

PTI