Stockholm: This year’s laureates in the Economic Sciences, Ben Bernanke, Douglas Diamond, and Philip Dybvig, have significantly improved our understanding of the role of banks in the economy, particularly, during financial crises. An important finding in their research is why avoiding bank collapses is vital.

Modern banking research clarifies why we have banks, how to make them less vulnerable to crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond, and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.

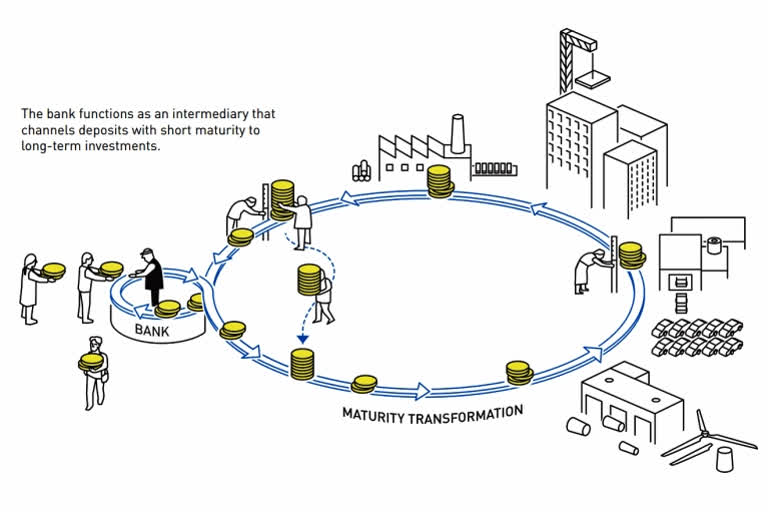

For the economy to function, savings must be channeled to investments. However, there is a conflict here: savers want instant access to their money in case of unexpected outlays, while businesses and homeowners need to know they will not be forced to repay their loans prematurely. In their theory, Diamond and Dybvig show how banks offer an optimal solution to this problem.

By acting as intermediaries that accept deposits from many savers, banks can allow depositors to access their money when they wish, while also offering long-term loans to borrowers. However, their analysis also showed how the combination of these two activities makes banks vulnerable to rumors about their imminent collapse.

If a large number of savers simultaneously run to the bank to withdraw their money, the rumor may become a self-fulfilling prophecy – a bank run occurs and the bank collapses. These dangerous dynamics can be prevented through the government providing deposit insurance and acting as a lender of last resort to banks. Diamond demonstrated how banks perform another societally important function.

As intermediaries between many savers and borrowers, banks are better suited to assessing borrowers’ creditworthiness and ensuring that loans are used for good investments. Ben Bernanke analyzed the Great Depression of the 1930s, the worst economic crisis in modern history. Among other things, he showed how bank runs were a decisive factor in the crisis becoming so deep and prolonged.

When the banks collapsed, valuable information about borrowers was lost and could not be recreated quickly. Society’s ability to channel savings to productive investments was thus severely diminished. “The laureates’ insights have improved our ability to avoid both serious crises and expensive bailouts,” says Tore Ellingsen, Chair of the Committee for the Prize in Economic Sciences.

Also read: Nobel economics prize awarded to Ben Bernanke, Douglas Diamond, Philip Dybvig for research on banks

The work for which Bernanke is now being recognized is formulated in an article from 1983, which analyses the Great Depression of the 1930s. Between January 1930 and March 1933, US industrial production fell by 46 percent and unemployment rose to 25 percent. The crisis spread like wildfire, resulting in a deep economic downturn in much of the world.

In Great Britain, unemployment increased to 25 percent, and to 29 percent in Australia. In Germany, industrial production almost halved and more than one-third of the workforce was out of work. In Chile, national income fell by 33 percent between 1929 and 1932. Everywhere, banks collapsed, people were forced to leave their homes and widespread starvation occurred even in relatively rich countries.

The world’s economies slowly began to recover only towards the middle of the decade. Before Bernanke published his article, the conventional wisdom among experts was that the depression could have been prevented if the US central bank had printed more money. Bernanke also shared the opinion that a shortage of money probably contributed to the downturn but believed this mechanism could not explain why the crisis was so deep and protracted.

Instead, Bernanke showed that its main cause was the decline in the banking system’s ability to channel savings into productive investments. Using a combination of historical sources and statistical methods, his analysis showed which factors were important in the drop in GDP, and gross domestic product. He found that factors that were directly linked to failing banks accounted for the lion’s share of the downturn.

Douglas Diamond and Philip Dybvig showed that problems can best be solved by institutions that are constructed exactly like banks. In an article from 1983, Diamond and Dybvig develop a theoretical model that explains how banks create liquidity for savers, while borrowers can access long-term financing. Despite this model being relatively simple, it captures the central mechanisms of banking – why it works, but also how the system is inherently vulnerable and thus needs regulation.

The three economists that are awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 by the Royal Swedish Academy of Sciences are Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig.

Ben S. Bernanke was born in 1953 in Augusta, GA, USA. He has done his Ph.D. in 1979 from Massachusetts Institute of Technology, Cambridge, USA. Distinguished Senior Fellow, Economic Studies, The Brookings Institution, Washington DC, USA.

Douglas W. Diamond was born in 1953. He has completed his Ph.D. in 1980 from Yale University, New Haven, CT, USA. Merton H. Miller Distinguished Service Professor of Finance, University of Chicago, Booth School of Business, IL, USA.

Philip H. Dybvig was born in 1955. He has done his Ph.D. in 1979 from Yale University, New Haven, CT, USA. Boatmen’s Bancshares Professor of Banking and Finance, Washington University in St. Louis, Olin Business School, MO, USA.