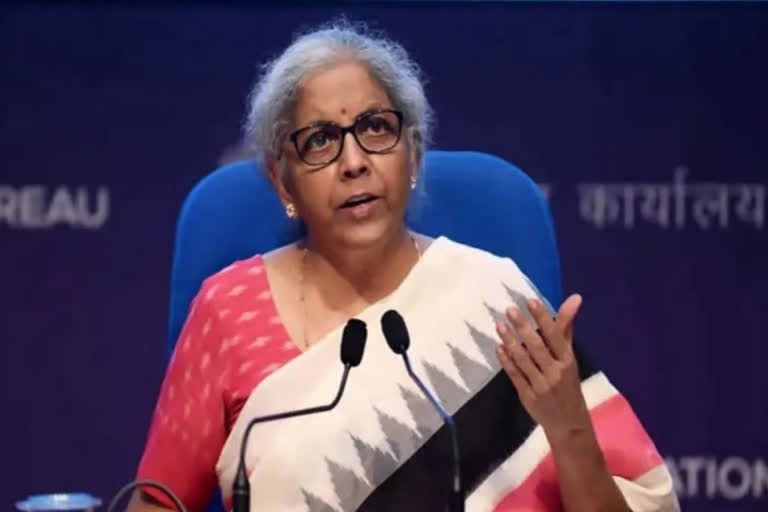

New Delhi : The 49th meeting of the GST Council is scheduled to be held here in the national capital on February 18. The GST Council meeting will be chaired by Union Finance Minister Nirmala Sitharaman. The much-awaited report by Group of Ministers on online gaming and GST appellate tribunal are unlikely to be submitted in the upcoming meeting, Central Board of Indirect Taxes and Customs (CBIC) Chairman Vivek Johri said, adding that the agenda will be circulated soon.

The 48th Meeting of the GST Council was held on December 17, 2022, through video conference. At the last meeting, the GST Council had recommended decriminalising three different types of offences, including the tampering of material evidence. They pertain to obstructing or preventing any officers in the discharge of his duties, deliberate tampering of material evidence, and failure to supply information.

The other major decision taken at the meeting was regarding the threshold limit of tax amount for launching prosecution on any criminal offence defined under the GST laws that has been increased from Rs 1 crore to Rs 2 crore. This, however, would not be applicable to those offences such as fake invoicing. Moreover, GST rates on pulses husk and knives have been reduced from 5 per cent to nil. GST on ethyl alcohol for the purpose of blending of ethanol has been exempted. Earlier, it was taxed at 18 per cent.

Goods and Services Tax was introduced in the country with effect from July 1, 2017 and states were assured for compensation for loss of any revenue arising on account of implementation of GST as per the provisions of the GST (Compensation to States) Act, 2017 for a period of five years.

For providing compensation to States, Cess is being levied on certain goods and the amount of Cess collected is being credited to Compensation Fund. Compensation to States is being paid out of the Compensation Fund with effect from July 1, 2017. (ANI)