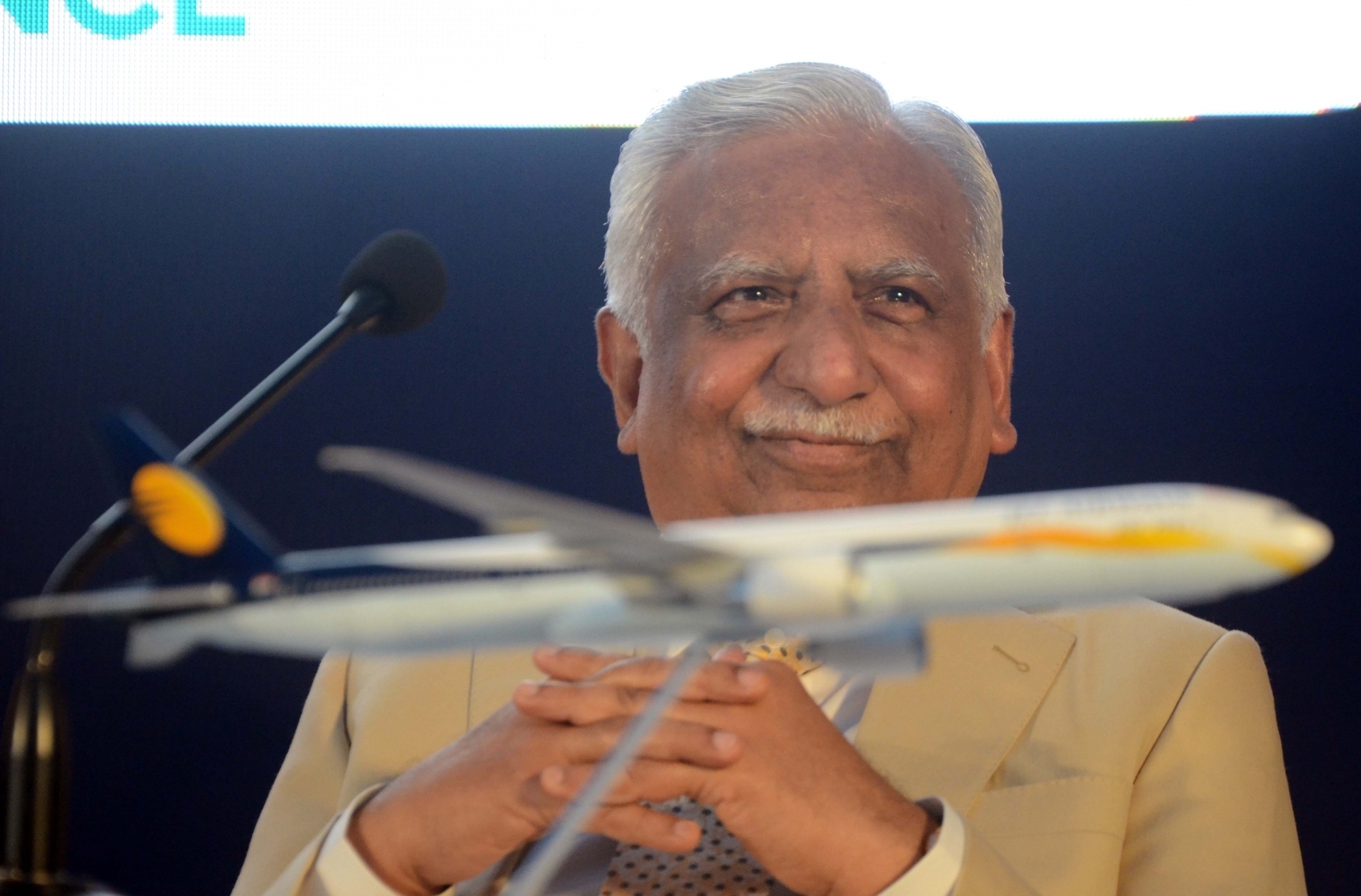

Mumbai: Jet Airways founder Naresh Goyal and his wife Anita Goyal exited from the board of Jet Airways. As per the sources, the decision was announced in an emergency board meeting held in Mumbai today. Etihad nominee director Kevin Knight also resigned from the board. Goyals' stake in the ailing airline has been reduced to 25.5% from 51% earlier.

Etihad Airways, the joint venture partner of Jet has also reduced its stake in the ailing carrier to 12% from 24% earlier. Now, lenders hold more than 50% stake in Jet Airways.

Naresh Goyal, who quitted as chairman of Jet Airways under a debt resolution plan on Monday said no sacrifice is too big for him to safeguard the interest of the airline and the families of its 22,000 employees. Goyal is also the founder of the full-service airline, which has been operating for more than 25 years.

"... no sacrifice is too big for me to safeguard the interest of Jet Airways and the families of the 22,000 employees. For the sake of my family of 22,000 employees and their respective families, I have today taken the step of stepping down from the board of Jet Airways," he said in a statement issued by the airline. He became chairman of the company in April 1992.

SpiceJet chief Ajay Singh said it was a "sad day" for Indian aviation as Naresh Goyal and his wife Anita Goyal stepping down from the board of Jet Airways.

According to industry estimates, Jet's total debt is around Rs 8,000 crore. The company urgently needs funding to maintain whatever is left of its market share, even as the full-service carrier's pilots and crew are said to be approaching other airlines for employment.

The pilots, along with engineers and other highly critical segments of employees, have not been paid salaries from January 1, and have received only 12.5 per cent of their December pay.

Read more:SpiceJet in talks with lessors for inducting planes

Aviation regulator, the Directorate General of Civil Aviation (DGCA) said that Jet Airways has only 41 aircraft in its fleet for operations, out of around 120 planes and that there may be further reduction in the fleet size and the number of flights.

On an immediate basis, lenders are expected to give Rs 750 crore to Jet Airways, which would come by pledging the airline's stake in Jet Privilege with banks. Sources said the Punjab National Bank (PNB) could be the lender in question.

Etihad was also to infuse Rs 1,600-1,900 crore for a stake of 24.9 per cent, just below the 25 per cent threshold to avoid an open offer. Lenders are expected to infuse Rs 1,000 crore and take 29.5 per cent stake, according to banking sources.

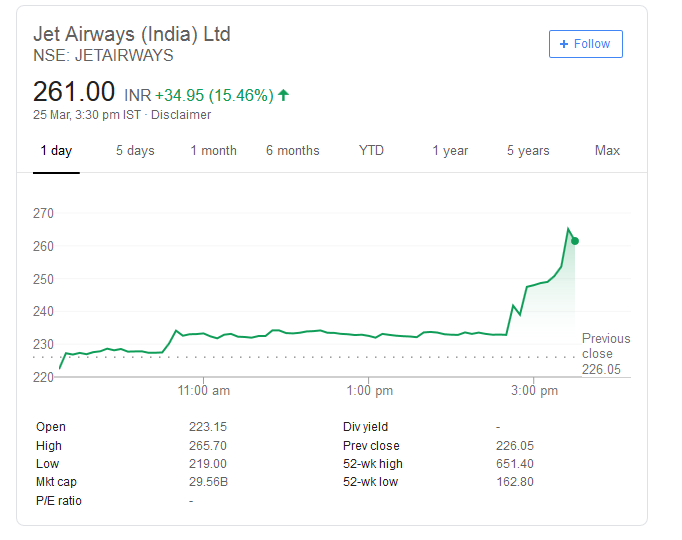

Jet Airways stocks jumped 12 per cent on Monday afternoon following reports that Naresh Goyal has quit the company's board.

Lenders to nominate two members to Jet Airways board; interim management committee to be constituted to manage airline's daily operations.

The Jet Airways Board met on Monday to decide on ways to procure interim funding and on the future role. Jet Airways can receive immediate funding of up to Rs 1,500 crore from lenders.

"This is an emergency Board meet. It is ongoing. The main agenda is to get interim funding," an airline source here said. "Goyal's future role in the Board might also come up. His exit is one of the pre-conditions set by bankers led by SBI."

(Inputs from agencies)