Mumbai: Coffee Day Enterprises on Thursday appointed Ernst & Young LLP to investigate into the circumstances leading to statements made in the letter by its late Chairman V.G. Siddhartha.

EY would also scrutinise the books of the company and its subsidiaries, Coffee Day Enterprises said in a statement.

"The Board of Directors in the meeting held on Thursday has appointed Ernst and Young LLP ('EY') to investigate into the circumstances leading to statements made in the purported letter of the former Chairman, late V.G. Siddhartha dated 27 July 2019 and to scrutinize the books of accounts of the company and its subsidiaries," the statement said.

Read more:World Bank Group to invest Rs 130 crore in Srinivasa Farms

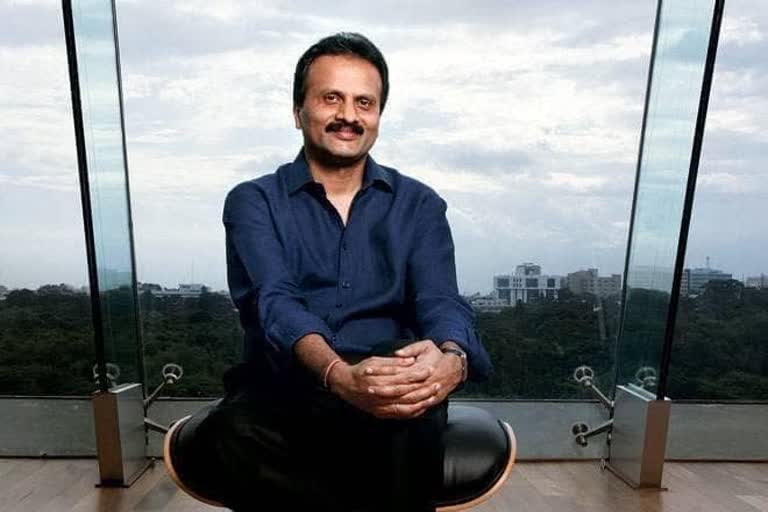

In a letter to the board before he went missing, Siddhartha had said that he was under pressure from a private equity partner who was forcing him to buy back shares, a transaction which he had partially completed six months back by borrowing a large sum of money from a friend.

"Tremendous pressure from other lenders lead to me succumbing to the situation. There was a lot of harassment from the previous DG Income Tax in the form of attaching our shares on two separate occasions to block our Mindtree deal and then taking possession of our Coffee Day shares, although the revised returns have been filed by us. This was very unfair and has led to a serious liquidity crunch," he said in the letter.

Almost 36 hours after the Cafe Coffee Day owner went missing, the police recovered his body from the Netravathi river in Karnataka early on July 31.

In Thursday's meeting, the board also has appointed Malavika Hegde as an additional member of the Executive Committee which was formed in the meeting held on July 31.