Hyderabad: Gold has come a long way from being the standard currency of the ancient world to a smart investment choice today. The recent rally in gold prices has attracted the attention of Indian investors, who are now viewing gold as a safe asset to ride out the uncertainty in the markets. You can now gain exposure to the yellow metal through several channels – both digital and physical, as explained ahead.

Physical Gold

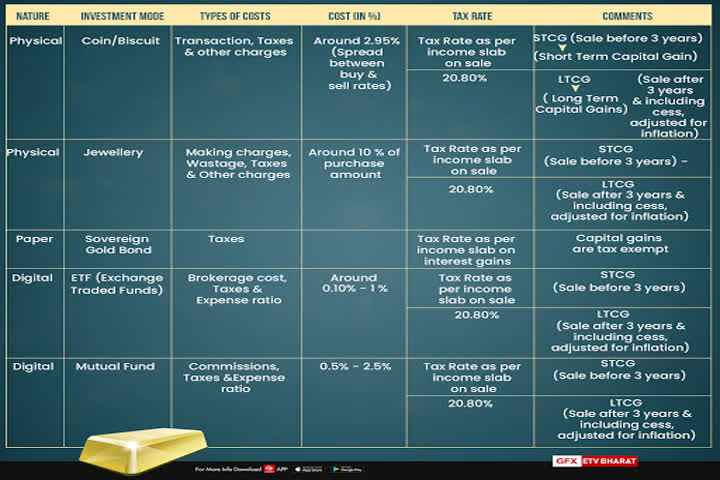

Indian households’ favourite form of gold is jewellery. The main drivers of the ornamental use are purchases during marriages & other auspicious occasions like Akshaya Tritiya. While ornaments may bring pride & satisfaction to the consumer, it is definitely not the most efficient form of investing in gold.

Jewelers & goldsmiths collect hefty making charges & wastage charges, making it expensive. A better way of investing in physical gold is through purchase of gold coins with BIS hallmark (The official Indian standard of gold purity). The gold coin options start as small as 1 gram.

This helps keep the cost of lower due to the absence of a few costs associated with jewellery. The coins are available for purchase through banks and most popular e-commerce sites, making it easily accessible. It is important to verify the authenticity of the seller & the embedded hallmark before purchase.

Read more: All you need to know about Garib Kalyan Rojgar Abhiyaan!

A lot of jewelers are offering gold based saving schemes that allow the customer to deposit a fixed amount every month for a fixed duration.

The accumulated fund can then be used for purchase of gold with the same jeweller, along with a bonus contribution from the jeweler. However, the regulatory opinion on such schemes is still unclear and it would be wise to stay away until clarity is achieved in this regard.

With the high costs of purchase & maintenance associated with physical gold, many consumers & investors are turning to digital, paper gold.

Gold Exchange Traded Funds (ETF)

A gold ETF most closely tracks the actual rate of gold in the market and is traded on the exchanges similar to stock. A demat account is hence mandatory to invest in ETFs.

The transparency in pricing & low cost makes gold ETF a popular investment option.

The costs of owning gold ETF are as follows:

- Brokerage cost: The brokers may charge a commission/brokerage for the trades placed through a demat account. DP charges also are levied on these trades.

- Expense ratio: This is the charge for managing the fund including the expense of the fund manager & the team.

The ETF might also have a tracking error, which is a small difference in the NAV price & the rate of the underlying asset. This difference is caused by the cash held by the fund & costs of management.

Gold Mutual Funds

Gold mutual funds either invest in several gold ETFs and other gold funds or in companies involved in mining or allied businesses. The expense ratio for mutual funds is higher than that of ETFs. If you are seeking a pure exposure to gold, an ETF is better as it tracks the underlying asset more closely.

It is generally difficult to find a skilled gold fund manager who can consistently out-perform the underlying asset’s performance and justify the fee. Hence, gold ETFs are popular.

Sovereign Gold Bonds

Sovereign Gold Bonds are issued by the RBI, GOI and carry a fixed interest payout along with the capital growth in gold investment. These bonds are available on subscription for limited ‘windows’ of time, generally once every few months.

The government backing and interest pay-out make it a popular investment among the investors. An issue in 2016 received over 2 lakh subscriptions.

The 5-year lock in period might also affect your financial plans. If you wish to exit an SGB investment immediately, low volumes of trade in the secondary market may curtail the sale process or end up happening at an unfavourable price.

Which is the best way to invest in gold then?

The higher cost of physical gold makes it the least attractive among all options.

A good mode of investing in gold is undoubtedly through an SIP (Systematic Investment Plan) in gold ETF, especially one with low expense ratio & low tracking error.

SGB has a significant advantage given the fixed interest payment & that the gains from an SGB are tax exempt, unlike the hefty tax on gains from ETF depending on the holding period.

The choice between SGB & Gold ETF must be made based on the tax considerations, holding period & alignment with goals.

While the allocation differs for each individual depending on personal goals & finances, the overall allocation to gold can be limited at 15%.

(Written by Sankarsh Chanda. Author runs a SEBI licensed investment advisory.)

Disclaimer: The views expressed above are solely of the author and not those of ETV Bharat or its management. Above views must not be construed as investment advice and ETV Bharat recommends readers to consult a qualified advisor before making any investment.

If you have any queries related to personal finances, we will try get those answered by an expert. Reach out to us at businessdesk@etvbharat.com with complete details.