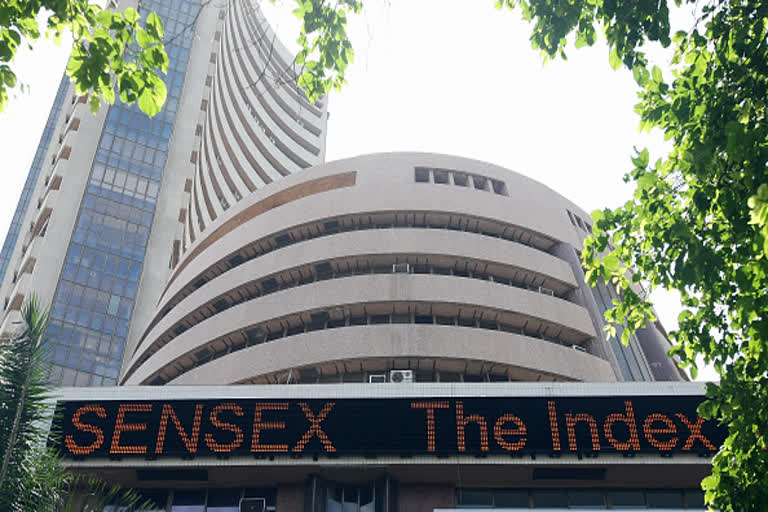

Mumbai: Benchmark equity index Sensex plummeted 587 points on Thursday, pressured by heavy selling in banking and energy stocks amid weak global cues.

Investor sentiment also tanked after Chief Economic Adviser Krishnamurthy Subramanian virtually ruled out a stimulus package from the government.

The 30-share Sensex sank 587.44 points, or 1.59 per cent, to 36,472.93. It hit an intra-day low of 36,391.35 and a high of 37,087.58.

The broader NSE Nifty ended 177.35 points, or 1.62 per cent, down at 10,741.35. During the day, it plunged to a low of 10,718.30 and touched a high of 10,908.25.

ONGC, SBI, Hero MotoCorp, ICICI Bank, Tata Steel, HDFC twins and RIL also ended in the red.

Tech Mahindra, TCS, HUL and HCL Tech were the only gainers, spurting up to 1.57 per cent.

Read More: UAE will be first Middle East country to issue RuPay card

According to traders, Chief Economic Adviser Subramanian's comments practically ruling out a stimulus package for the economy weighed on investor sentiment.

"If we basically expect the government to use taxpayers' money to intervene every time when there are some 'sunsets', then I think you introduce possible moral hazards from 'too big to fail' and as well as the possibility of a situation where profits are private and losses are socialised," Subramanian said at an event.

Globally, markets were jittery ahead of comments from Federal Reserve Chair Jerome Powell at Jackson Hole, Wyoming, US.

Elsewhere in Asia, Shanghai Composite Index and Nikkei ended on a positive note, while Hang Seng and Kospi settled in the red.

Equities in Europe were trading lower in their respective early sessions.

Meanwhile, the Indian rupee depreciated 33 paise to 71.88 against the US dollar intra-day.

Brent crude futures, the global oil benchmark, rose 0.65 per cent to USD 60.69 per barrel.