Mumbai: Returning to its pre-budget level, market benchmark Sensex zoomed 917 points on Tuesday, helped by hectic buying across the board as investors seemed relieved sensing stability in global markets.

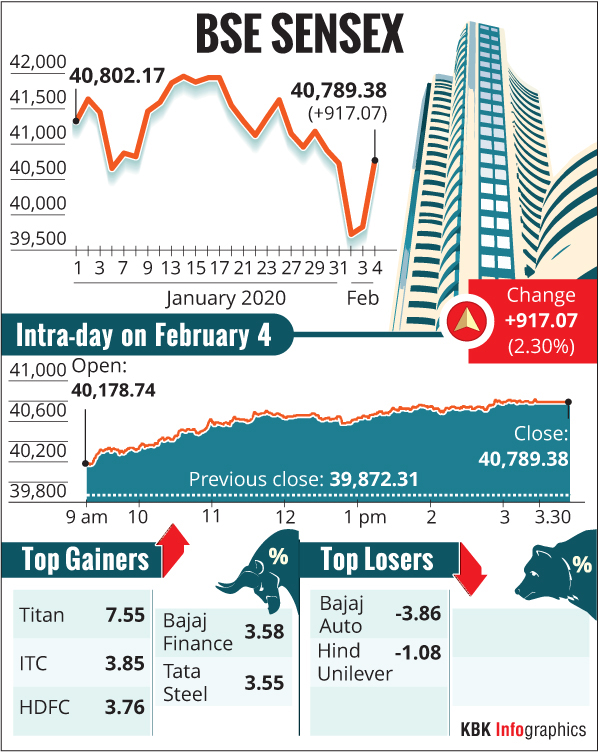

The 30-share BSE Sensex settled 917.07 points, or 2.30 per cent, higher at 40,789.38. It hit an intra-day high of 40,818.94.

Similarly, the broader NSE Nifty soared 271.75 points, or 2.32 per cent, to 11,979.65. Whereas gold prices dropped by Rs 388 to Rs 41,270 per 10 gram in the national capital.

Top gainers and losers

Titan was the biggest gainer in the Sensex pack, rallying 7.97 per cent, followed by ITC, HDFC, Bajaj Finance, and Tata Steel.

On the other hand, Bajaj Auto and HUL were on the losing side.

Analysts said efforts to contain the deadly coronavirus and a significant drop in global crude oil prices in recent days helped improve investor sentiment.

Global Market

Meanwhile, bourses in Shanghai, Hong Kong, Tokyo and Seoul settled with firm gains.

Stock exchanges in Europe too opened on a positive note.

Brent crude oil futures advanced 0.96 per cent to USD 54.97 per barrel.

On the currency front, the Indian rupee appreciated 16 paise to 71.22 per US dollar (intra-day).

Read more:SEBI welcomes Budget announcement on DDT

Gold price

Gold prices on Tuesday dropped by Rs 388 to Rs 41,270 per 10 gram in the national capital in line with sell-off in global prices and rupee appreciation, according to HDFC Securities.

Likewise, silver also fell by Rs 346 to Rs 47,080 per kg from Rs 47,426 per kg in the previous trade.

Gold had on Monday closed at Rs 41,658 per 10 gram.

"Spot gold for 24 Karat in Delhi plunged by Rs 388 in line with sell-off in global gold prices and rupee appreciation. Spot rupee was trading around 18 paise stronger against the dollar during the day," HDFC Securities Senior Analyst(Commodities) Tapan Patel said.

In the international market, gold was quoting lower at USD 1,570 per ounce, while silver was ruling flat at USD 17.73 per ounce.

"Gold prices declined as global markets bounced back with stable Chinese indices after China central bank infused liquidity," he added.

Investor wealth

Investors' wealth increased Rs 3.57 lakh crore in two days of market rally.

Recovery in the market led to a rise in market capitalisation of the BSE-listed firms which climbed Rs 3,57,044.43 crore to Rs 1,56,61,769.40 crore since Saturday.

(-A PTI Report)