Sensex, Nifty hit lower circuit; trading halted for 45 minutes

Mumbai: Equity benchmark Sensex plummeted over 3,200 points and the broader Nifty sank near 8,600 level, hitting their lower circuit limits, in opening session on Friday as coronavirus pandemic-led recession fears fuelled worldwide panic.

Stock exchanges have halted trading for 45 minutes.

Manic selling across the globe rendered stocks at multi-year lows.

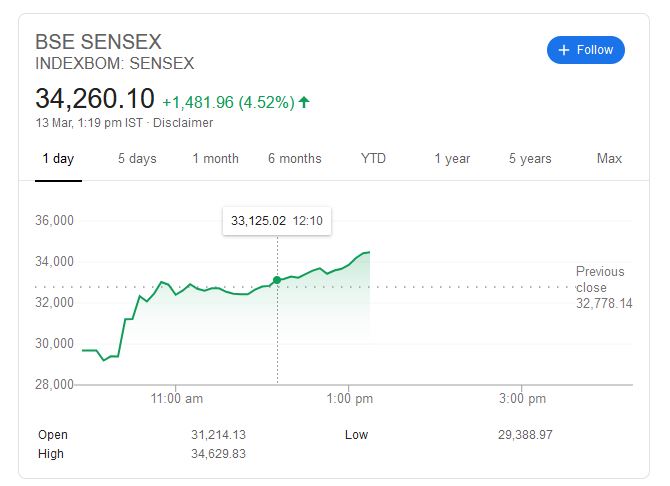

Continuing its downward spiral, domestic BSE Sensex sank 3,213 points in early trade, plummeting 10.86 per cent to 29,564.58, which triggered the lower circuit limit.

Similarly, the NSE Nifty cracked 966.10 points, or 10.07 per cent, to 8,624.05.

In the previous session, the 30-share BSE barometer settled 2,919.26 points or 8.18 per cent lower at 32,778.14, and the broader Nifty slumped 868.25 points or 8.30 per cent to close at 9,590.15.

On a net basis, foreign institutional investors sold equities worth Rs 3,475.29 crore on Thursday, data available with stock exchanges showed.

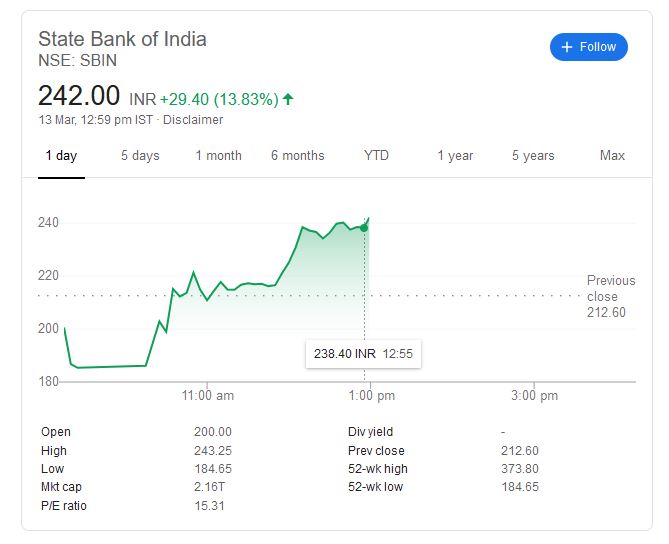

All Sensex components were in the red. HCL Tech was the top loser, tanking up to 15 per cent, followed by Tech Mahindra, Kotak Bank, TCS, IndusInd Bank, Axis Bank and NTPC.

According to traders, volatility heightened in global markets as benchmarks world over went into panic mode, insinuating a freakish selloff.

Wall Street lost 10 per cent in its worst session since 1987, while London also had its worst day since that year.

Frankfurt had its blackest day since 1989, the year the Berlin Wall fell, while Paris suffered its worst one-day loss on record.

Besides selloff in global equities, choppiness in international oil prices and depreciating rupee added to investor concerns, they added.

The rupee depreciated 13 paise to 74.41 per US dollar (intra-day).

Brent crude oil futures dropped 0.90 per cent to USD 32.92 per barrel.

Further, incessant foreign fund outflow also spooked market participants, traders said.

Elsewhere in Asia, bourses in Shanghai dropped over 3.32 per cent, Hong Kong 5.61 per cent, Seoul 7.58 per cent and Tokyo cracked up to 7.97 per cent.

More than 130,000 cases of the novel coronavirus have been recorded in 116 countries and territories, killing at least 4,900 people.

The number of coronavirus patients in India has risen to 74, as per health ministry log.

(Inputs from agencies)