Company: Happiest Minds Technology Ltd

Initial public offering (IPO) date: 7th September, 2020 to 9th September, 2020

Price band: INR 165-166 per equity share

Lot size: Minimum of 90 equity shares and in multiples thereafter

Issue size

- INR 110 crores with an offer for sale up to 3.56 crores equity shares

- Ashok Soota, who holds almost 49% of the company's shares (62% with his family), will offer 8,414,223 equity shares, while JP Morgan CMDB II will exit its investment by selling 27,249,362 shares.

Date of allotment of shares: 15th September, 2020

Listing date: 17th September, 2020

Purpose of listing: The company proposes to utilize the net proceeds from the issue to meet the long-term working capital requirement and general corporate purposes.

Business Description

Happiest Minds is an IT consulting and product engineering services company. It is headquartered in Bangalore, India, and has its operations in the United States, United Kingdom, Canada, Singapore, and Australia.

The company’s business has three units:

Digital business services provides digital application development and application, enabling automation and IoT led capabilities, assisting in design and testing of operations and management of platform & other consulting and domain-led offerings.

Product engineering services helps product company customers to materialize their ideas, from building scalable MVP to testing the market to build the product by leveraging emerging technologies. This also includes platform engineering, device engineering & Quality engineering.

Infrastructure management & security services unit provides DC & Hybrid Cloud Services, workspace Services, Service Automation (ITSM & ITOM), Database & Middleware Services & SD Network Services.

The revenue and profits of the company have steadily grown between FY 2018-20. The expected rates of future growth may not necessarily be in line with the historical ones. It is safer to remain conservative with such assumptions when considering investment.

The company’s income is well diversified across industry groups, which is critical to ensuring steady revenues:

In the recent years, the company has brought its debt down to INR 63.1 crore (As of 15 May 2020). As a result, its finance cost in FY2020 stood at just INR 8 crore, reflecting a 50% reduction from the previous year.

Promoter & Investors

Happiest Minds was founded in April 2011 by Ashok Soota. Ashok Soota has an experience of over three decades in the IT industry serving as the president of 'Wipro Infotech' from 1984 to 1999 & also co-founding 'Mindtree', which was eventually acquired by L&T.

Later in 2011, Ashok co-founded 'Happiest Minds'. The company now has more than 170 customers globally. The company has significant investment from private equity players like Intel Capital & J. P. Morgan Asset Management. Recent reports also suggest that the company has raised over INR 316 crores from 25 anchor investors including several mutual funds.

Important tip: Investments by reputed individual or institutional investors does not mean that an investment is good. An investment is considered by good primarily by the merit of its underlying business and potential for growth.

Risk analysis

High revenue concentration on US-based clientele’

As of 2020, 77.5% of revenue came from US based clientele’. This revenue concentration may negatively affect business revenues and profitability. Any policy changes by the U.S.A. government can hamper the outsourcing revenues severely.

Premium valuation

In the Rs 165-166 price band, the issue is seeking a multiple of 26.76 times FY20 earnings per share. The company has priced its shares richly and at a premium to its industry peers.

Lack of strong moat

The company’s primary business is the legacy IT solution driven by outsourcing by foreign clients. This is a very competitive and crowded space across the world and witnessing steady margin pressure currently, which is expected to deepen over the long term.

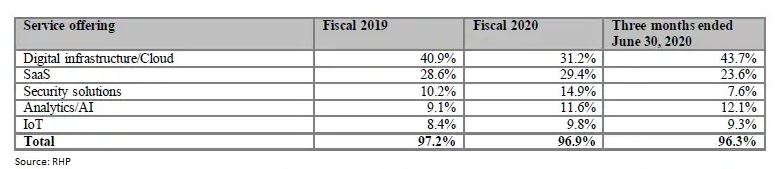

The company has made progress in verticals like AI & Internet of Things (IoT), but it is insignificant to the overall size of the company at the moment.

Conclusion

It is important to note that there are many aspects of a business that must be considered before making an investment. It is very popular among retail investors to invest in IPOs because of the myth that all IPOs are a source of quick profits. The general tendency is to try and book the lucky, quick gains on listing and worry about the research later. Just because the company is getting listed at the moment does not mean that it is cheap. This myth is very dangerous to the financial health of the investors.

The decision to invest in an IPO is no different from the research process followed for an investment in the secondary market.

Note: The business unit details & all the visuals above have been taken from the DRHP/RHP (Draft Red Herring Prospectus) filed by the company.

(Written by Sankarsh Chanda. Author runs a SEBI licensed investment advisory.)

Disclaimer: This write-up is only an opinion of the author and must not be construed as a recommendation neither personally nor of Savart (Svobodha Infinity Private Limited and not those of ETV Bharat or its management. Above views must not be construed as investment advice and ETV Bharat recommends readers to consult a qualified advisor before making any investment.

If you have any queries related to personal finances, we will try get those answered by an expert. Reach out to us at businessdesk@etvbharat.com with complete details.