Gold prices rally Rs 455 on rupee depreciation, global cues

Gold prices on Monday jumped by Rs 455 to Rs 41,610 per 10 gram in the national capital amid rupee depreciation and recovery in global prices, according to HDFC Securities.

In the previous trade, the precious metal had closed at Rs 41,155 per 10 gram.

Silver prices, however, dropped by Rs 1,283 to Rs 40,304 per kg from Rs 41,587 per kg in the previous trade.

"Spot gold for 24 karat in Delhi was trading up by Rs 455 with rupee depreciation and recovery in global gold prices. The spot rupee was trading around 36 paise weaker against the dollar during the day," HDFC Securities Senior Analyst (Commodities) Tapan Patel said.

In the global market, gold was quoting with gains at USD 1,539 per ounce, while silver was trading flat at USD 15.65 per ounce.

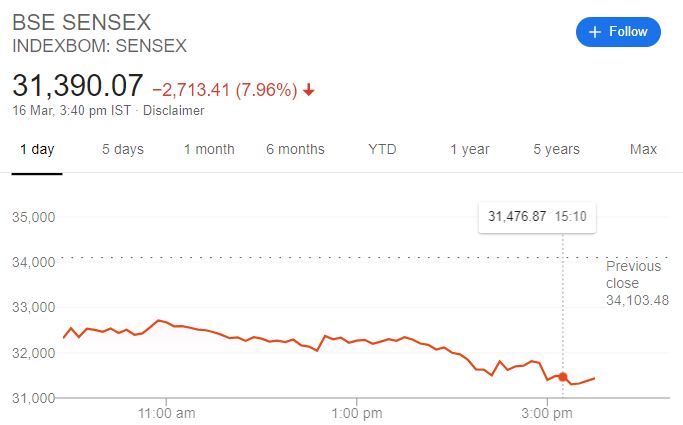

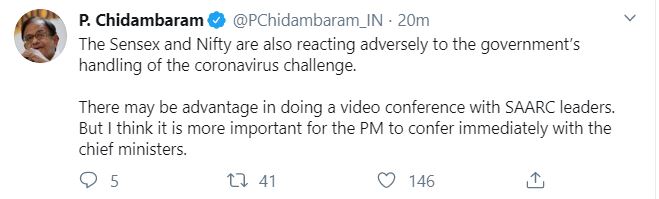

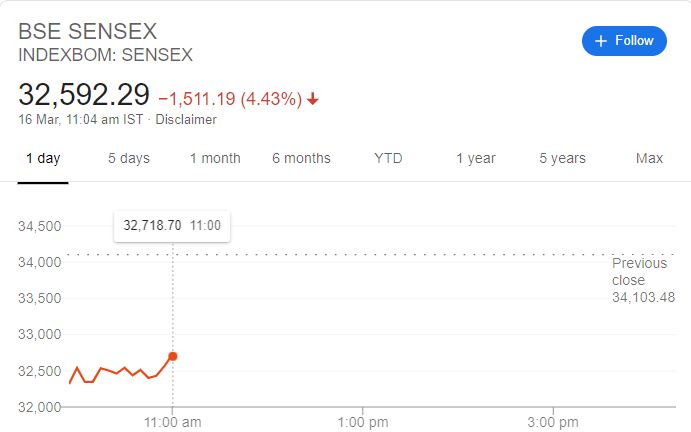

Domestic equity benchmark Sensex plummeted over 2,700 points on Monday as the impact of Covid-19 on world economy prompted investors to go for safe haven assets.

According to Navneet Damani, VP – Commodities Research, Motilal Oswal Financial Services, "Gold prices rose nearly 3 per cent, following a steep decline in the previous session, as the dollar and global equities fell sharply."