New Delhi: Union government has paid a whopping Rs 1.65 lakh crore to States as GST compensation dues in the last financial year against the GST compensation collection of Rs 95,444 crores, ministry of finance said on Monday.

According to the latest official data released on Monday, the Centre also paid Rs 13,806 crores to States in GST Compensation dues for March 2020.

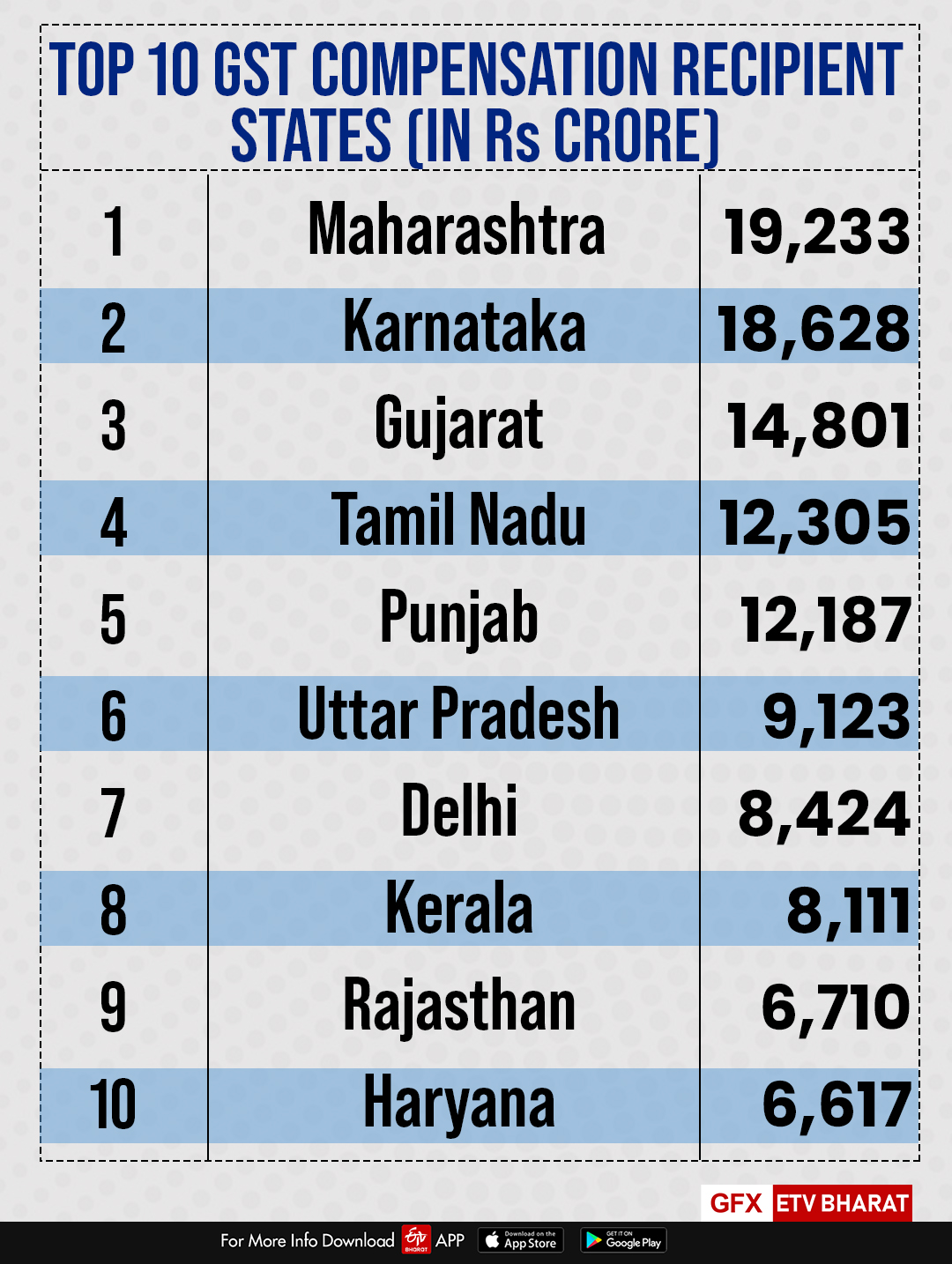

Maharashtra was the biggest recipient of GST Compensation Dues in FY 2019-29 with the net receipts of Rs 19,233 crores, followed by Karnataka (Rs 18,628 crores), and Gujarat (Rs 14,801 crores).

Tamil Nadu and Punjab also received over Rs 12,000 crores in GST compensation last year, Rs 12,305 crores and Rs 12,187 crores respectively. These top five states are followed by Uttar Pradesh (Rs 9,123 crores), Delhi (Rs 8,424 crores), and Kerala (Rs 8,111 crores), Rajasthan (Rs 6,710 crores) and Haryana received Rs 6,617 crores.

Under the GST Compensation Act of 2017, the Union government is under legal obligation to compensate States for any loss in their revenue collection for five years.

The amount of compensation is calculated by taking into account the projected 14% year-on-year growth over the base year of FY 2015-16.

In FY 2017-18, the Centre has paid Rs 62,956 crores as GST compensation dues to states, which went up to Rs 95,081 crores in FY 2018-19, a jump of over 51%.

However, the GST Compensation payments to states registered an even sharper hike in the last fiscal as it went up by over Rs 70,000 crores, an increase of 73% over the money paid during FY 2018-19.

How Centre managed funds to pay GST Compensation in FY 2019-2020

Due to a variety of reasons and a slowing economy, the Centre and States both faced severe revenue constraints in FY 2019-20 and the adverse economic impact of Covid-19 global pandemic further hit the revenue collection during the last two months of the previous fiscal.

As a result, the union government’s GST compensation cess collection was short of Rs 69,858 crores against the GST Compensation Dues of Rs 1,65,302 crores.

Read more:Sharp V-shaped economic recovery in Q3, Q4: N K Singh

In order to make up the shortfall of Rs 69,858 crores, the Centre utilized the balance of cess amount collected during FY 2017-18 and FY 2018-19.

However, that was not enough to meet the massive shortfall as the centre’s GST cess collection in the last fiscal has been pegged at only Rs 95,444 crores, nearly Rs 70,000 crore less than the required amount.

In order to meet the shortfall, the Centre also transferred Rs 33,412 crores from the Consolidated Fund of India as a part of an exercise to apportion balance of IGST pertaining to 2017-18.

Five States did not receive any GST Compensation in FY 19-20

Five states Arunachal Pradesh, Manipur, Mizoram, Nagaland and Sikkim did not receive any amount under the GST compensation dues in FY 2019-20.

It means revenue growth in these states from their own sources were either 14% or more than the revenue collected during FY 2018-19.

While Andhra Pradesh received Rs 3,028 crores in GST compensation in the last fiscal, Assam received Rs 1,284 crores, Bihar (Rs 5,464 crores), Chattisgarh (Rs 4,521 crores) and Goa received (Rs 1,093 crores).

Himachal Pradesh received Rs 2,477 crores, Jammu & Kashmir (Rs 3,281 crores), Jharkhand (Rs 2,219 crores).

While the centre paid Rs 6,538 crores to Madhya Pradesh, Meghalaya received Rs 157 crores, Odisha (Rs 5,122 crores), Puducherry (Rs 1,057 crores), Telangana (Rs 3,054 crores), Tripura (Rs 293 crores), Uttarakhand (Rs 3,375 crores), and West Bengal (Rs 6,200 crores).

(Article by Krishnanand Tripathi)