Mumbai: Reserve Bank of India Governor Shaktikanta Das headed six-member rate-setting panel started its three-day brainstorming meeting on Tuesday in the backdrop of Union Budget projecting a widening of fiscal deficit amid slowing economy and hardening inflation.

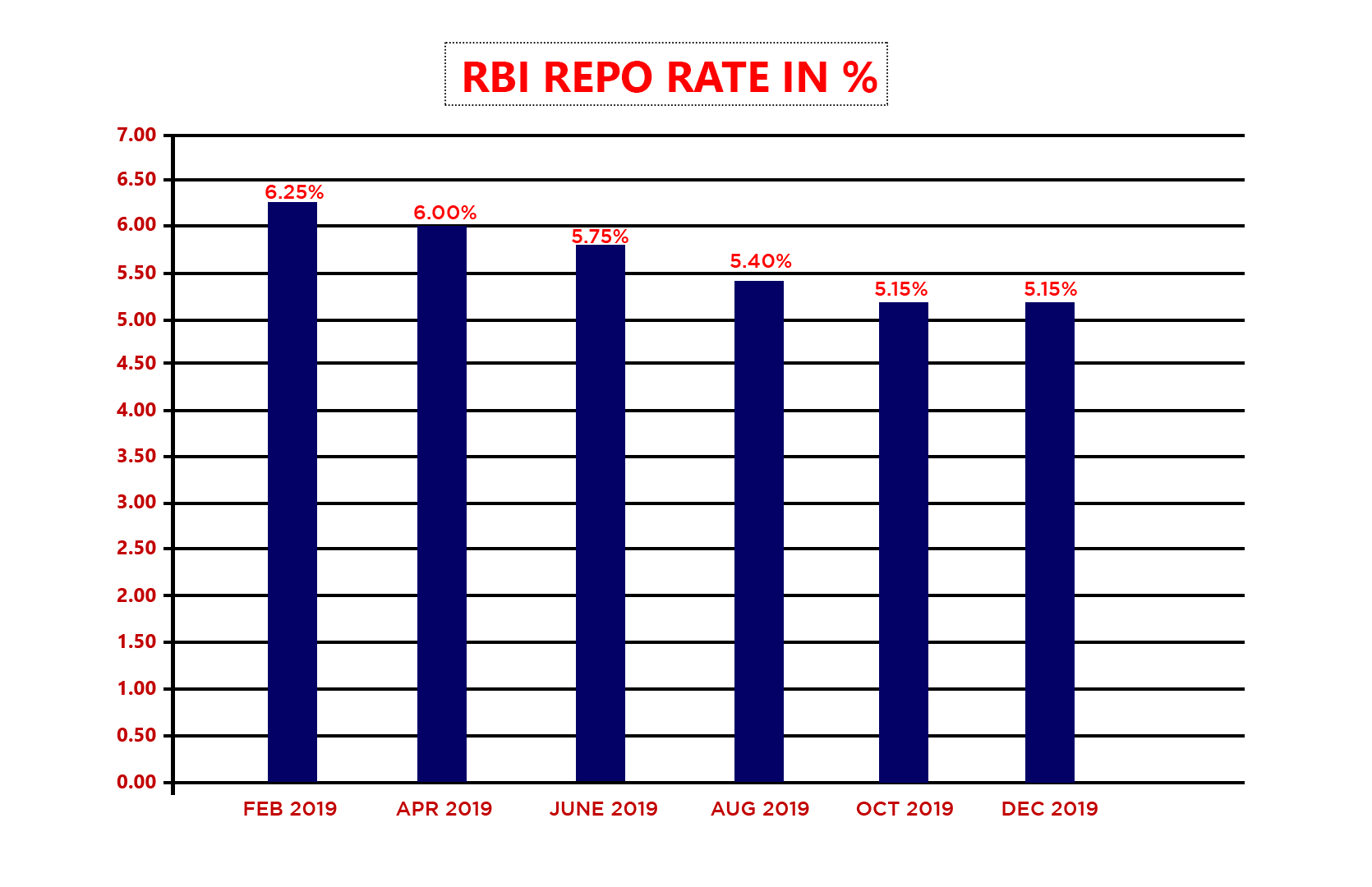

The Monetary Policy Committee (MPC), which announces the benchmark lending rate (repo) on a bi-monthly basis, has been tasked by the government to tame retail inflation based on Consumer Price Index (CPI) at 4 per cent (+,- 2 per cent).

The retail inflation that for several months remained in the comfort zone of the central bank has started inching up and crossed the 7 per cent mark during December 2019, mainly due to spiralling prices of vegetables.

Experts said the MPC members are going to have a tough time as slowing economy makes the case for reduction in repo rate while rising inflation and higher fiscal deficit will require the central bank to either hike the rate or maintain a status quo.

The sixth bi-monthly monetary policy statement for 2019-20 will be announced at 1145 hours on Thursday.

Read more: Doubling farmers income may not be possible by 2022: Pushpendra Singh

The government has estimated India's gross domestic product (GDP) at 5 per cent in the current financial year owing to both domestic as well as global factors amid weakening consumption demand in the country.

In December, retail inflation also peaked to a five-year high of 7.3 per cent, mainly due to costlier vegetables, specifically onion and tomato.

In its previous monetary policy review in December, the RBI had decided for a status quo, leaving the repo unchanged at 5.15 per cent on concerns of rising inflation.

While presenting the Union Budget on February 1, Finance Minister Nirmala Sitharaman projected the fiscal deficit to widen to 3.8 per cent of the GDP against the earlier estimate of 3.3 per cent.

A higher fiscal deficit in simple terms means the government will go in for more market borrowing leading to hardening of interest rate which in turn will put pressure on inflation.

(PTI Report)