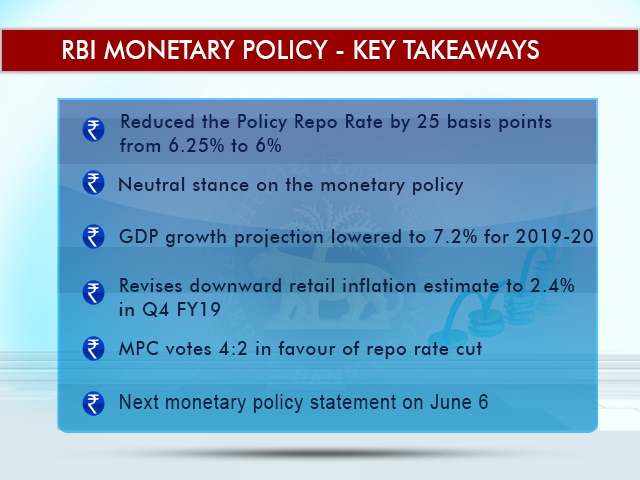

Mumbai: The Reserve Bank of India on Thursday cut benchmark interest rate by 0.25 per cent for the second time in a row to bring interest rate to the lowest level in one year on softening inflation.

Consequently, the reverse repo rate under the LAF stands adjusted to 5.75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 6.25 per cent. The MPC also decided to maintain the neutral monetary policy stance.

The central bank, however, kept monetary policy stance at 'neutral'.

RBI has also projected GDP growth for 2019-20 at 7.2 per cent and has revised downward retail inflation estimate to 2.4% in Q4 FY19, 2.9-3% in H1 FY20 and 3.5-3.8 pc in H2 FY20.

Next monetary policy statement will come on June 6.

Read more:Centre to gain more from GST than states: Y V Reddy

In the second policy review under Governor Shaktikanta Das, the six-member Monetary Policy Committee voted 4:2 in favour of the rate cut.

The benchmark interest rate was cut by 0.25 per cent to 6 per cent, a move that will result in lower cost of borrowing for the banks that are expected to transmit the same to individuals and corporates.

The RBI had on February 7 had last cut interest rate to 6.25 per cent from 6.5 per cent. Last time repo rate stood at 6 per cent was in April 2018.

"The Monetary Policy Committee (MPC) notes that the output gap remains negative and the domestic economy is facing headwinds, especially on the global front. The need is to strengthen domestic growth impulses by spurring private investment which has remained sluggish," it noted.

In the monetary policy report the RBI said going forward, alternative farm support schemes and farm loan waivers announced by some state governments, higher minimum support prices and food procurement, and lower direct tax collections could put upward pressure on the combined fiscal deficit.

It also said that headline CPI inflation is expected to move up from its recent lows as the favourable base effects dissipate but is expected to remain below the target of 4 per cent.

Talking about upside risk to inflation trajectory, it said, higher crude oil prices, volatility in international financial markets, the risk of a sudden reversal in the prices of perishable food items, and fiscal slippages are some of the challenges.

As the repo rate is the rate at which RBI lends to banks for a short period, the back-to-back cuts would enable banks to give personal, auto and home loans to customers at reduced rate of interest. Consequently, the Equated Montly Installments (EMI) would come down.