New Delhi: Parliament on Thursday approved changes in the three-year old Insolvency and Bankruptcy Code (IBC) providing greater clarity over distribution of proceeds of auction of loan defaulting companies, with the Lok Sabha passing the Bill with voice vote.

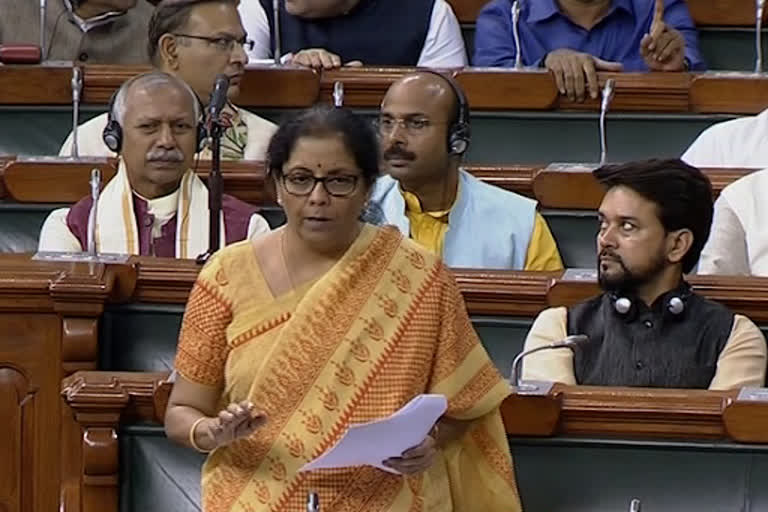

Piloted by Finance Minister Nirmala Sitharaman, the Insolvency and Bankruptcy Code (Amendment) Bill 2019 gives committee of creditors of a loan defaulting company explicit authority over the distribution of proceeds in the resolution process and fixes a firm timeline of 330 days for resolving cases referred to the IBC.

The amendments, she added, would also bring in more clarity on various provisions, including time-bound disposal at the application stage for resolution plan and treatment of financial creditors.

As many as seven sections of the Code are being amended.

Once the Corporate Insolvency Resolution Process (CIRP) begins, it has to be completed in 330 days, including litigation stages and judicial process, the minister said, citing the proposed amendments.

Among others, the approved resolution plan would be binding on central and state governments as well as various statutory authorities.

Sitharaman said proposed amendments also responds to issues pertaining to financial creditors in the wake of a recent ruling with respect to financial and operational creditors.

Recently, the National Company Law Appellate Tribunal (NCLAT) had ruled in the Essar Steel Ltd's case that the Committee of Creditors (CoC) had no role in distribution of claims and brought lenders (financial creditors) and vendors (operational creditors) on par.

Sitharaman quoted a Supreme Court judgement to say that with implementation of the Code, there is no longer a defaulter's paradise.

Read More: Insolvency law amendments to ensure greater timeliness: Nirmala Sitharaman

Referring to the issue of home buyers raised by some opposition members, the Minister said the provisions of the bill strengthen the hands of homebuyers and the government would endeavour to do full justice to them.

The government, she added, was also looking at ways to resolve the issue concerning buyers of flat from JP Group companies.

On issues concerning Jet Airways, the Minister said that the stakeholders were free to work out resolution plan and they were not obliged to use the IBC which is optional.

She further added that the issue of inclusion of cross- border insolvency under the IBC is under examination and the government will take a view after consulting the stakeholders.

The bill was passed by Rajya Sabha on Monday.

Earlier, participating in the debate, Gaurav Gogoi (Congress) said the performance of the Insolvency Bankruptcy Code has been a mixed bag.

Gogoi also raised concern about liquidation of companies, especially the ones in the real estate sector that also puts home buyers' life savings at risk.

Sanjay Jaiswal (BJP) said the IBC has improved the Ease of Doing Business.

M Srinivasulu Reddy (YSR Congress) referred to the death of Cafe Coffee Day founder V G Siddhartha and said industries are sick because of business failures.

He said while the government is working towards 'Ease of Doing Business', there is an increase in 'Difficulties in Doing Business'.

There is a fear psychosis in the minds of businesses which has to be addressed, Reddy said.

"Asses and horses are in the same stable," Reddy said, noting that the government is looking at honest and dishonest business through the same prism.