Hyderabad: Whoever has said money can’t buy happiness might not have seen the varied ways we use it to buy our self-proclaimed happiness. Visiting a beauty salon or grocery shop or even darshan to a place of worship is impossible without this piece of paper or without the plastic money.

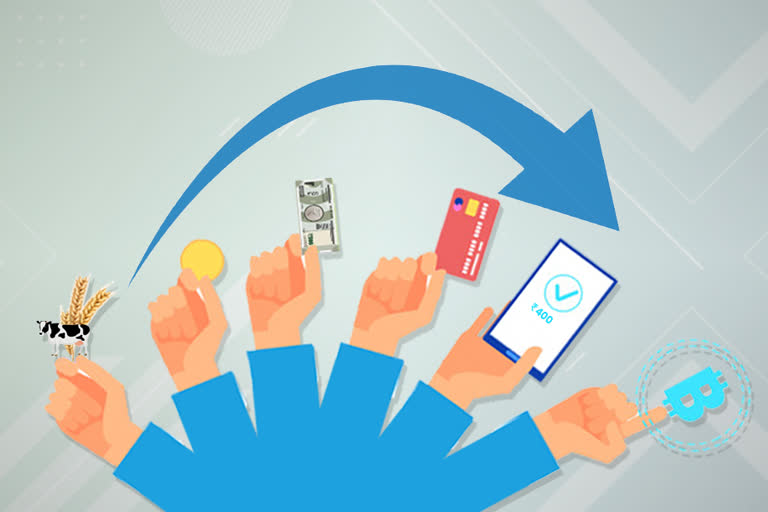

However, the way we use money has undergone several alterations. From barter system and gold coins to paper notes and now digital methods- the evolution in payment methods is varied and intriguing.

Barter System

Let’s talk about the barter system. Before currencies came into existence, people used to exchange goods and commodities to get what they needed. But the challenge that cropped up with the barter system was perceived inequalities in the value of the exchanged goods.

For example, one could not exchange a goat to get a handful of rice or pulses. This paved way for the need for some other common mode of exchange.

Metals

In the 6th century BC, India witnessed its first coins made up of either gold, silver or copper with fixed weight and value and bearing an official seal representing the government who issued them.

However, it was Sher Shah Suri who first introduced a new currency, which is the predecessor of the modern-day Rupee. He had set up a new civic and military administration that issued a silver coin termed as the Rupiya.

Paper Notes

Thereafter, between the year 1770-1832, Bank of Hindostan (1770– 1832), General Bank of Bengal and Bihar (1773–75), and Bengal Bank (1784–91) issued paper currencies.

Post independence, the Indian Rupee replaced all the currencies of previous autonomous states. After which the Reserve Bank of India started to issue notes and coins. The five-rupee note was the first one to be issued and notes of other denominations of up to Rs 10,000 were subsequently added.

Debit/Credit Cards

Plastic money was introduced in the Indian market with the onset of a robust Indian banking sector, especially private sector banks. Debit cards enabled people to keep less cash in hand, while credit cards promoted the concept of 'buy now and pay later'.

Digital Payments

Digital payment by using digital wallets is a convenient way of modern-day transaction. Obviously, the wide-spread smartphone usages along with the deep internet penetration, have enabled millions to use e-wallets. In a way, demonetisation of high value currency notes in 2016 promoted digital payments in the country.

The thrust on digital payment methods backed by Unified Payments Interface (UPI) is another development in this segment.

Cryptocurrency

Cryptocurrency is the innovative form of digital payments that is gaining ground. Bitcoin, Ethereum, etc are attracting users as they are a decentralised and highly secure form of money.

Though there is no uniformity across the globe on the legitimacy of cryptocurrency, experts believe this new age payment method will gain traction in the post-COVID world.

(ETV Bharat Report)