New Delhi: Oil marketing companies’ decision to raise the retail prices of petrol and diesel for over 15 days in a row attracted much criticism but the Centre and States are real beneficiaries of high retail prices of petrol and diesel. In principle, oil marketing companies are free to revise the retail price of petrol and diesel as per the international price of crude oil but only one third of the retail price of these two commodities comes to oil companies and two-third goes to the exchequer in form of central and state taxes. Oil sector’s contribution to the exchequer has gone up by 66% in last five years as Centre and States collected over Rs 5.5 lakh crore in FY 2019-20.

The Centre is the biggest beneficiary of this growth in revenue as its earning from the oil sector nearly doubled during this period while States’ revenue collection went up by just 38%.

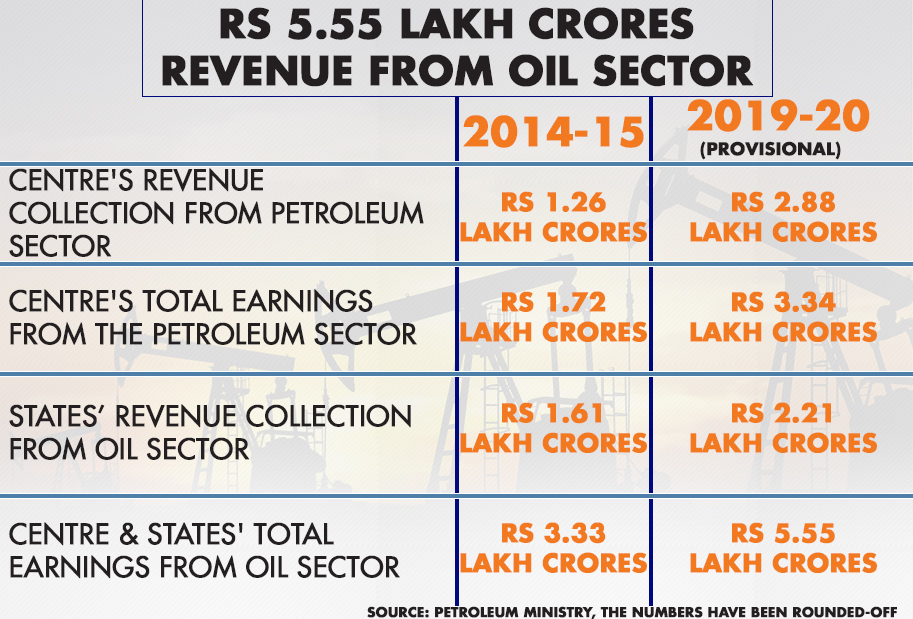

As per the latest official data, the cumulative revenue earned by both the Centre and States from the petroleum sector has gone up from Rs 3.33 lakh crore to Rs 5.55 lakh crore, an increase of 66% between 2014-15 and 2019-20.

Low crude prices during the first term of Prime Minister Narendra Modi allowed the Centre to increase the excise duty on petroleum products to augment its revenues.

Union government’s revenue collection and income from the oil sector went up from Rs 1.72 lakh crores in 2014-15 to Rs 3.34 lakh crore in 2019-20 (provisional), a jump of over 94%.

In 2014-15, the Centre collected Rs 1.72 lakh crore from petroleum sector, Rs 1.26 lakh crore as revenue and Rs 46,000 crores from oil companies in form of dividends, corporate tax and other profits from the exploration of oil and gas.

Read more:Co-op banks come under RBI as President Kovind clears ordinance

In 2019-20, this figure went up to Rs 3.34 lakh crore, an increase of 94%. While the tax mop from the sector accounted for Rs 2.88 lakh crore, dividends, corporate tax and other incomes accounted for almost Rs 47,000 crore.

In this case, the stark difference between the growth in the Centre’s tax mop up from the oil sector and other income from oil companies in form of dividends, corporate tax and others is significant.

While the Centre’s tax collection from the petroleum sector went up from Rs 1.26 lakh crores to Rs 2.88 lakh crore in the last five years, a growth of 129%, the dividends and corporate tax collection from oil companies remained almost flat in 2014-15 (Rs 46,040 crores ) and 2019-20 (Rs 46,775 crores).

Though the Centre’s receipt from oil companies in form of dividend, corporate tax, and profit from exploration of oil gas remained flat during 214-15 and 2019-20, but it has seen sharp rise in preceding three years. The Centre earned Rs 61,950 crore in 2016-17, Rs 59,994 crores (2017-18) and Rs 68,194 crore (2018-19) before it declined to Rs 47,775 crore in 2019-20 (provisional).

States earn over Rs 2 lakh crore from petrol-diesel

Tax collected on the sale of petrol and diesel is one of the biggest source of revenue for states as well. In 2014-15, States collected over Rs 1.6 lakh crores from the petroleum sector in form of VAT and royalty on crude and natural gas. This amount went up to Rs 2.21 lakh crore in 2019-20 (provisional).

While Sales Tax/VAT account for the biggest chunk at Rs 2.02 lakh crore in FY 2019-20, followed by royalty on crude oil and natural gas (Rs 11,882 crores) and States Goods and Service Tax (SGST) at Rs 7,345 crores.

(Article by Krishnanand Tripathi)