Hyderabad: In a surprise move, the Reserve Bank of India on Friday slashed the benchmark lending rate by 40 basis points to mitigate the impact of COVID-19 crisis.

In an off-cycle meeting of the Monetary Policy Committee (MPC), the decision was taken unanimously to cut repo to support growth.

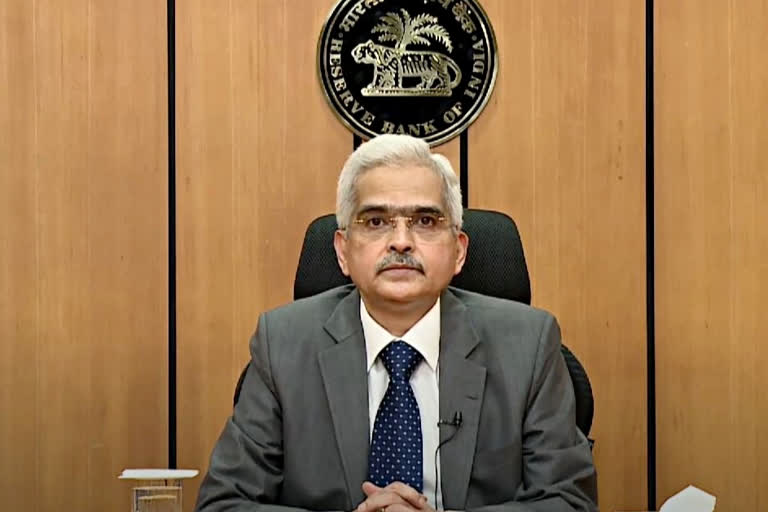

Major Key takeaways from RBI Governor's Press Conference:

- The repo rate cut by 40 basis points from 4.4 % to 4%. Reverse repo rate stands reduced to 3.35% to maintain accommodative stance

- Six member monetary policy committee voted 5:1 in favour of 40 bps cut in interest rate

- RBI asked banks to allow Moratorium extension for further 3 months, from 1 June - 31 August, 2020. In the previous press conference, the RBI asked to allow banks to give moratorium for three months starting from March

- Industrial production shrank by close to 17% in March with manufacturing activity down by 21%. Output of core industries contracted by 6.5%

- India seeing collapse of demand; electricity, dip in petroleum product consumption; fall in private consumption.

- Govt revenues have been impacted severely due to slowdown in economic activity amid COVID-19 outbreak

- Inflation outlook highly uncertain; elevated level of inflation in pulses worrisome, requires review of import duties

- Headline inflation may remain firm in first half of yr; ease in second half, falling below 4% in Q3/Q4 of FY21

- GDP growth in 2020-21 to be in negative territory. Combination of fiscal, monetary and administrative actions will create conditions for revival of economy in 2nd half of FY21

- RBI to roll over Rs 15,000-crore refinance facility for SIDBI for 90 days

- RBI increases export credit period to 15 months from 1 year and Rs 15,000-crore line of credit to EXIM Bank

- Group exposure limit for lenders to corporates raised to 30% from 25%

- RBI to be vigilant in battle readiness to address dynamics of unknown future; will preserve financial stability

(With inputs from PTI And ANI)

Read more: Reliance strikes 5th deal, sells 2.32% in Jio Platforms for Rs 11,367 crore to KKR