Hyderabad: Every other day there is a strong emphasis by the government on its intent to increase Foreign Direct Investment (FDI) into the country. In the last one year, the onset of the trade war between the USA and China has triggered a renewed push to attract FDI into various emerging markets, especially those in East and South Asia.

In the past two months, in order to attract more investments, Thailand and Vietnam cut tax rates on new companies wanting to relocate their manufacturing units from China to 10%. This cut by those countries probably weighed on the Government of India to cut taxes a few weeks ago.

Since the turn of the century, the growth in FDI has been mostly slower than most major emerging market economies. Instead, India is one of the hot favourites for foreign portfolio investments (FPI) which mostly go to the stock markets and are considered as “hot money”.

The fact that these major changes have come in the context of an overall slower economic growth in the case of India gives a sense of urgency to the task of attracting FDI into the country.

Recent statements by large foreign institutions including the World Bank and those with deep pockets (like Blackstone) that India continues to remain an attractive destination should be some solace in the attempts of the government.

As a generalisation, FDI is always preferable to the country because it tends to be more long-term in outlook and tends to create assets in the country which in turn help in the creation of long-term jobs.

In contrast, portfolio investment is usually into the financial markets and tends to be more short term in outlook. More importantly, a large part of these FPI inflows are through countries like Mauritius where the ultimate source of funds itself may be suspect.

Read more:'The de-railed Indian Railways'

Such importance of FPI money creates a possible stress point – especially when there is a likely slowdown, even if the slowdown is cyclical in nature because they tend to aggravate and magnify the movement of various benchmark indices.

Simultaneously, there is a need for the government to remain sensitive to the need of long-term investors and remain proactive since World Trade has showed signs of continuous decline over the past four months – the longest continuous decline in a decade.

Declining world trade means that there is going to be huge rush to attract long-term investments from different countries. Hence, the more conducive India becomes to the concerns of long-term investors, the more profitable for India’s economic needs.

Compulsive need for FDI

However, much we may not like the influence of foreigners on the economy of the country, we have to realise that India cannot afford to reject FDI in totality. The fact that India imports most of its ever increasing oil needs means that India faces a perpetual shortage of valuable foreign exchange, especially since exports are not growing fast enough.

The result of this lack of exports is that India’s foreign trade deficit is high and since independence it has averaged about 2-3 percentage of the GDP. The result is that India has to earn, attract or borrow more dollars (or other important currencies).

It is important to note that FDI should be welcomed, especially in areas where it adds value to the Indian economy and enables Indian companies to climb the economic value chain by providing high value and niche items.

FDI is needed in the country simply because we are a country that is capital deficient and often (though not always) runs all the three worst possible deficits: fiscal, revenue and capital deficits. In any country, if these three deficits are allowed to get out of hand and if FDI flows dry up, there will be a high likelihood that any economy will go into an existential crisis.

Moreover, the nature of Indian economy is that we are mostly a consuming country that imports technology and one that essentially exports raw materials/commodities, semi finished goods or low end services. The problem with such exports is that they are low margin and are highly impacted or prone to the vagaries of global trends.

In contrast, countries like South Korea that export high end technology products and services tend to be relatively more insulated from short-term events. Another important reason why need FDI is that in poor (or relatively poor) countries that have been slow to develop can improve their economic outputs through a judicious adoption of transferred technology and attracting foreign capital.

It takes a long time for a country to develop indigenous technology and even longer to adopt it to suit local conditions. In contrast, importing technology can give a head start for any economy, especially large ones like India which are witnessing large scale entry of youth into the labour market.

The case of Japan (after the Second World War, China, South Korea and the whole of South East Asia in the 1990s) is a clear indication of a possible advantage that a careful and planned adoption of technology combined with foreign capital can bring to the economy.

Issues in India’s FDI

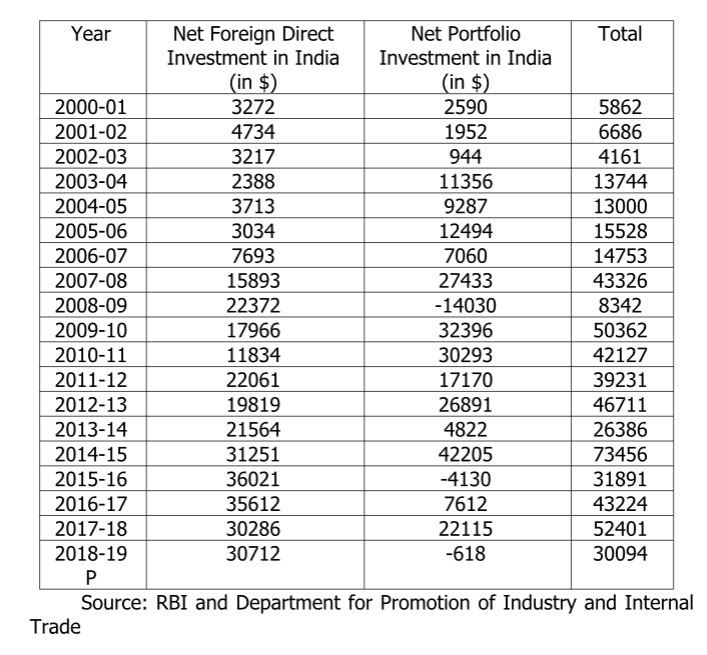

A detailed analysis of the statistics released by the Reserve Bank of India (RBI) and Department for the Promotion of Industry and Internal Trade (DPIIT) of the Ministry of Commerce indicates that there are a number of issues related to FDI that require urgent attention of policy makers.

FDI statistics are worrying because they started declining long before the slowdown started. It is not clear if it is a consequence or one of the major causes for the slowdown. Since 2016-17, FDI growth has mostly been stagnant and has hovered around the USD 60-64 billion mark.

One probable reason for this stagnation in FDI may be because foreign investors are also reinvesting larger amounts of their earnings (which varies from USD 10 – 13.5 Billion or Rs.70,000 to Rs.1 lakh crores) every year. In contrast, in the case of China from 2015-18, it has varied from approximately USD 196 – 128 billion annually. Even more problematically over the past decade, most of the FDI inflows originate from six countries:

| Countries | Percentage of FDI origination |

| Mauritius | about 30-35% |

| Singapore | 15-20% |

| Japan | 5-10% |

| Netherlands | 5-10% |

| UK | 5-7% |

| USA | 5-7% |

Foreign inflows either FDI or FII flows are like a honey tipped sword: they can work both ways – in a beneficial or detrimental way. FDI can be beneficial if it goes into high technology, technology infrastructure or those areas where it can create globally useful intellectual property.

In such cases, it has the potential to create high value jobs that can remain globally competitive while helping India remain competitive in a global economy when the world is witnessing rapid transformation due to technology and demographic change. Unfortunately, an analysis of FDI statistics indicates that most of the FDI has gone into areas that may not add direct value to the economy in the long-term.

Despite the insufficient details, analysis indicates that a large part of FDI since the year 2000 has entered into:

| Areas | FDI |

| Service sector | 18% |

| Computer software and hardware | 7% |

| Construction | 7% |

| Telecommunications | 7% |

| Automobile industry | 5% |

| Pharma | 4.43% |

| Trading | 4.23% |

| Chemicals | 4% |

| Power | 3.49% |

| Metallurgical industries | 3.11% |

| Hotels and Tourism | 3.06% |

Problematically, even among services a large part of it has entered outsourcing, financial services, couriers and occasionally into Research and Development. This indicates that India may be attracting FDI into areas that do not increase the global competitiveness of the economy in the long-term. Instead, it is geared towards exploiting the large Indian market.

Road ahead

Thus, it is clear that there is an urgent need for the government to recalibrate its policy towards FDI. While the health of the Indian and the global economies may not give India the luxury to turn away any new investments, there is a need to be cautious about what it encourages.

There is not much economic benefit in laying the red carpet or offering tax concessions to e-commerce, courier firms, trading, construction, hotel sector or any other consumer oriented industries. Foreign investors in such sectors have little to offer the country in terms of technology or export earnings, though such investments may add to the overall increase in productivity.

The long-term cost of providing tax benefits to such internal consumption driven sectors brings few benefits in the form of value addition that will enable Indian products to increase their competitive standing in the changing global conditions. The nature of benefits that India offers to FDI is all the more important in the context of the raging debate about RCEP.

There is thus a need for the government to offer support, either as tax benefits or other support like concessional land rates, etc only to those sector that are to the niche markets rather than to low margin businesses which are here only to take advantage of labour arbitrage (or trying to take advantage of low cost of the labour).

The re-orientation of the South Korean economy and the type of concession that they offered in the aftermath of the 1997 crisis may be a good template for the government to consider. It is important that the government avoid giving benefits to sectors that will lead to more job losses or loss of livelihoods (like agriculture) even while not adding any long-term substantial value addition to the economy.

Ideally, the government should consider placing investments in such high-technology areas under the 100% automatic route and also ease the transfer pricing norms.

Net Foreign Direct and Portfolio Investment in India 2000-2019

(Dr. S. Ananth)