Mumbai: With fintech innovations and their adoptions by the financial sector entities growing at a frenetic pace, the Reserve Bank is strengthening its surveillance framework.

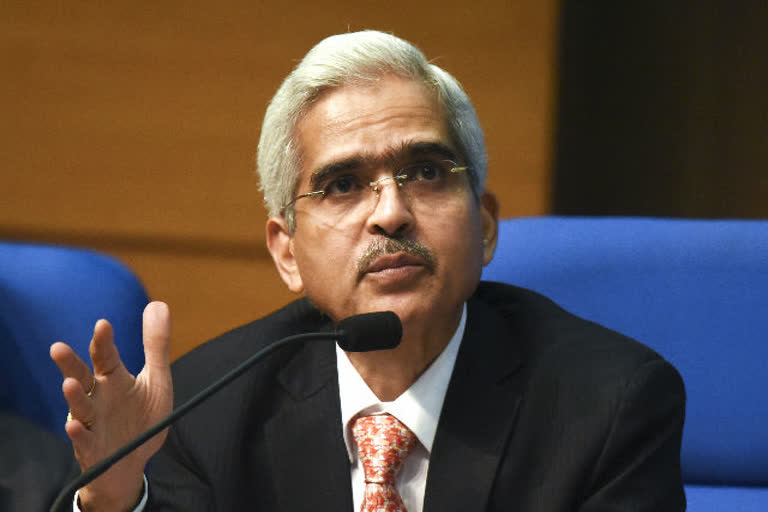

Governor Shaktikanta Das said the central bank is also aligning its framework to help the market intermediaries provide financial access to the bottom-of-the-pyramid.

"In view of the growing significance of fintech innovations and their growing interface with the financial sector entities, RBI is strengthening its surveillance framework," Das said while making the opening remarks at the CD Deshmukh memorial lecture at the Mint Road headquarters.

The central bank recently issued draft guidelines on 'Enabling framework for regulatory sandbox' to which is awaiting comments from stakeholders.

A regulatory sandbox refers to live-testing of new products/services in a controlled test/regulatory environment for which regulators may permit some relaxations of rules.

Das said the emergence of fintech/digital innovations is a strong transformative force that can reshape the global financial sector. A big benefit of these technological developments is the scope to expand financial outreach in a cost-effective manner, which in turn can deepen financial inclusion, he said.

"The RBI is continuously aligning its regulatory and supervisory framework so that the evolution of fintech can be leveraged to widen and ease the financial access to the excluded population," Das said.

Taking cognisance of the exponential growth of digitisation and online commerce, policy efforts are directed to put in place a state-of-the-art national payments infrastructure and technology platform, Das said.

Meanwhile, delivering the 17th CD Deshmukh memorial lecture, Agustin Carstens, a general manager at the Bank for International Settlements, said financial inclusion is key to participating in a modern economy.

Noting that substantial progress has been made in expanding financial access across the globe, Carstens said, since 2011, more than 1 billion adults have gained access to basic transaction accounts.

Read more:Bank credit grows by 14.19% ; deposits by 10.60%: RBI data

"India's Jan Dhan scheme is a good example. Yet more needs to be done, in terms of both expanding access and creating incentives for financial engagement," he said.

According to him, the barriers to financial inclusion are lack of trust in the financial system, high costs and lack of documentation.

"By looking after their core mandates, namely price and financial stability, central banks and financial authorities can bolster the trust in the system, thus providing the basis for financial inclusion," he said.

Carstens, an ex-governor of the Mexican central bank, noted that while the price and financial stability help resolve trust-related barriers to financial inclusion, they cannot promote financial inclusion on their own, thus there is a need for an adequate legal system, technology and innovation.

"Digital technologies, and big data in particular are key to overcoming the barriers to financial inclusion, namely the high costs of financial services, and users' lack of documentation and credit history," he said.

He said innovation also creates new vulnerabilities and criminals can exploit the anonymity conferred by some digital platforms and the absence of supervisory oversight.

For financial innovation to promote financial inclusion further, its potential adverse effects must be addressed, and policymakers can play a vital role in it by upgrading or providing new infrastructure, he said.

Pointing out that policy initiatives should be coordinated across borders, Carstens said "coordination is needed because both innovation and data flow across borders" because the challenges posed by financial innovation show that we need to broaden our collective efforts and integrate data into policy considerations.

Whether monetary policy normalisation in advanced economies will take a longer time, Carstens said no. "It seems there would not be much action on policy normalisation in advanced economies this year. Hopefully, the world economy would be much stronger in 2020," he said.