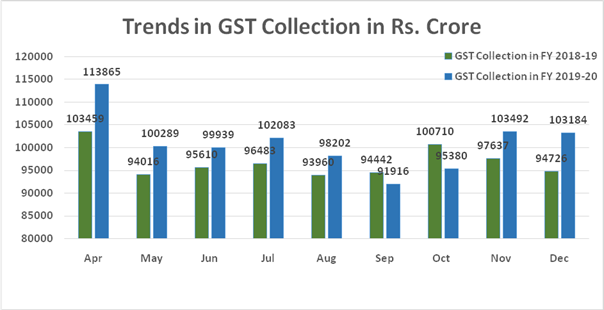

New Delhi: The gross GST collection grew by 8.92 per cent year-on-year to 1.03 lakh crore in December 2019, but remained much below the target of Rs 1.10 lakh crore set by the government.

The gross GST collection in December 2018 was Rs 94,726 crore. The GST revenues during the month of December, 2019 from domestic transactions has shown an impressive growth of 16% over the revenue during the month of December, 2018.

Tax experts said the situation is not alarming as the monthly collection is above the Rs 1 lakh crore mark as seen in the previous festive months of October and November.

"It is seldom that higher target is met in the very next month. Therefore, it is not that much alarming. The Rs 1.10 lakh crore target was a little ambitious given that nothing has fundamentally changed in terms of rate of taxes or other things," said Mahesh Jaising, Partner at Deloitte India.

In an official statement, the Finance Ministry said that out of the total Rs 1,03,184 crore collection in December, CGST was Rs 19,962 crore and SGST was Rs 26,792 crore.

Total IGST was Rs 48,099 crore (including Rs 21,295 crore collected on imports) and cess was Rs 8,331 crore (including Rs 847 crore collected on imports).

The total number of GSTR 3B Returns filed for the month of November up to December 31, 2019, was 81.21 lakh.

"GST revenues during the month of December 2019 from domestic transactions have shown an impressive growth of 16 per cent over the revenues collected during the month of December 2018. If we consider IGST collected from imports, the total revenues during December 2019 have increased by 9 per cent in comparison to the revenues collected during December 2018," the Finance Ministry said.

The government settled Rs 21,814 crore to CGST and Rs 15,366 crore to SGST from IGST as regular settlement. Total revenues earned by the Central government and the state governments after regular settlement in the month of December 2019 was Rs 41,776 crore for CGST and Rs 42,158 crore for SGST.

Some of the states and Union Territories that recorded very high growth in GST collection were Jammu and Kashmir, Sikkim, Nagaland and Arunachal Pradesh. The states that posted lower growth in GST collection were Rajasthan, Punjab and Uttar Pradesh. Jharkhand reported negative growth in collection during the said period.

Read more:Non-subsidised LPG price hiked by Rs 19 per cylinder