New Delhi: Goods and Services Tax Network (GSTN) Tuesday launched a new taxpayer friendly feature that will inform the GST payers the exact amount of input tax credit (ITC) that will be available to them in their annual GST return form called GSTR-9 Form, said the company.

“It will enable GST payers to file their annual GST returns more conveniently,” the GSTN said in a statement sent to ETV Bharat.

The GST Network, which manages the IT backbone of the nationwide common goods and services tax (GST), says the earlier system used to calculate the eligible input tax credit (ITC) amount on the basis suppliers’ GSTR-1 form for outward supplies, which did not provide the break-up at the invoice level. It was mainly due to certain governing rules such as whether the GSTR-1 form was filed by the supplier before the last date or not.

“Taxpayers used to raise query on the computation of Input Tax Credit,” GSTN said while highlighting the problems faced by the GST payers in calculating the precise amount of ITC available to them at the time of filing of annual return.

The GSTN says the new feature has been developed to provide the entire computation to taxpayers by showing all the invoices filed by the suppliers, which will also reflect the eligibility of ITC against each individual invoice.

How GST payers can check ITC eligibility?

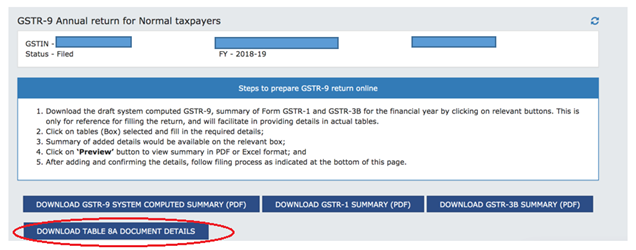

GSTN has launched a new tab called ‘Download Table-8A details’ on the GSTR-9 dashboard which will have data for FY 2018-19 and subsequent years.

A GST payer can visit the services tab, then click on returns, annual return, form GSTR-9, then on prepare online tab and then finally click on the Download Table 8A Document Details tab.

(Navigate to Services > Returns > Annual Return > Form GSTR-9 (Prepare Online) >Download Table 8A Document Details)

GSTN says it will be a major relief for the Annual Return filers who faced the problem of mismatch between the input tax credit amount as populated in Table-8A of GSTR-9 form and the figure appearing in the GSTR-2A form.

GSTR-2A is a dynamic form, which is auto populated after filing of GSTR-1 form by a supplier, and it shows the details of filed and saved invoices of suppliers.

Read more: Mukesh Ambani in talks to buy several retail ecommerce firms

However, the GSTR-2A form also shows those invoices that have been filed after the last date for inclusion in the annual return and as such not eligible for use in availing the input tax credit (ITC).

The new feature will allow GST taxpayers to know their ITC at the invoice level and reconcile the values in Table-8A of GSTR-9 forms while filing their annual return.

The new feature will also enable taxpayers to download document-wise details of Table-8A of GSTR-9 Form from the GST portal in the Microsoft Excel format. Taxpayers can now check the entire Table-8A to know their ITC eligibility against each invoice.

(Article by Krishnanand Tripathi)