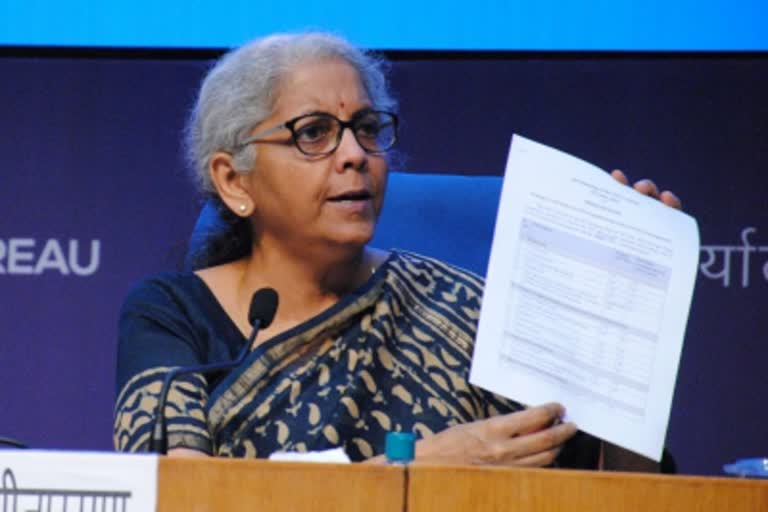

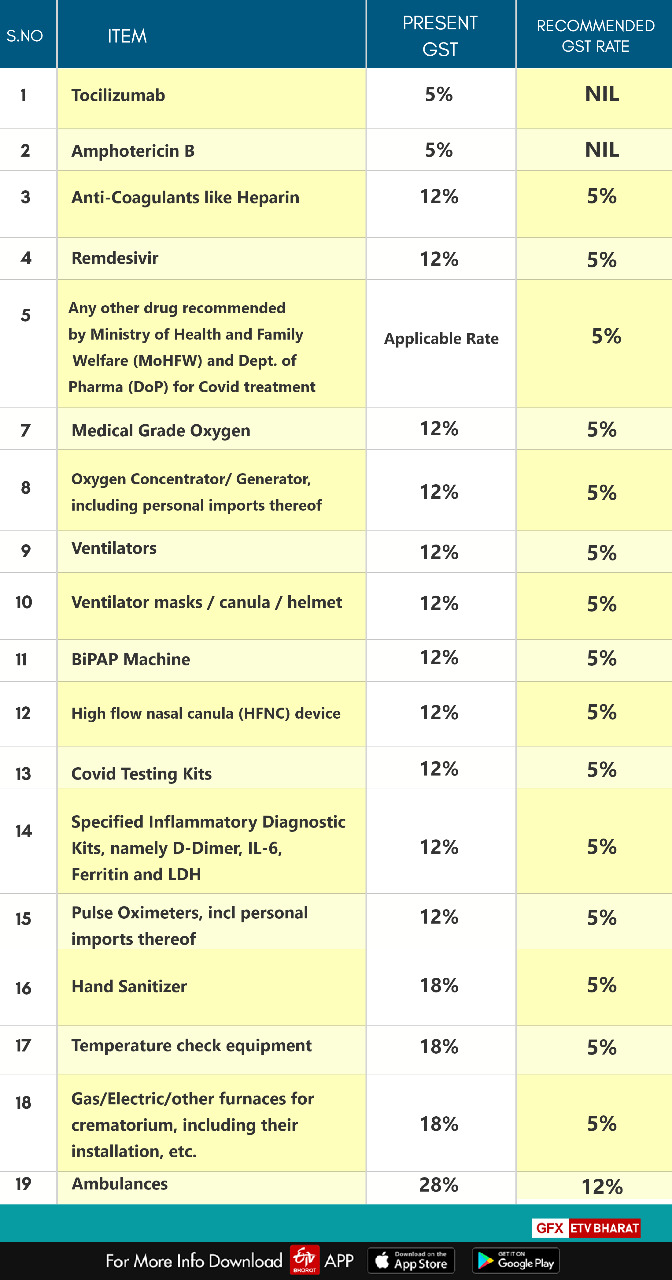

New Delhi: In view of the ferocious Covid-19 pandemic, the Goods and Services Tax (GST) Council has reduced tax rates on various Covid-19 related items. However, the Council has kept the 5% tax rate on the Covid-19 vaccines unchanged. Announcing the decisions of the 44th meeting of the Council which had met virtually earlier today, Union Finance Minister Nirmala Sitharaman said that GST rate on ambulances was cut to 12% from current 28%. Similarly, tax rates on electric furnaces and temperature checking instruments, medical grade oxygen, BiPaP machines, oxygen concentrators, ventilators and pulse oximeter have been reduced to 5%.

Notably, GST Council has approved rate reduction for Remdesivir from 12% to 5% and nil tax on Tocilizumab as well as Amphotericin used to treat Black Fungus. According to the minister, the Council has accepted the GoM recommendations and the new rates will be valid till September end.

However, the GST Council agreed to stick to 5% tax rate on vaccines. There were demands from opposition parties to reduce this rate to zero per cent.

While the Union Finance Minister Nirmala Sitharaman chaired the meeting, the Minister of State for Finance Anurag Thakur along with finance ministers and senior officials of states and union territories (UT) had participated in the meeting. The Council took these decisions after discussing the report of the Group of Ministers (GoM), headed by Meghalaya Deputy Chief Minister Conrad Sangma, on GST concessions on COVID-19 relief items like medical grade oxygen, pulse oximeters, hand sanitisers and ventilators, among others.

The GST Council in its previous meeting on May 28 left taxes on COVID-19 vaccines and medical supplies unchanged after the BJP- and Opposition-ruled states sparred over whether the tax cut benefits will reach the common man. The GoM was set up to recommend rates for COVID-19 essentials.

The Congress party- and other Opposition-ruled states have been demanding a reduction in taxes but the central government felt the move may not result in tangible gains for people.

(With Agency Inputs)