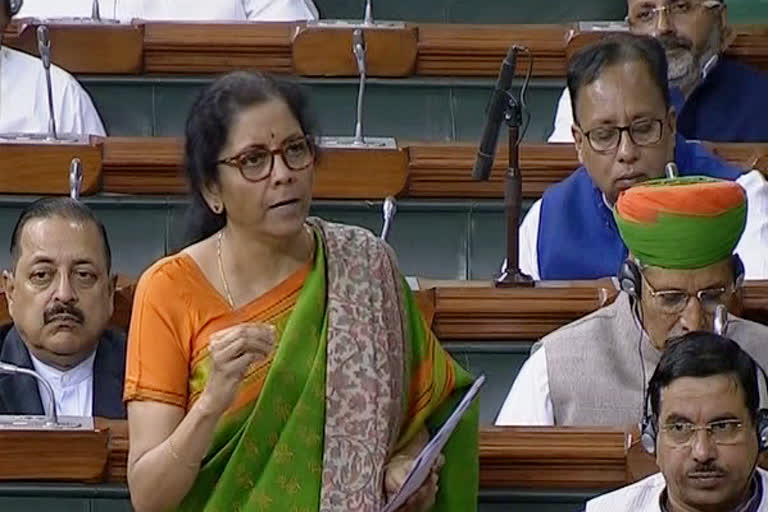

New Delhi: Finance Minister Nirmala Sitharaman on Wednesday introduced a bill in Lok Sabha which seeks to provide for resolution of disputed tax cases involving Rs 9.32 lakh crore.

Introducing the Direct Tax Vivad Se Vishwas Bill, 2020, the minister said this bill emphasises on trust building.

The scheme, she said, will not be an open ended scheme and can be availed for a limited time. The bill seeks to provide a formula-based solution without any discrimination, she said.

Giving the rationale behind the scheme, Sitharaman said it will reduce the litigation expenditure for the government and at the same may help in generating some revenue.

Read more:DeMo, flawed GST, squeeze on banks sent economy in tailspin: Chidambaram

Opposing the introduction of the bill, Congress leader Adhir Ranjan Chowdhury said the bill's name is drafted in Hindi and the government is trying to impose one specific language on the country. At the same time it will hurt the government's tax collection, he said.

Echoing similar sentiments, his party colleague Shashi Tharoor said this bill violates principle of equality by equally treating honest and dishonest tax payers.

In her budget speech on February 1, Sitharaman had announced Vivad se Vishwas scheme to resolve 483,000 direct tax disputes pending in various tribunals.

Under the scheme, taxpayers whose tax demands are locked in dispute in multiple forums can pay due taxes by March 31, 2020, and get complete waiver of interest and penalty.

(PTI Report)