New Delhi: Against widespread expectations of responding to the slowdown, the budget does very little.

In the end, a budget awaited most for some relief from an unrelenting slowdown turned out to be a disappointment, failing to meet expectations even half way.

Businesses and households had expected the budget would do something to help boost their spending power, even though it was broadly known that the government was struggling for resources to do so.

But despite (i) an ingenious tiptoeing through deferring subsidy payments, (ii) extraordinary resource mobilization by mega public disinvestments next year, and (iii) recourse to the FRBM escape clause that provides for deviation of the fiscal deficit by 0.5% of GDP on some specified grounds, the budget was unable to provide much of a fiscal boost.

It just about managed to avoid fiscal contraction; such is the position of the government’s balance sheet.

Income Tax Rates Slashed – Will This Help?

A key expectation of income taxpayers was a relief on the lines given earlier to corporates some months ago.

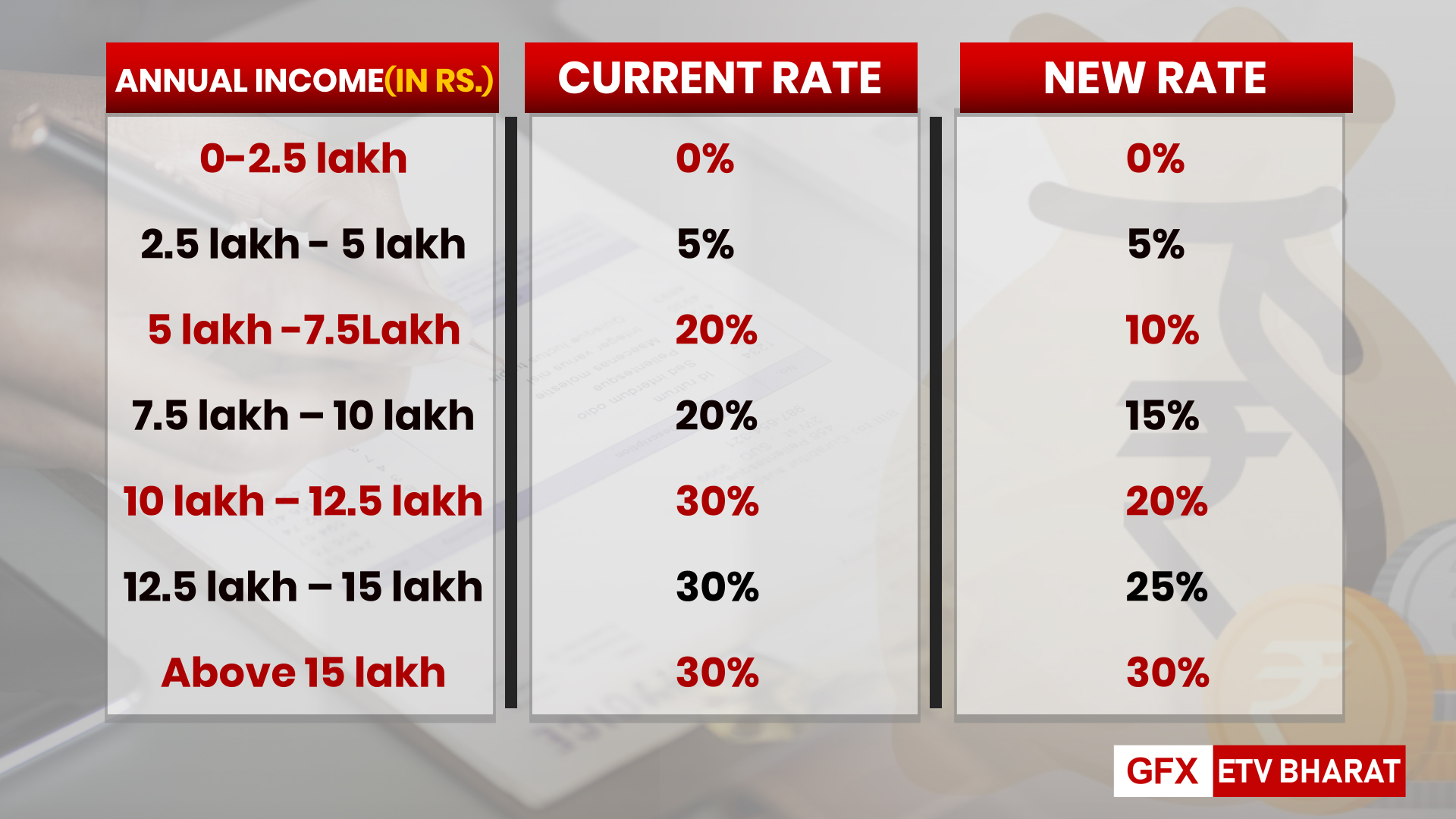

The budget does that by reducing the tax rates on slabs of 5-7.5 lakhs, 7.5-10 lakhs, 10-12.5 lakhs, and 12.5 -15 lakhs to a respective 10%, 15%, 20% and 25% from an existing 15%, 20%, and 30%. This however is not a free lunch as it comes with strings attached.

Specifically, individual taxpayers have the option to choose the new rates by foregoing several exemptions and deductions, chief of which are those on allowances (e.g. housing rent, leave travel, and so on), interest on housing loans, etc.

With respect to aggregate demand boost, this is unlikely to have an immediate impact as taxpayers will definitely be cautious and study the final impact upon their disposable incomes before exercising a choice.

The net outcome will therefore be known only after a long time; then too, the offsetting impact may not result in much tax savings even though the FM illustrated with some examples.

This leaves this measure aside as far as a clear or visible boost is concerned.

SABKA VISHWAS

The Finance Minister emphasized upon trust, the veneration of wealth creators (i.e. businesses) and entrepreneurs.

Repeatedly, Sitharaman reminded all of us Modi Government’s pet slogan - Sabka Sath, Sabka Vikas, Sabka Vishwas (together with all, development for all, the trust of all).

This appears a direct response to murmurs of ‘trust deficit’ that have gained ascendancy in past months due to many reasons; inter alia, the perceptions of private businesses about structural change, unmet expectations, a lack of clarity and unease about the direction of economic policies, and so on.

Read more:Exclusive: Sitharaman says wait till Monday to see full impact of Budget

This is also understood to have contributed to the undermining of business confidence, affecting economic activities.

Concrete measures in this regard are the institution of a taxpayers’ charter into the statutory law, extension of faceless assessment to dialogue, strengthening of the contract act, etc.

Outcomes here will only be observed over time and through a change in the overall business confidence and sentiments.

JOB CREATION

The budget makes some feeble attempts at job creation. For example, urban local bodies will now offer internship opportunities for fresh engineering graduates. They are best placed to tell us how helpful this is!

Then, under the 102-lakh-crore National Infrastructure Pipeline (NIP) announced last December, a national project management agency will be set up to involve numerous nongovernment stakeholders to contribute their skills.

Teachers, nurses, para medical staff and caregivers will be assisted to upgrade/meet international standards for exploiting employment opportunities abroad.

That should cheer those desiring to migrate abroad for better economic opportunities!

Apart from this, the government continues to rely on infrastructure creation to revive growth.

Looking at the furious pace at which roads and highways have been built in the past five years and which have pushed NHAI deep into debt, but not produced the desired or expected growth outcomes. This is uninspiring.

For A CARING SOCIETY!

Allocation to the Mahatma Gandhi National Rural Employment Guarantee Program (MGNREGA) is reduced by 13.4% whereas that under PM-Kisan remains the same as one year ago. Even, the amount in FY20 was not even fully spent!

Current spending outlays on Umbrella Scheme for Development of Schedule Castes and Other vulnerable groups are up a respective 12% and 20%.

There was much said about agriculture, farming, livelihoods, rural development and so on but in terms of encouraging the states, there was not much clarity.

Overall, there is a sense of tiredness and fatigue that seems to come across in this budget. It is true the government has run out of money but the budget speech shows it hasn’t run out of ideas and solutions!

(-Renu Kohli is a New Delhi based Macroeconomist. Views expressed above are her own.)