Hyderabad: On November 8, 2016 Prime Minister Narendra Modi announced a major decision of demonetising Rs 500 and Rs 1000 notes forcing the entire country to rush to banks to exchange banned notes with that of new Rs 500 and Rs 2,000 currency notes.

Even today, after three years of demonetization the debate on the effectiveness continues.

Let us know how successful demonetisation proved to be in its stated objectives. The government initially stated the five main objectives of demonetisation.

Black Money

On the day of the announcement, the government claimed that the demonetisation exercise would unearth the black money. However, the Reserve Bank of India (RBI) in its annual report for 2017-18 stated that after the announcement of demonetisation, about 99.3 per cent of old 500 and 1000 rupee notes were deposited back in banks and the old notes of only Rs 10,720 crore were not returned.

While experts point out that the RBI’s data show the demonetisation was a futile exercise, the government said that all the money deposited with banks is under scrutiny and lakhs of notices were issued to suspicious account holders.

Counterfeit Currency

While issuing new notes of 500 and 2,000 rupees, the RBI said that it will not be easy to print and circulate counterfeit currency because of security features in new notes.

As per a latest report of the National Crime Records Bureau (NCRB) of the Union Ministry of Home Affairs, there was nearly 20 per cent reduction in the recorded incidence of counterfeit notes in 2017 as compared to that of 2016.

However, recovery of fake notes in different parts of the country at regular intervals raise questions on the touted ‘fool-proof’ security features.

Terrorism

As per the government data, terrorist attacks have actually increased in the Kashmir after demonetisation. While in 2016, 322 terrorist incidents occurred, in 2017 it increased to 342.

However, so far, no official data has been released related to terror funding.

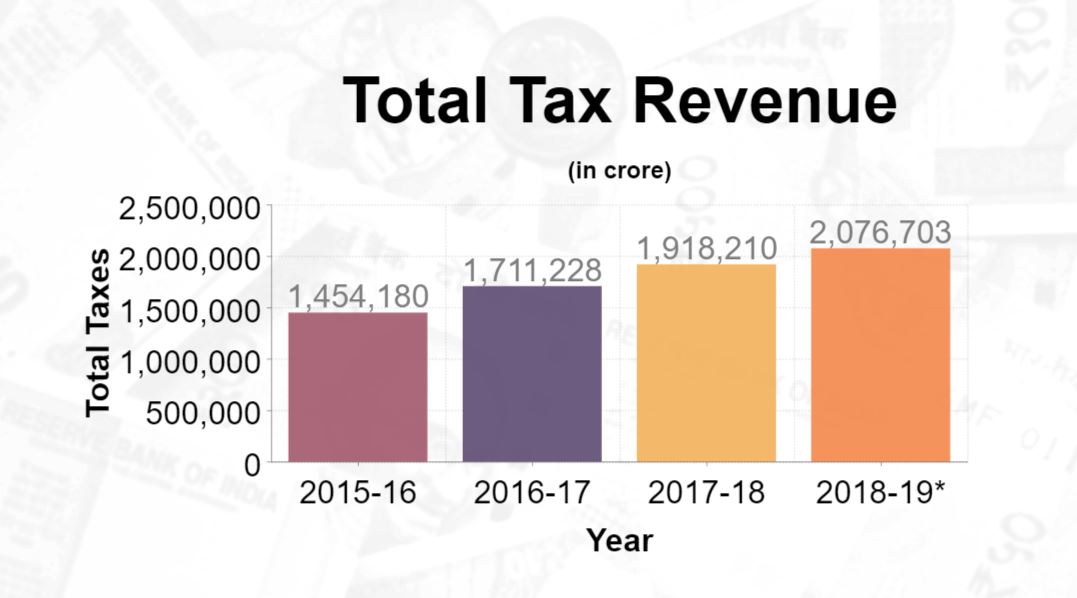

Tax Revenue

The data shows that the number of taxpayers has increased post-demonetisation. However, as per tax experts, high tax revenues can’t be attributed solely to crackdown on black money with the help of demonetisation.

Simplification of tax filing procedure is also a major contributor for this.

Digital Payments

Data shows that increase in digital payments is a major outcome of the demonetisation. As per the RBI, digital payments constituted a high 96% of total non-cash retail payments during the period October 2018 to September 2019.

During the same period, the National Electronic Funds Transfer (NEFT) and Unified Payments Interface (UPI) systems handled 252 crore and 874 crore transactions with year on year growth of 20% and 263%, respectively.

Read more: Onions@100: Only middlemen?