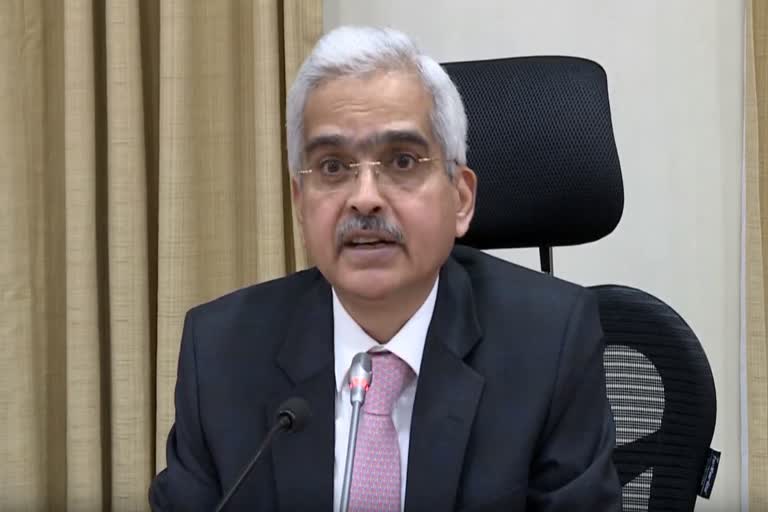

Hyderabad: The Governor of Reserve Bank of India (RBI) Shaktikanta Das on Friday said that the Central Bank was very much aware of what was happening in Yes Bank and Lakshmi Vilas Bank.

Responding to a question whether there is a need to strengthen the supervisory mechanism of RBI in view of two bank failures in the last eight months, Das maintained that regulatory intervention takes place only in the best interests of depositors.

“Its not as if they happened one fine morning and we were not aware of what was happening. Our first focus is to work with the management of the bank and resolve the problem,” the RBI Governor said in the monetary policy review press conference.

“Only when we see there is a need for regulatory intervention in the best interest of depositors, we intervene,” he added.

It may be recalled the RBI had to roll out amalgamation schemes to rescue ailing Yes Bank and Lakshmi Vilas Bank in March and November 2020 respectively.

Read more: Group of 209 employees to bid for Air India

While the SBI-led consortium was roped in to keep the Yes Bank afloat, LVB was merged with the Indian arm of Singapore’s DBS Bank.

Strengthening supervision and surveillance

Speaking on the recent efforts of the RBI to keep a tab on the health of financial institutions, the RBI Governor said: “We have really strengthened and deepened our supervisory systems and supervision mechanisms. The kind of depth of supervision we have achieved in the last two years is something like never before.”

Further elaborating on the topic, the Deputy Governor of RBI MK Jain said that unprecedented steps like the unification of supervisory departments, strengthening off-site monitoring and surveillance, large scale use of analytics and IT and upskilling of supervisors were taken in the recent past to strengthen banks supervision.