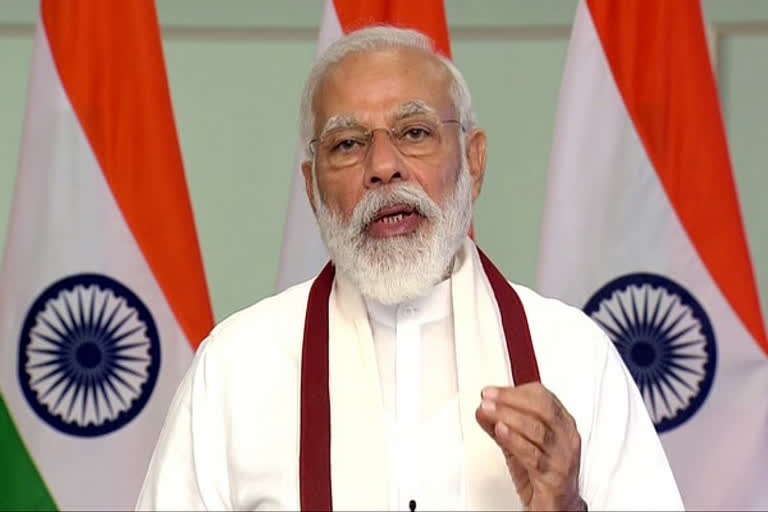

New Delhi: The government’s vision about the country’s financial sector is very clear, it is to restore trust and transparency in the sector that is why the government has made it mandatory for banks and financial institutions to report even one-day NPA unlike the past culture of brushing them under the carpet, Prime Minister Narendra Modi said on Friday.

Addressing a webinar to discuss the budget proposals related to the financial services sector, Prime Minister Modi said a clear roadmap has been laid out in the Union Budget on how to expand the participation of the private sector and strengthen the Public sector institutions.

Prime Minister Modi said in the name of Aggressive Lending, the banking sector and the financial sector in the country was severely harmed 10-12 years ago.

“Steps have been taken one-by-one to free the country from non-transparent credit culture. Instead of brushing the NPAs under the carpet, now it is mandatory to report even one day NPA,” the PM told the audience.

“Reforms will continue in the banking sector,” said the Prime Minister.

Also read: National Education Policy to make India knowledge capital of world: Goyal

Honest business decisions will be protected

While listing out his government’s drive against bad loans or non-performing assets of public sector banks, as they are popularly known, the Prime Minister also assured the audience that the government understands the uncertainties of the business and recognizes that every business decision is not underlined by bad intentions.

In such a scenario, it is the responsibility of the government to stand by business decisions taken with clear conscience, we are doing this and will continue to do so. Mechanisms like Insolvency and bankruptcy code, are assuring the lenders and borrowers, said the Prime Minister.

Prime Minister Modi said income protection of common citizens, effective and leakage free delivery of government benefits to the poor, and development of infrastructure in the country are a priority for the government.

Prime Minister Modi said there is a lot of potential for banking and insurance in our economy. In view of these possibilities, several initiatives have been announced in this budget including privatization of two public sector banks, permitting upto 74% FDI in insurance, listing Initial Public Offering for LIC and others.

Also read: Economic recovery in consolidation phase since January: ICRA

Govt to stay in financial services sector

Prime Minister Modi said that private enterprises are being promoted wherever possible but an effective participation of the public sector in banking and insurance is still needed by the country.

He said the government is infusing equity in public sector banks to strengthen them and a new Asset Reconstruction Company is created which will keep track of NPAs of banks and will address loans in a focussed way.

“This will strengthen Public Sector Banks,” said PM Modi.

The Prime Minister also talked of a new Development Finance Institution for development of infrastructure and industrial projects to cater long term financing needs of such projects.

He also encouraged sovereign wealth funds, pension funds and insurance companies to invest in infrastructure.

Prime Minister Modi also praised India’s Fintech startups for launching new products during the Corona period to help people to use cash-less means of making payment.

He said the Fintech market is estimated to touch a record Rs 6 trillion in the next five years.

Also read: New rules for social media, OTT require right implementation: Nasscom