Chennai: The government was taking efforts to ensure more regulatory mechanism in the banking sector to benefit bank account-holders, Union Finance Minister Nirmala Sitharaman said on Saturday in the context of the PMC Bank and IL&FS issues.

On the PMC Bank scam, Sitharaman said the Reserve Bank of India (RBI) has started making sure there are steps taken within the institution which would strengthen the supervisory and regulatory roles.

"And together with that any legislative changes or amendments that I have to make so that RBI gets a bit more empowered to its job it is something all of us are talking about as such measures are required to make sure the markets are better regulated, banks better regulated," she said addressing the 6th G Ramachandran Memorial Lecture here.

Anomalies allowing the institutions to take "liberty" were all being corrected so that regulators can perform better and ensure the bank account-holders have a greater sense of what is happening, Sitharaman said.

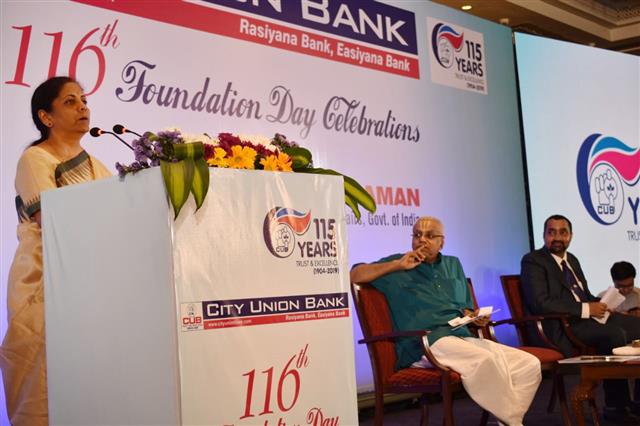

Sitharaman also said that banks should understand their core strengths before deciding on scaling up their operations while speaking at the 116th foundation day celebrations of private lender City Union Bank (CUB).

Sitharaman said "Scaling up is like a contagious disease. But institutions like banks should understand their core strengths."

She said that banks should first ponder whether it's core strength would get weakened.

On non-performing assets (NPAs), she said they multiplied between 2007-08 and 2013 and had become a burden on the banks' books.

However, banks had taken corrective action and most of them are out of it, she said.

"As a result banks are also going through a churn of how to assess their risk and how to rate property or asset. And in this we had even discussions with credit agencies on how to really rate assets," she said.

Sitharaman said she has met with few of these credit agencies to understand if the way in which the rate was consistent with what is happening in the economy.

On the automobile sector, she said she was 'pilloried' earlier for making some remarks on vehicle sales, apparently referring to her statement on millenials using cab aggregator services as a reason for the slowdown.

"Irrespective of that debate, a decision of the Supreme Court keeping in mind the climate change and pollution-level considerations, giving us a two-year window tells you to move from one level of emission standard to another," she said.

"And government in its wisdom calls saying we shall not move from (BS) IV to V which is a natural consequence but move from IV to VI given that we have two-year window given by the court," she said.

People started "withdrawing" from BS IV purchases "well in advance" and probably were waiting for BS VI, she said.

"I don't know what is the fact here. Several facts would have played, but it ended in the automobile sector having a huge inventory of BS IV. And that also became an issue which we had to address," she added.

The government had earlier announced that BS-IV vehicles purchased upto March 2020 will be operational for their entire duration of registration.

The NDA government was "receptive" to issues faced by the Indian businesses, she said, and referred to the Centre announcing Corporate Tax cuts "between budgets" to buttress her claim.

"We could work between two budgets in coming up with the majar structural refords, in reducing the corporate tax," she said.

Read more:SEBI bans Karvy Stock Broking for unauthorised use of clients' money