Hyderabad: Coronavirus is changing how Indian families look at health insurance. People realize no one would offer health insurance, or mediclaim in popular parlance, when they are sick. And, if you don’t have health insurance, good luck with paying hospital bills from your own pocket.

The top quality hospitals are charging quite a lot of money for basic treatment of Covid-19 patients. In a few states, the local government is paying for the treatment. Government run hospitals offer a certain level of healthcare. If you want anything better, pay up.

Bills of Rs 8-10 lakh are not unheard of when it comes to coronavirus patients. ICUs, ventilators, doctor charges, nursing fees, medicines, injections and personal protective equipment (PPEs) all pinch the pocket.

In this article, we will look at various types of policies available which differ in terms of coverage, duration, benefit etc. Policy buyers must understand the pros and cons before buying them. Read on.

Different strokes for different folks

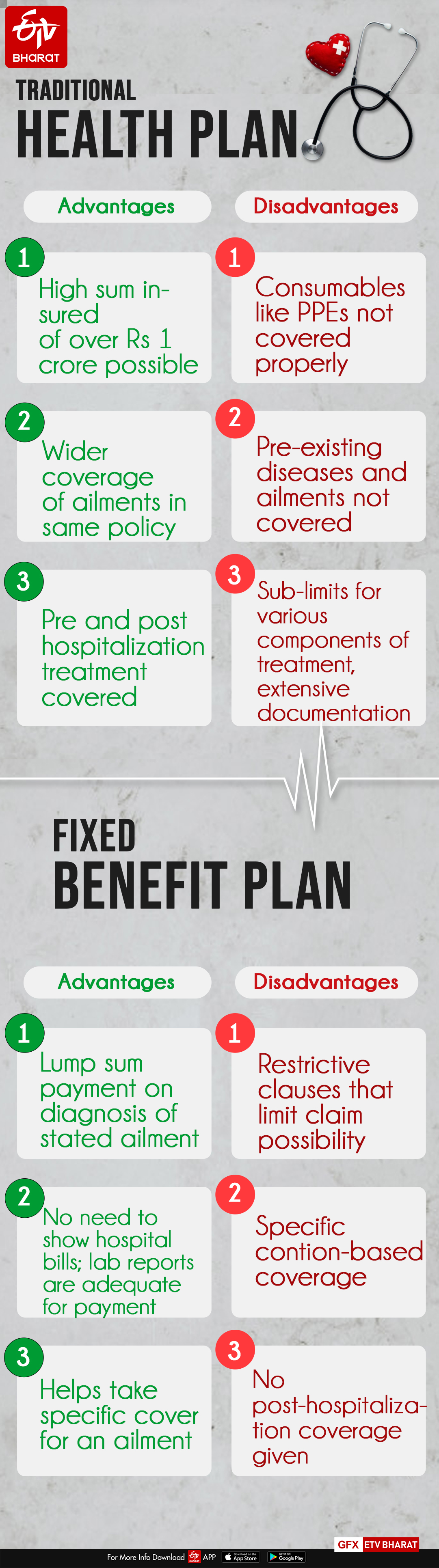

Traditional health insurance policies cover hospitalization and treatment charges on account of various ailments, including the novel coronavirus disease. In this type of reimbursement policy, the insurance money is directly paid to the hospital through cashless mode. Once you are admitted for any ailment and undergo treatment, everything is on auto-mode if your sum assured is big enough. Some even cover home care treatment at no extra cost.

There are also fixed benefit plans available that pay an upfront amount if the policyholder is diagnosed with a specific ailment like Covid-19. No hospital bills are required for such a claim. A mediclaim-type health insurance policy may not cover the cost of most consumables used in the treatment of a disease or condition in a hospital.

Regulator IRDAI has also allowed insurers to offer short-term health policies against COVID-19. General and health insurers have been permitted to offer both indemnity based (traditional) and benefit based short term health insurance policies.

Pros and Cons

Reimbursement policies (general health covers) can be for individuals or family (floater). The existing medical policies cover Covid-19. However, there are many customers who do not have an insurance policy. They are opting to buy a medical insurance product to get covered for Covid-19.

A comprehensive product that covers all kinds of illnesses, however, has its drawbacks. There can be sub-limits for room used (per day limit) for treatment, various expenses, and also exclusions when it comes to certain expenses. Quarantine just for isolation without any treatment also may not be covered.

Plus, traditional health covers don't pay for certain expenses. For instance, PPEs used widely in corona virus patient treatment is a point of strife for insurers and hospitals. First of all there is no standardized cost of PPEs, which means hospitals are charging arbitrary amounts.

Two, PPEs are not covered by some policies and so in a typical coronavirus patient treatment 25% of bill amount may not be entertained by the health insurance company. In some hospitals however, PPEs are not billed separately and as such are part of the overall room rent for packages.

A good news is that IRDAI’s Covid-19 standard health insurance policy is likely to cover consumables such as PPE Kit, gloves, mask and other similar expenses used for the treatment.

An area where reimbursement plans score big is wide protection especially in pre-hospitalization and post-hospitalization treatment, and other value-added benefits like hospital cash add-on.

As mentioned earlier, some plans are covering home care costs if it is prescribed by the treating doctor. Covid-19 home care treatment is covered subject to guidelines specified by the MoHFW & State Government Regulations.

In case of admission required at hospital, the insured is guided with the next course of action by the treating doctor / service provider. The insurer plays the role of the facilitator for cashless & reimbursement service.

In fixed benefit disease-specific health plans, the money is paid to the policyholder by the insurance company upon verified diagnosis reports. However, the laboratory authority whose diagnosis report is considered for a claim may differ and so customers should look at this area very carefully. Fixed benefit plans for coronavirus do not pay huge benefits (usually up to Rs 2 lakh).

Since you get the money upfront, you can use it in any way you want. However, do remember that pay-out may be dependent on the corona virus disease diagnosis (mild, moderate, and severe).

Since fixed benefit plans are a touch and go situation, insurance policies may have tough conditions like excluding people with a travel history to any location overseas post December 31, 2019, smaller or no payment if quarantine for a suspected COVID-19 infection doesn’t eventually turn out to be a confirmed case etc.

Do take a note of the entry age for fixed benefit plans (usually up to 65 years). Senior citizens and those with existing ailments may find it difficult to be covered. Certain fixed benefit policies cover patients as old as 75 years but may have other eligibility norms.

Right approach

The right approach to deal with the financial challenges that coronavirus treatment may pose is to combine a normal health insurance policy and a fixed benefit plan. You need to buy two policies. For a comprehensive and overall protection for every illness and ailment, a regular health insurance policy with maximum sum insured is good.

A family floater option works well for a family of 4-5 people, and premium cost will be manageable. Those who have a small sum insured of Rs 1-3 lakh, can take a top-up cover to enhance the cover.

For the extra costs associated with Covid-19 like controversial PPE charges etc., a fixed benefit plan can add another protective financial shield. Money from this policy can also be used to run the household if the employer does not pay salary during hospitalization.

(Written by Kumar Shankar Roy. Author is a financial journalist, specialising in personal finance.)

Disclaimer: The views expressed above are solely of the author and not those of ETV Bharat or its management. Above views must not be construed as investment advice and ETV Bharat recommends readers to consult a qualified advisor before making any investment.

If you have any queries related to personal finances, we will try get those answered by an expert. Reach out to us at businessdesk@etvbharat.com with complete details.