Hyderabad: As taking multinational companies to courts and international arbitration centres would dent India’s image as an attractive destination for investments, the Government of India should not shy away from trying out of the court settlement option, said a prominent international tax expert.

In a chat with ETV Bharat after an international arbitration tribunal ruled in favour of Cairn Energy in the Rs 10,247 crore retrospective tax case, Prabhakar KS, CEO of Bengaluru-based Shree Tax Chambers, said that the way the Government of Tamil Nadu settled a long-pending dispute with Nissan Motor is the best way forward for the Central Government.

“Recently, the Government of Tamil Nadu and Nissan Motor have found an amicable solution to the Rs 2,900 crore tax dispute. In my view, it’s a good way to settle an international tax dispute at a time when the global supply chains are in flux and India is emerging as an alternative to China for the global manufacturers,” said Prabhakar KS.

It may be recalled, like the Cairn Energy Plc, Japanese automaker Nissan went to an International Arbitration Tribunal in 2017 seeking Rs 5,000 crore as compensation from the government under the India-Japan Comprehensive Economic Partnership Agreement (CEPA).

In another striking similarity with the Cairn tax dispute case, Nissan and its partners contested amendments made in 2016 to the Tamil Nadu Value Added Tax (TNVAT) Act of 2006 which has retrospective effect starting from January 1, 2007.

Need to revisit BIT-2016

Citing a lukewarm response to the Model Bilateral Investment Treaty (BIT) that was drafted in 2016 to assure foreign investors on ease of doing business conditions in India, Prabhakar KS has said that the government needs to revisit the treaty.

“To address the anxieties of global investors in view of the Vodafone case, the union government has done its best by bringing the Model BIT. However, the fact that not a single treaty has been signed under the revised model shows that the investors still have some concerns,” he said.

To plug the loopholes in the Model BIT, the tax expert has suggested the government for its revision.

“My suggestion for the government is for a thorough revision of the Model BIT. And, for this purpose an expert panel can be constituted in line with Direct Tax Code,” he concluded.

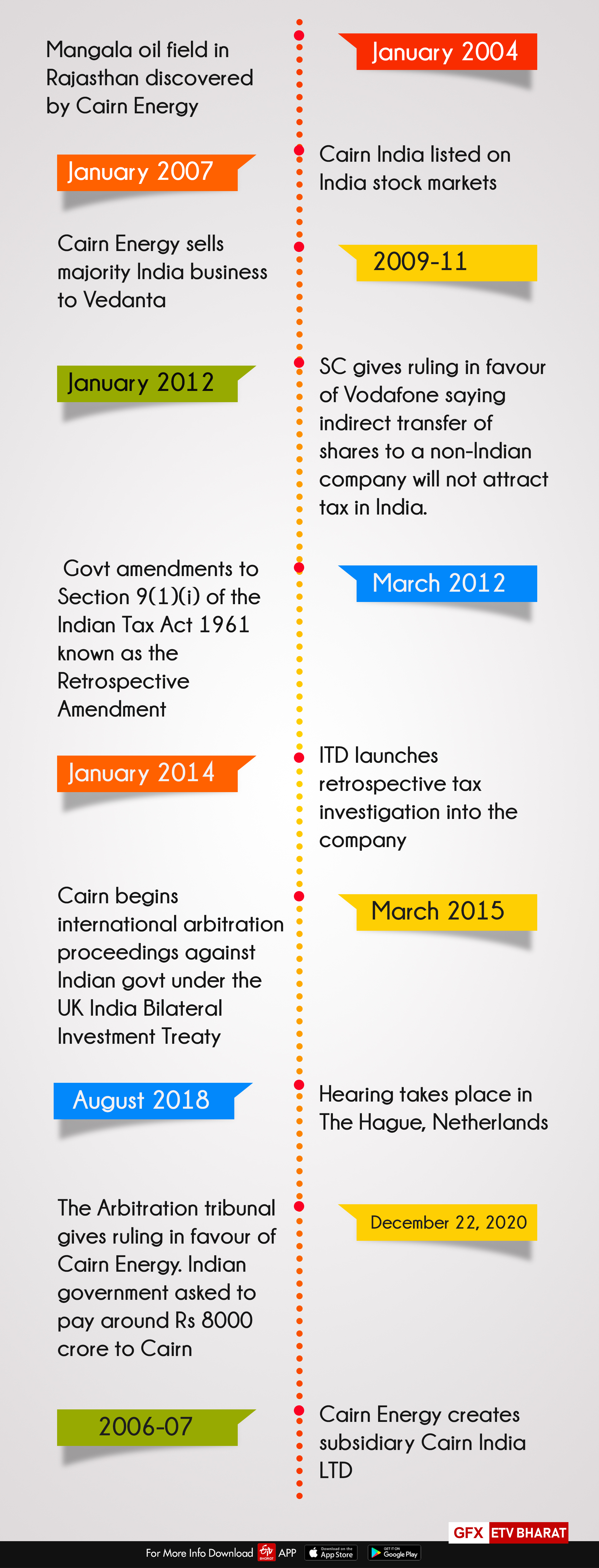

Read: Cairn Energy wins arbitration against government in tax dispute