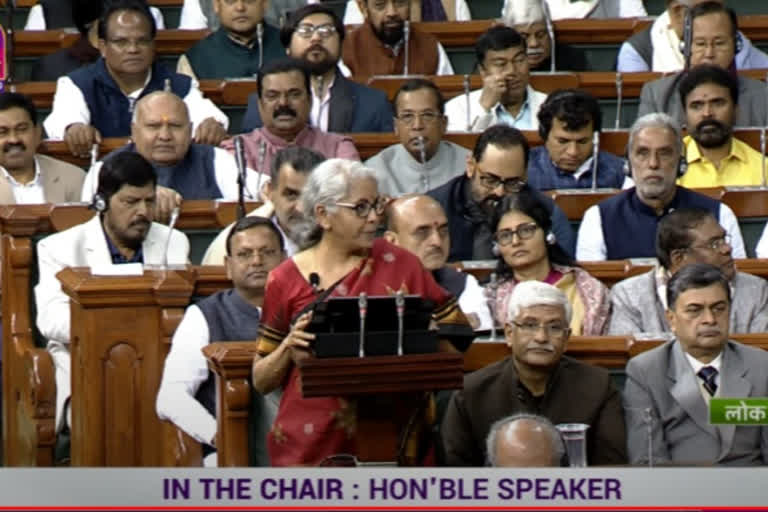

New Delhi: Union Finance Minister Nirmala Sitharaman is presenting the Union Budget 2023 in Parliament. Here are excerpts from her speech:

- "The Government has to forgo a total revenue of Rs 35000 crore because of this. There will be Rs 3 lakh tax exemption on leave encashment. The limit has been increased to Rs 25 lakh," the Finance Minister said.

- As for salaried persons and pensioners with an income of Rs 15.5 lakh rupees or more, they will get a benefit of Rs 52,500. The highest tax in the country is 42.7 percent.

- The highest tax in the country is 42.7 percent and the surcharge rate has been reduced from 32 percent to 27 percent. This will bring down the maximum tax rate to 39 percent.

- Personal tax:

Individuals with Rs 9 lakh income will have to pay 45000 rupees that 5 % of his income Currently he is supposed to pay Rs 60 000. Those with Rs 15 lakh income will have to pay 1. 5 lakh, 10 percent of his income. Currently, he has to pay Rs 187500

- Here are Income Tax rebate slabs:

Rs 0-3 lakh – nil

Rs 3-6 lakh – 5 %

Rs 6- 9 lakh – 10 %

Rs 9-12 lakh - 15 %

Rs 12- 15 lakh 20 %

Above 15 – 30 %

- In a major announcement, the Finance Minister said that the Government has decided to increase the rebate limit of Income Tax to Rs7 lakh. This will provide a major relief to tax payers ahead of the 2024 Lok Sabha elections.

- Gold, Silver, and Diamonds are costlier, she said adding that 45 percent of the returns were processed in 24 hours . She said that 6.5 crore returns were filed this year.

- FY24 net tax receipts is seen at 23.3 lakh crore, the Finance Minister said adding that an infusion of Rs 9,000 cr in the corpus for MSME credit has been done. She said that 100 labs for developing apps to use 5G will be set up adding that there will be customs duty for mobile phone manufacturers duty on the import of certain parts.

- The Finance Minister said that 500 new waste-to-wealth plants under the Gobardhan scheme will be set up. She also said that the allocation of Rs 10,000 crore per year will be provided for the Urban Infrastructure Development Fund.

- The Finance Minister said that Rs 79,000 crore has been allotted for the 100 last-mile Railway projects. " We are aiming for 100% mechanical desludging in all cities and towns," she added.

- She said that Rs. 75,000 crore has been allotted for transport infrastructure projects. The Finance Minister announced Rs 5,300 crore in Central aid to poll-bound Karnataka for irrigation.

- The Finance Minister said that replacing old polluting vehicles is an important part of greening the economy. She also said that to scrap old vehicles of the Central government and states will also be assisted in scrapping old vehicles and ambulances. "Funds have been allocated for it," she added.

- The Finance Minister said that the Pradhan Mantri Primitive Tribal Group Development mission is being launched to improve the quality of lifestyle of the vulnerable tribal communities of the country adding that it will provide house, clean drinking water, and sanitation for them.

- As for the Railways capital outlay of Rs 2.40 lakh crore has been provided she said adding this is the highest ever outlay which is about nine times the outlay made in FY 2013-14.

- Regarding support to states for capital investment, the Union Finance Minister said "I have decided to continue the 50-year interest-free loan to the state governments for one more year."

- Regarding grants and aid to states, she said that there will be a budgeted capital outlay of Rs 13.7 lakh crore, which will be 4.5 pc of the GDP. As for the empowerment of women, she said that under the Dindayal Antodadya Yojna - National rural livelihood mission- 81 lakh self-help groups have mobilized women. "We will help these groups to reach the second stage of economic empowerment," she added.

- Infra investment: "Investment in productivity infrastructure has a large multiplier effect. On growth and employment, private investments have been renewed after the covid pandemic," she said.

- As for job creation and creating new opportunities the capital investment outlay increased for the third year in a row by 33 per cent to Rs 10 lakh crores, which would be 3.3 of GDP. " This is three times of the outlay made in 2020," she said.

- The Finance Minister said that with Jan Bhagidhari there will be opportunities for citizens, especially the youth. " There will be a strong impetus on growth and job creation, establishing and giving stability to micro-economy," she said. She also said that the number of EPFO members currently stands at 27 crore.

- The Finance Minister said that grants and aids to states, budgeted at a capital outlay of Rs 13.7 lakh crore, will be 4.5 per cent of the GDP. " Empowerment of women- Dindayal Antodadya Yojna - National rural livelihood mission- through which 81 lakh self-help groups have mobilized women. We will help these groups to reach the second stage of economic empowerment," she added.

- As for investment in infrastructure development, she said that investment in productivity infrastructure has a large multiplier effect. She also said that as for growth and employment, private investments have been renewed after the covid pandemic.

- "For job creation and creating new opportunities, Capital investment outlay increased third year in a row by 33 per cent to Rs 10 lakh crores, which would be 3.3 of GDP. It is three times of the outlay made in 2020," she added.

- Speaking on Health education and skilling the Finance Minister said that 157 new nursing colleges will be established in colocation with the existing 157 medical colleges established in 2014.

Special drive Sickle cell anemia:

- The Finance Minister announced that under the PM Vishwa Karma Kaushal Samman a package of assistance for traditional artisans and craftspeople has been conceptualized which will enable them to improve the quality, scale, and reach of their products, integrating with the MSME value chain.

- "Components of the scheme will include financial support, access to efficient green technologies, advanced skill training, social security, modern digital techniques, brand promotion, and market linkages; will greatly benefit people of the weaker sections of the society," she added.

- "Per capita income has more than doubled to Rs 1.97 lakh. India's economy increased in size from Rs 7400 crore in digital payments to Rs 126 lakh crore through UPI," the Finance Minister said.

Priorities of the budget: The Union Budget has seven priorities that complement each other. Terming the seven priorities as "Saptarishi guiding us in the Amrit Kaal" she listed them as

1. Inclusive development

2. Reaching the last mile

3. Infrastructure and investment

4. Unleashing the potential

5. Green growth

6. Youth power

7. Financial sector.

- " The government's philosophy of 'Sabka Saath Sabka Vikas' has facilitated inclusive development covering specific farmers, women, youth, OBCs, SC, ST, divyangang and economically weaker section and overall development for the underprivileged," said the Finance Minister.

- The Finance Minister said that India has significantly improved its position and is a well-governed and innovative country with a conducive environment for business as reflected in several global indexes.

- "G20 Presidency gives us a unique opportunity to strengthen our role in the world economic order. We are steering an ambitious people-centric agenda to address global challenges and facilitate sustainable economic development," the Finance Minister said in the Budget speech.

- She also said that the world had recognized India as a bright star, our growth for the current year is estimated at 7.0%, which is the highest among all major economies, in spite of the massive global slowdown caused by the pandemic and the war.

- "The Indian economy is on the right track, heading to a bright future. Our focus on reforms and sound policies resulting in Jan Bhagidari helped us in trying times, our rising global profile is due to several accomplishments," she added.

- The Finance Minister in her speech said that the Union Government has set up unique world-class public infrastructure such as Aadhaar, Cowin, and UPI-based transactions. "This is the First Budget of the Amrit Kaal. It hopes to build on the foundation laid in the previous budgets," she added.

- Union Finance Minister Nirmala Sitharaman started her Budget speech in the Parliament on Wednesday. The Union Budget 2023 will be the last full-fledged budget ahead of the 2024 Lok Sabha elections.

- Earlier in the day, the Union Cabinet led by Prime Minister Narendra Modi approved the Union Budget 2023 for presentation in Parliament. Copies of the Union Budget have already been brought to the Parliament. Union Home Minister Amit Shah and Defence Minister Rajnath Singh attended the meeting.

- Earlier the Union Minister reached Rashtrapati Bhavan and met President Draupadi Murmu who approved the Budget. Nirmala would present the Union Budget at the Parliament at 11 am after attending a Union Cabinet meeting. This would be her fifth straight Union Budget for the fiscal year 2023-24 (April 2023 to March 2024).

- The Budget comes at a time when the global economy has slowed down and inflation remains a concern. Speaking to reporters Minister of State for Finance Dr. Bhagwat Kishanrao Karad said India has recovered from COVID. "If we look at Economic Survey, all sectors are making progress. Compared to other countries, our economy is good. When Prime Minister took oath in 2014, India was the 10th largest in terms of economy, today it is the 5th largest in the world."

- "Before the presentation of the Budget, under her (FM Nirmala Sitharaman) leadership, my colleague Pankaj Chaudhary and the Finance Secretary will meet the President at 9 am. At 10 am, under PM Modi's leadership, a cabinet meeting will be held," MoS Finance Dr. Bhagwat added.