New Delhi: Despite demands from several quarters to bring petroleum products under the GST regime as it will reduce their retail prices, the government on Monday said there is no such proposal under its consideration.

Under the present dual tax regime administered by both the Centre and States, taxes account for nearly two-thirds of the retail price of petrol and diesel.

If these two commodities are brought under the GST then under the present four-slab structure of GST, these two would attract a maximum of 28% tax.

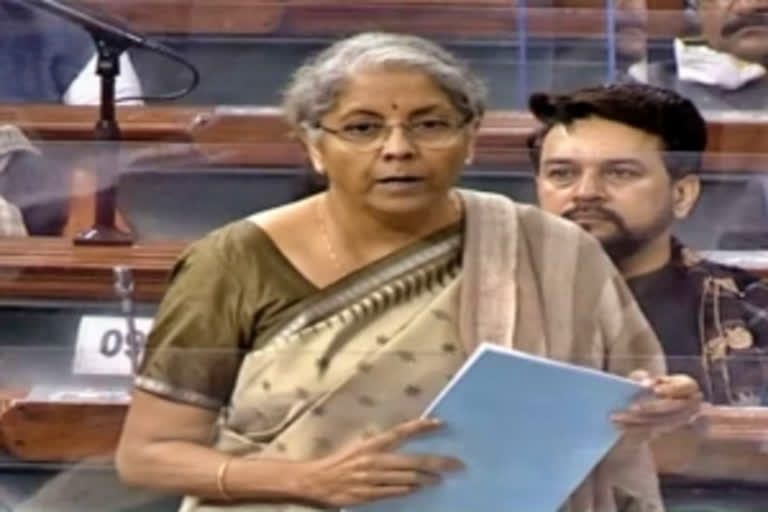

In response to a question in the Lok Sabha, finance minister Nirmala Sitharaman on Monday clarified that five commodities, crude oil, natural gas, petrol, diesel, and Aviation Turbine Fuel (ATF) have not been excluded from the GST as the GST Council, comprising both the Centre and States may recommend the date for inclusion of these products in the GST.

“So far, the GST Council, in which the states are also represented, has not made any recommendation for inclusion of these goods under GST,” Nirmala Sitharaman told the Lok Sabha.

Also Read: Petrol, diesel prices unmoved though global oil rate firm

Former finance minister Arun Jaitley, during whose tenure a constitutional amendment was passed to subsume most of the indirect taxes levied by both the Centre and States, had ensured the inclusion of petroleum products under the GST but left the date of implementation to the GST Council.

Sitharaman told the Lok Sabha members that the GST Council might consider the issue of inclusion of the five petroleum products (petrol, diesel, natural gas, ATF and crude oil) at an appropriate time keeping in view all the relevant factors, including revenue implication.

“At present, there is no proposal to bring crude oil, petrol, diesel, ATF and natural gas under GST,” said the finance minister.

A significant source of revenue

Despite strong demand from various stakeholders, including consumers, traders and transporters, the government has refused to reduce the excise duty burden on petrol and diesel.

Similarly, States have also shown little inclination to forego their share of the revenue from the sale of petroleum products.

While the retail price of petrol and diesel has gone up by nearly Rs 20 a litre in last one year, taking the prices to a record high, the price of the domestic gas cylinder has also gone up by Rs 100 since the start of the year.

In FY 2019-20, the Centre earned Rs 2,87,540 crores from taxes on the petroleum sector, and in the first 9 months of this fiscal, it has already collected Rs 2,63,351 crore.

Also Read: Govt considering tax cuts to control fuel prices: Minister

Similarly, States earned over Rs 2.21 lakh crore in the last fiscal and Rs over 1.45 lakh crore in the first 9 months of the current fiscal.

The total contribution of the petroleum sector to the exchequer (Centre & States) have been in the range of Rs 5.5 lakh crore per year between 2016-17 to 2019-20.

Responding to a question about the high retail prices of petrol and diesel, finance minister Nirmala Sitharaman early this month told reporters that it was a Dharm Sankat (a complex dilemma) and both the Centre and States need to talk to resolve the issue.

She said that if the Centre cuts the excise duty then the transfers to States might be affected as 41% of the taxes collected by the Centre are transferred to States under the devolution formula recommended by the 15th finance commission.

Also Read: 'Not a single State asked us to include petroleum products in GST Council agenda'