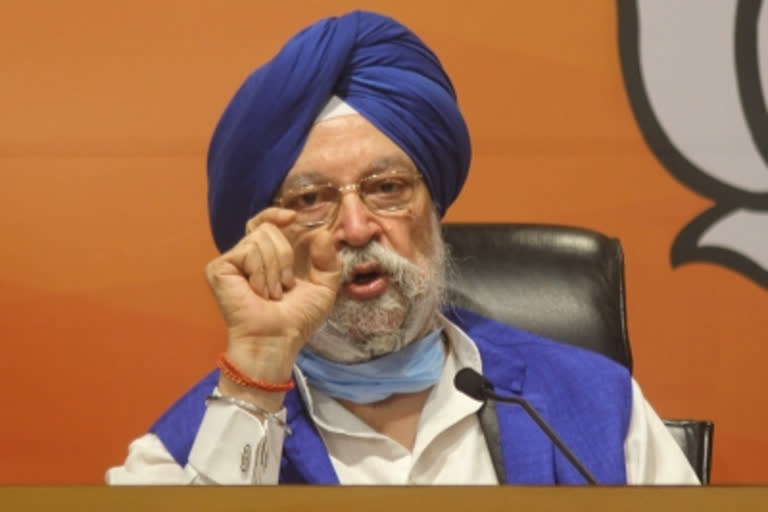

New Delhi: Madhya Pradesh levies the highest sales tax or VAT on petrol in the country, while Rajasthan has the highest tax on diesel, Oil Minister Hardeep Singh Puri told the Lok Sabha on Monday.

Heavily taxed petrol and diesel rates have shot to their highest prices this month. Taxes, both central and state, make up for 55 per cent of the retail price of petrol and 50 per cent of diesel rates.

While the central government levies a fixed excise duty of Rs 32.90 a litre on petrol and Rs 31.80 a litre on diesel, states charge an ad valorem rate of VAT that essentially results in per litre tax going up when prices rise, and falling when rates come down.

"The excise duty/cess collected (by the Central government) from petrol is Rs 1,01,598 crore and from diesel is Rs 2,33,296 crore during the financial year 2020-21 (that ended on March 31, 2021)," Puri said in a written reply to a question.

State governments, he said, levy VAT on the total amount of base price and central taxes of petrol and diesel.

The lowest VAT on petrol and diesel is in Andaman and Nicobar Islands at Rs 4.82 per litre and Rs 4.74 a litre, respectively.

Madhya Pradesh levies Rs 31.55 a litre VAT on petrol - the highest in the country, while Rajasthan charges Rs 21.82 a litre on diesel, according to Puri's reply.

Rajasthan levies Rs 29.88 a litre VAT on petrol and Maharashtra charges Rs 29.55.

Also Read: Fuel price cut relief may come soon as global oil softens

In the case of diesel, Andhra Pradesh levies Rs 21.78 a litre VAT, Madhya Pradesh Rs 21.68, Odisha Rs 20.93, and Maharasthra charges Rs 20.85 a litre.

The petrol retail selling price of Rs 101.54 per litre in Delhi is made up of Rs 32.90 a litre central excise duty and Rs 23.43 state VAT. In the case of diesel, Rs 31.80 a litre is central excise and Rs 13.14 is state VAT in the final retail selling price of Rs 89.87.

"The total excise duty/cess incidence as a percentage of retail selling on petrol and diesel is 32.4 per cent and 35.4 per cent, respectively, as on July 16, 2021," Puri said.

He said the revenue generated by such taxes is used for various developmental schemes of the government like road-building scheme Pradhan Mantri Gram Sadak Yojana (PMGSY), free LPG connection programme Pradhan Mantri Ujjawala Yojana (PMUY), Ayushman Bharat and Pradhan Mantri Garib Kalyan Yojana (PMGKY).

It is also used "to provide relief to the poor during pandemic by schemes like Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) under which free ration was provided to 80 crore beneficiaries during April 2020 to November 2020 and May-June 2021, free vaccination for COVID-19 etc," he said.

The relentless price rise over the last year has meant that most states gained on taxes unless they cut levies.

Andhra Pradesh gained the most - Rs 7.59 a litre on petrol and Rs 5.48 on diesel in the last year, according to Puri's reply.

It was followed by neighbouring Telangana that gained Rs 5.77 on petrol and Rs 4.08 on diesel. Madhya Pradesh gained Rs 5.65 a litre on petrol and Rs 3.65 on diesel.

Delhi gained Rs 4.94 a litre on petrol, but because it had cut taxes on diesel, its per litre revenue came down by Rs 5.69.

North-eastern states of Meghalaya, Nagaland and Assam too saw per litre revenue fall.

In absolute revenue, which is also dependent on total sales made in the state, Rajasthan saw its VAT revenue rise by Rs 1,800 crore to Rs 15,119 crore in 2020-21 over the previous year.

Madhya Pradesh witnessed its revenue boost by Rs 1,188 crore to Rs 11,908 crore, while the Rs 846 crore addition took Andhra Pradesh's VAT revenue to Rs 11,014 crore, according to the reply. Uttar Pradesh saw its revenue rise by Rs 1,844 crore to Rs 21,956 crore in FY21.

Delhi saw its VAT revenue fall by Rs 1,180 crore to Rs 2,653 crore, while Maharastra had its kitty shrunk by Rs 1,361 crore to Rs 25,430 crore. Tamil Nadu's revenue fell by Rs 1,112 crore to Rs 17,063 crore.

PTI