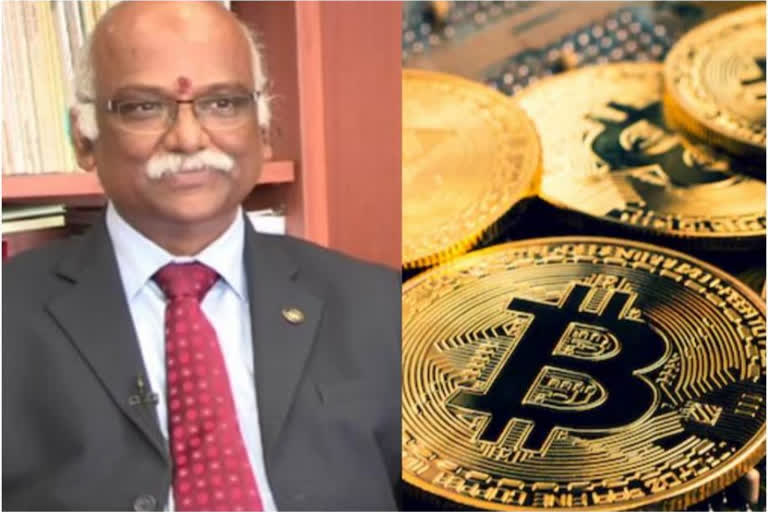

Hyderabad: With Cryptocurrencies finding a place in the 2022-2023 Union Budget presented by Finance Minister Nirmala Sitharaman, former Reserve Bank of India (RBI) Deputy Governor Rama Subramaniam Gandhi, in a special conversation with Associate Editor of Eenadu N Viswa Prasad, said he was in favour of cautioning people about the exact status of Cryptocurrency in India.

Q: One of the major proposals in the new budget is the attempt to levy tax on Cryptocurrencies and other digital asset transactions. What is your opinion on this issue?

Former RBI Deputy Governor: Firstly, it is not illegal to transact in Crypto. Secondly, it has also brought clarity on taxation when you deal in Crypto. Earlier, there was a debate whether income from Crypto transactions will be taxed or not and if it is taxed whether that would be based on capital gains, taxations, normal income or something like lottery gains. Those ambivalent positions have been settled now.

Q: People are viewing the announcement as an indirect way to endorse Crypto trade in India. A news was published in a national daily that after the government's announcement, there is a sharp increase in new users downloading the Crypto apps. What kind of changes do you expect in the overall economy based on this decision?

Former RBI Deputy Governor: You used the phrase 'indirect way to endorse Crypto trade in India'. It is actually a direct way. The budget has clearly announced that any trade in Crypto will be taxed, so it is a direct announcement. But, that does not make Crypto recognised as a currency or a payment instrument. This announcement has only been recognised for a limited purpose. And this does not mean that automatically everything about Crypto has been recognised. We should not get into assumptions.

You mentioned a sharp increase in users. There is no data. These are all qualitative things. We cannot come to the conclusion that post-announcement there has been increased interest or new users downloading the Crypto apps based on somebody writing something. Anecdotally, you can always show me several people using it, but it is not a trend. I don't think this announcement makes a very big difference for the Crypto world.

Q: Will Crypto trade have any negative impact on the monetary sovereignty of the RBI?

Former RBI Deputy Governor: Especially if it is used as a currency or a payment instrument, then it would certainly be impacting the monetary stability of the country.

Q: What will be the consequences?

Former RBI Deputy Governor: Obviously, the Reserve Bank's ability to manage the monetary system of the country, controlling inflation, controlling money supply--all those things would not be feasible as people will have an entirely alternative method of transactions without bringing it to the mainstream accounting system--all this can happen if Crypto is allowed to be operated as a currency.

Q: What are the issues being faced by the government and the RBI in maintaining macro-economic and financial stability in the future?

Former RBI Deputy Governor: Everybody should clearly understand that the legal clarity on taxation in dealing with the income that one gains out of Crypto trade cannot be deemed as a legal clarity on its position as a currency. This is a communication that has to be understood by any and everybody. If people are misled into believing that Crypto is now recognised and they can do whatever they want, subsequently start doing it, it will undermine the macro-economic and financial stability of the country. Hence, Reserve Bank has time and again reiterated its position that Crypto cannot be recognised as a currency.

Very recently, RBI Deputy Governor, in a speech at the annual conference of the Indian Bank Association, very clearly said that Reserve Bank is in favour of banning Crypto as a currency. Everyone will have to take that statement in the right spirit. The budget announcement relates to income generated from Crypto. That does not mean Crypto can be used the way everyone is assuming as a currency. Differentiation has to be understood very well.

Q: The volatility in the value of Cryptocurrency is very high. There are fears from some quarters that the endorsement of the Crypto trade will lure people into gambling and encourage them to make a quick buck. What is your advice to the common people? Can they consider Cryptocurrency as an investment or not?

Former RBI Deputy Governor: That is a danger we're facing here. One of the very negative positions about Crypto all these years has been the volatility in the value of the currency. If you look at the last one month, it has gyrated between $42,000 per Bitcoin, down to $35,000, and today back to $44,000. In six months, it has gyrated between $41,000 and $62,000 and then all the way down to $35,000. This kind of volatility is not good and cannot be handled by common people.

They can be misguided by unscrupulous people into believing that they can make big gains when investing in Crypto. After that, if uninformed people start dealing in Crypto, that is definitely bad. Ordinary people, who do not have the capacity to lose money, should be very much guarded after the announcement. If they believe in such quick-rich ways, then it is nothing but gambling and not the right way to manage your finances. This is why continuously cautionary advisories have to be issued, the way Reserve Bank has been doing, cautioning the people that 'it is not suitable for you'.

Q: What is advice on investing in Cryptocurrency?

Former RBI Deputy Governor: It requires guts and capital to tide over the crisis if you incur losses and you should also have surplus income.

Q: All the investments made by people in the Crypto trade go to private individuals. They will not be used to create public goods. Will the situation not adversely affect economic activity?

Former RBI Deputy Governor: That is not the way to look at it at all. If you look at consumption expenditure superficially, you will come to the conclusion that it is not available for investment, as capital for building infrastructure and long-term projects like that. For that reason can we say 'people should not consume at all? There needs to be a balance between consumption expenditure and capital which becomes a conduit for investment. people will save, and the savings will have to be funnelled for investment activity. For that, a separate flow of operations has to be there.

Any consumption leads to a reduction in investment, but consumption indirectly helps investment. In any macro-economic arrangement, it is one of the most important components. In many economies, it is the lead engine for growth. If some people are involved in activities like the crypto trade, it does not automatically mean that it will adversely affect economic activity.

Q: Finance Minister announced in the budget that India will have a digital currency soon. What is your assessment of the merits and demerits of the statement?

Former RBI Deputy Governor: Not just in India, but in many countries, the Central Banks and governments are engaged in trying to bring in official digital currencies. This is the recognition of the blockchain technology, which Cryptocurrencies are based upon. This is very valuable and countries around the world have to make good use of this technology, as this assures a higher level of security. That's why there is a fundamental advantage in utilising the benefits of this technology.

We understand the negatives of private currencies, we even spoke about banning the privately issued currencies. If an officially issued digital currency is available, people will have an alternative. People need not deal in hard, paper currency, or even the wallets that we use today. They all have certain levels of security, but if it is based upon blockchain technology, it adds further confidence in the safety of the currency. To that extent, it may be useful. We need to see to that once it comes into circulation.

As an official authority, they (the government) would like to give an option to the people, like 'you want a modern, technology-based currency offering? Here is one. You need not go to the private way of doing things, which will have its own security and safety issues. We're officially offering you this one. If you want to make use of it, make use of it'.

This is the merit of digital currency. It is a valid option for blockchain technology-based currency offering. It will be an officially issued one, so people can have absolute confidence in such currencies, as compared to privately issued currency.

I will not call it a demerit, but the expectation over the private currency over the world today is that you can make gains out of investments in such assets.

The value ratio between the normal and the digital currency would be 1:1 and it will not give big returns even if someone invests in this. However, a foreigner would be able to use it 'like a foreign exchange', similar to their investments in INR, and vice versa. If the US releases USD digital currency, Indians, under FEMA (Foreign Exchange Management Act), will be able to invest in such currency. Again, it might go up and down, but it is a valid, available investment option.