Patna: People in Bihar have raised their voices against the finance ministry's latest move to impose GST on unbranded and packed food products. Not only the opposition but the common man, think tanks and economists have also opposed the move.

The Rashtriya Janata Dal (RJD) has slammed the central government for the hike in GST on food items which has hit people hard. Opposition leaders including Tejashwi Prasad Yadav said that charging GST on the essential products will make the life of the common man "miserable". He alleged that the government was waiving taxes of its close corporate friends.

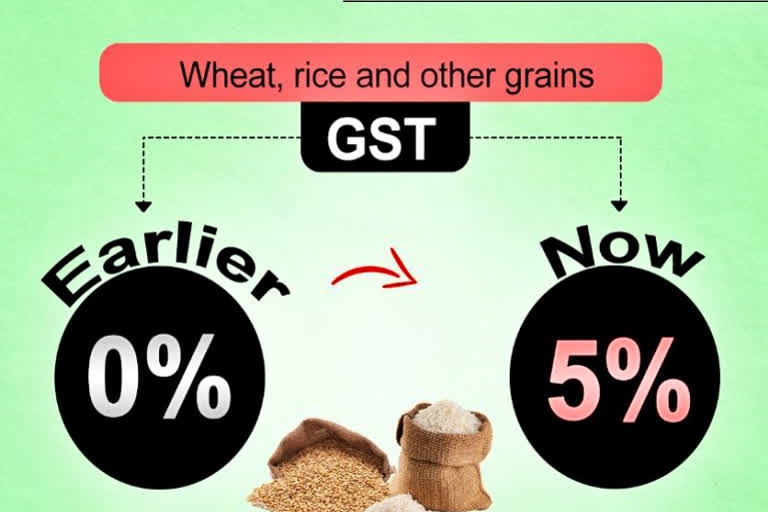

"For the first time after independence, people will pay tax on food grains. In the beginning, when the GST was being launched the government had promised that no tax would be imposed on essential commodities like milk, curd, flour and others. All these items would be tax-free. Once again the Modi government has cheated the people of Bihar. These items are consumed by poor people. Their life is going to be miserable now,” Tejashwi said.

Also read: Sitharaman should appoint a Chief Economic Astrologer: Chidambaram in a dig at FM

Former Chief Minister Rabri Devi echoed the same and said that the centre has "failed to control" the price rise. "People are already paying more for petrol, diesel and LPG gas cylinders. Now the GST on food items will further worsen the situation. It proves that the NDA government at centre is an anti-poor and anti-middleman and is not bothered about their problems,” Rabri said.

People are also feeling the pinch of price rise and GST imposed on unbranded, pre-packed and labelled food items. A common citizen has to shell out more money for the same products. Ever since the new rule has been imposed, the prices of curd and lassi have shot up in Bihar. According to the official press release of the Bihar State Milk Cooperative Federation Ltd, lassi that earlier cost Rs 10 would now cost Rs 12. Similarly, the curd one bought at Rs 25 will cost Rs 30.

The local traders and consumers have raised their objection to GST on essential commodities including Atta (flour). "We are already hit by price rise and now the GST on food products is a matter of serious concern. We urge the government to think about the common man and rollback this decision," Punam Devi, a resident of Patna said.

Also read: Pre-packaged rice, flour to get dearer as revised GST kicks in from today

Dr Bakshi Amit Kumar Sinha, a faculty member at the Centre for Economic Policy and Public Finance (CEPPF) at the Asian Development Research Institute (ADRI) in Patna, termed it a tough decision for the recovery of the economy but also suggested coming up with the alternative in which poor should not face the problem. "It is a tough decision taken in a bid to recover the economy. It is important to formalise the informal economy and that can only take place by collecting the tax. Packed food items are mainly consumed by upper-class people and there is no GST on the loose products. However, it is going to affect the middle class and small producers. The government must think of alternatives without troubling the poor people,” Dr Sinha said.

Bihar Congress on the other hand strongly opposed the move and demanded its immediate rollback. “In GST council meeting despite objections and opposition by Congress governed states and by West Bengal, the recommendations of the fitment committee were accepted by BJP governed majority states and the government of India accepted it. This is a time of dictatorship. The BJP government is dictating everything just like this 'Gabbar Singh Tax'," said Bihar Pradesh Congress Committee member and spokesperson of the party Kuntal Krishna.

Also read: Opposition parties protest against GST hike, raise slogans against govt in Parliament premises

"This is a government sponsored plan to exploit the common man of India. The BJP led NDA has chosen few of their industrialist friends and given a free run to exploit poors. For the first time in Independent India, the meal of the common man has been taxed at cost. The BJP led government will have to roll back this tax on Aam Aadmi Ki Thali (common man's platter),” Krishna said.

National Vice president of Confederation of All India Traders (CAIT) Kamal Nopani said that he has written a letter to Bihar finance minister Tarkishore Prasad to raise the issue before the GST council and also demanded to roll back GST on essential food items. Patna-based political expert Dr Sanjay Kumar said that GST on food items was a "direct attack" on the food of the common man.

“Food is important for the elite class as well as the poor class and imposing GST on food items is nothing but a direct attack on the platter of the common man. Pulses were already missing from the plate of the poor and now taxing curd, wheat and flour which is a source of protein will make people's life more miserable. GST on food items proves that the welfare schemes by the government is a facade. If the government is interested in collecting tax they should collect it from the pockets of industrialists, why to hit poor people who struggle for two meals a day. Middle class, lower middle class and people living below the poverty line will face its impact," said Dr Sanjay.