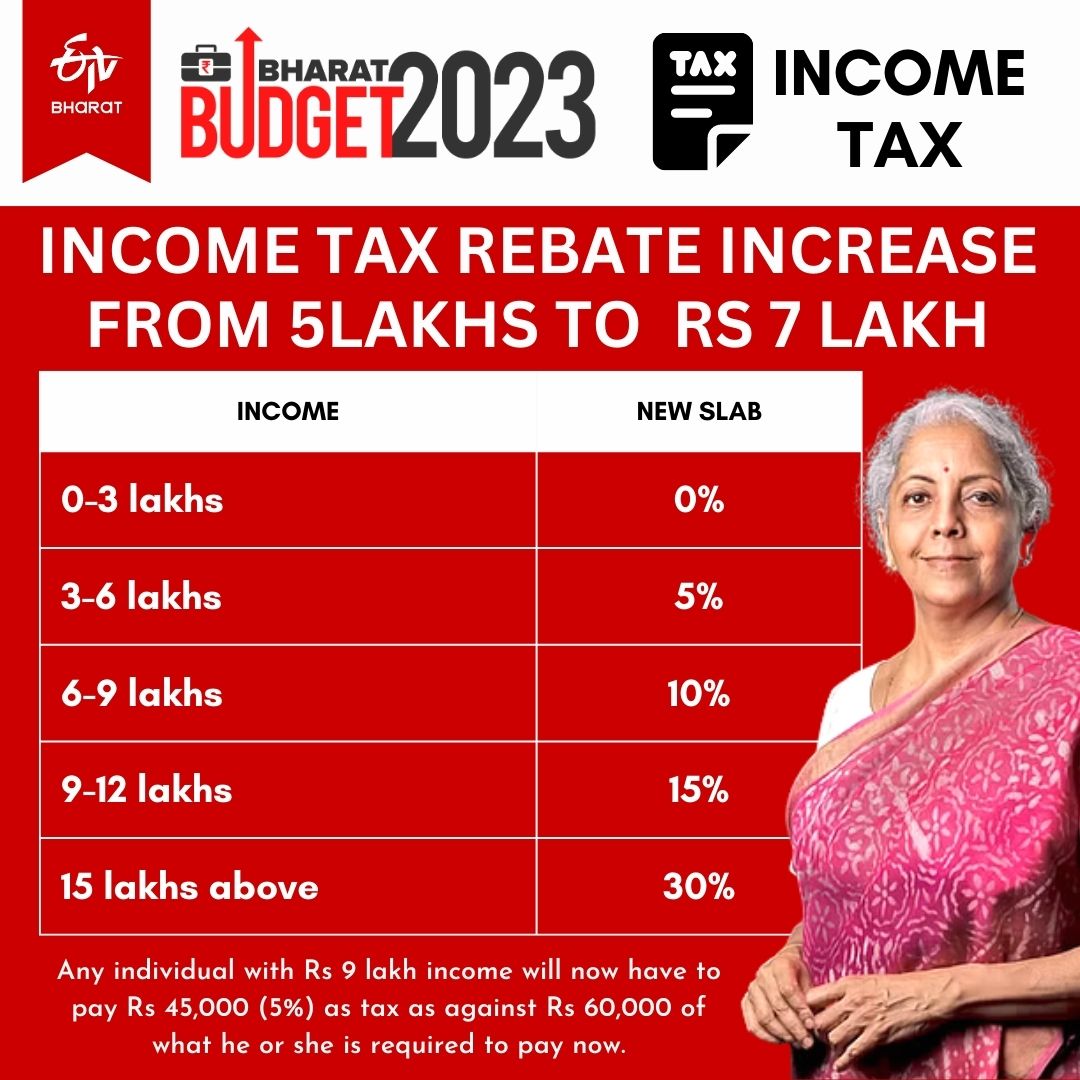

New Delhi: Finance Minister Nirmala Sitharaman Wednesday made a massive announcement for the middle class in her Budget 2023 speech by increasing the tax rebate limit from Rs 5 lakh to Rs 7 lakh.

The Finance Minister spoke of personal income tax at the end of her 87-minute Budget speech: "Now I come to what everyone is waiting for — personal income tax. I have major announcements to make in this regard. These primarily benefit our hard-working middle class."

"Currently, those with income up to Rs 5 lakh do not pay any income tax in both Old and New tax regimes. I propose to increase the rebate limit to Rs 7 lakh in the New tax regime," she declared, which was followed by the thumping of desks by her political alliance partners.

"I had introduced, in the year 2020, the new personal income tax regime with six income slabs starting from Rs 2.5 lakh. I propose to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs 3 lakh," she said.

Following are the key announcements around personal taxes in her Budget 2023-24 speech

- Renewed tax slabs as per the new tax regime: 0-3 lakh nil, 3-6 lakh 5%, 6-9 lakh 10%, 9-12 lakh 15%, 12-15 lakh 20%, and above 15 lakh 30%.

- The new tax regime will be by default.

- Any individual with Rs 9 lakh income will now have to pay Rs 45,000 (5%) as tax as against Rs 60,000 of what he or she is required to pay now. Similarly, those with Rs 15 lakh income will have to Rs 1.5 lakh (10%). Presently, they have to pay Rs 1.87 lakh.

- Each salaried person with Rs 15.5 lakh or more income to benefit by Rs 52500.

- At present, the highest tax in the country is 42.7 percent. The Budget 2023-24 proposed to reduce the surcharge rate from 32 percent to 27 percent. This will bring down the maximum tax rate to 39 percent.

- Encashment of earned leave up to 10 months of average salary, at the time of retirement in case of an employee (other than an employee of the Central Government or State Government), is exempt under sub-clause (ii) of clause (10AA) of section 10 of the Income-tax Act (“the Act”) to the extent notified. The maximum amount which can be exempted is Rs 3 lakh at present. It is proposed to issue notification to extend this limit to Rs 25 lakh.