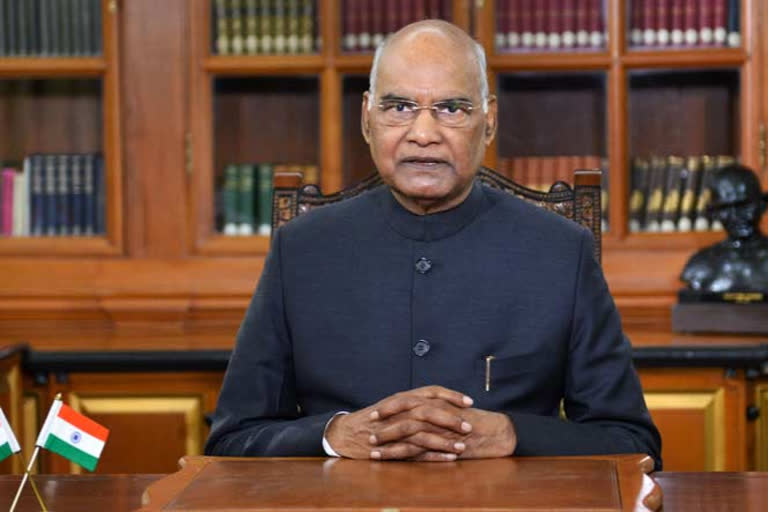

New Delhi: President Ram Nath Kovind promulgated the Banking Regulation (Amendment) Ordinance, 2020, which brings urban and multi-state cooperative banks under the direct supervision of the Reserve Bank.

"In pursuance of the commitment to ensure safety of depositors across banks, the President has promulgated the Banking Regulation (Amendment) Ordinance, 2020," a finance ministry statement said on Saturday.

"The Ordinance seeks to protect the interests of depositors and strengthen cooperative banks by improving governance and oversight by extending powers already available with RBI in respect of other banks to Co-operative Banks as well for sound banking regulation, and by ensuring professionalism and enabling their access to capital," the statement added.

The Ordinance amends the Banking Regulation Act, 1949 as applicable to Cooperative Banks. It seeks to protect the interests of depositors and strengthen cooperative banks by improving governance and oversight by extending powers already available with RBI in respect of other banks to Co-operative Banks as well for sound banking regulation, and by ensuring professionalism and enabling their access to capital.

Read: Trade dependency on China: India may not be able to boycott Chinese products

It also amends Section 45 of the Banking Regulation Act, to enable making of a scheme of reconstruction or amalgamation of a banking company for protecting the interest of the public, depositors and the banking system and for securing its proper management, even without making an order of moratorium, so as to avoid disruption of the financial system.

The Ordinance, however, will not affect the existing powers of the State Registrars of Co-operative Societies under state co-operative laws.

It also does not apply to the Primary Agricultural Credit Societies (PACS) or co-operative societies whose primary objective is long-term finance for agricultural development.

Speaking to ETV Bharat Dr. K. Srinivasa Rao, Adjunct Professor, Institute of Insurance and Risk Management (IIRM) said, "Yes, bringing cooperative banks under RBI like they brought all Housing Finance Corporations (HFCs) from NHB will pull them out from local administration of Registrar of cooperative societies. Thereby professional management of cooperative banks can begin. A good move in depositor interest."

(With inputs from agencies)