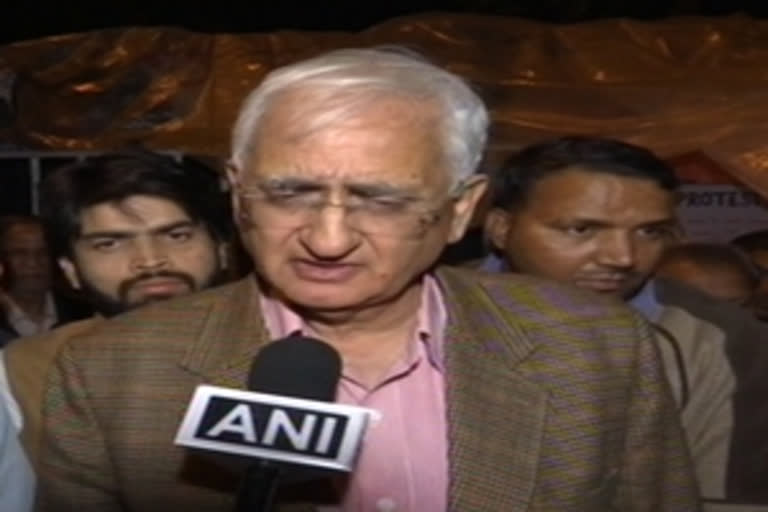

New Delhi: Taking a dig at the Centre over the Yes Bank crisis, senior Congress leader Salman Khurshid on Sunday said that Prime Minister Narendra Modi led government claims of making India a dollar 5 trillion economy but cannot even manage banks.

"There were rumours that money was not safe in banks. It was one of the top five private banks. It is not about any particular bank but has raised a question on the entire banking system. They were talking about a five trillion economy but they are not even able to manage the banks," Khurshid told media.

This comes as the Reserve Bank of India (RBI) has imposed several restrictions, including a Rs 50,000 cap on withdrawal until April 3 this year, saying that the bank's financial capability has undergone a steady decline largely due to the inability of the bank to raise capital.

"Concern has been raised in certain sections of media about the safety of deposits of certain banks. This concern is based on analysis which is flawed. Solvency of banks is internationally based on Capital to Risk-Weighted Assets (CRAR) and not on market cap," RBI said in a series of tweets.

-

Concern has been raised in certain sections of media about safety of deposits of certain banks. This concern is based on analysis which is flawed. Solvency of banks is internationally based on Capital to Risk Weighted Assets (CRAR) and not on market cap. (1/2)

— ReserveBankOfIndia (@RBI) March 8, 2020 " class="align-text-top noRightClick twitterSection" data="

">Concern has been raised in certain sections of media about safety of deposits of certain banks. This concern is based on analysis which is flawed. Solvency of banks is internationally based on Capital to Risk Weighted Assets (CRAR) and not on market cap. (1/2)

— ReserveBankOfIndia (@RBI) March 8, 2020Concern has been raised in certain sections of media about safety of deposits of certain banks. This concern is based on analysis which is flawed. Solvency of banks is internationally based on Capital to Risk Weighted Assets (CRAR) and not on market cap. (1/2)

— ReserveBankOfIndia (@RBI) March 8, 2020

Read: CBI registers FIR against Yes Bank co-founder Rana Kapoor, DHFL, DoIT Urban Ventures

"RBI closely monitors all the banks and hereby assures all depositors that there is no such concern of the safety of their deposits in any bank," it added.

-

RBI closely monitors all the banks and hereby assures all depositors that there is no such concern of safety of their deposits in any bank. (2/2)

— ReserveBankOfIndia (@RBI) March 8, 2020 " class="align-text-top noRightClick twitterSection" data="

">RBI closely monitors all the banks and hereby assures all depositors that there is no such concern of safety of their deposits in any bank. (2/2)

— ReserveBankOfIndia (@RBI) March 8, 2020RBI closely monitors all the banks and hereby assures all depositors that there is no such concern of safety of their deposits in any bank. (2/2)

— ReserveBankOfIndia (@RBI) March 8, 2020

Yes Bank founder Rana Kapoor was on Sunday handed over to the Enforcement Directorate (ED) by a special holiday court in Mumbai till March 11 in connection with a case pertaining to the alleged financial irregularities of Yes Bank and DHFL.

Several opposition parties, including Congress and CPI(M), have targetted the government over the crisis.

On the other hand. Finance Minister Nirmala Sitharaman has claimed that a reconstruction plan for Yes Bank will be introduced by the RBI within the moratorium period of 30 days.

(ANI Report)

Also Read: Government failed to fix responsibility in Yes Bank case: BSP