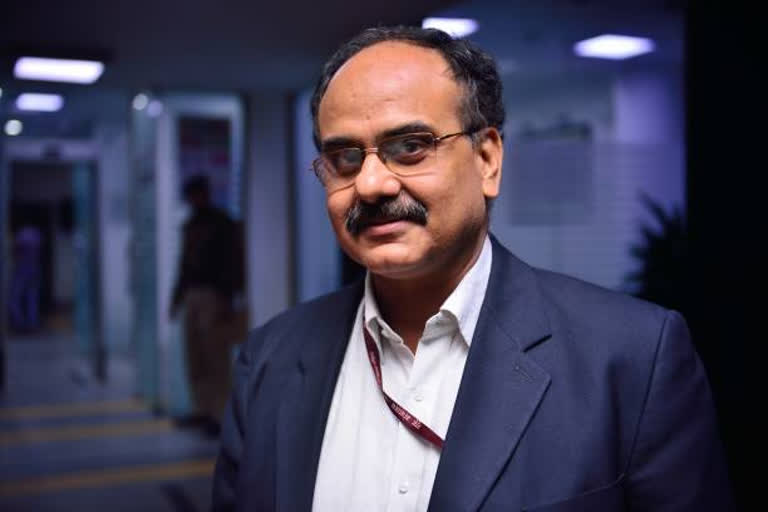

New Delhi: In yet another indication of an economic rebound, the generation of E-bills hit a record high of 5.74 crore bills in the month of September, said Finance Secretary Ajay Bhushan Pandey.

“In September, more than of 5.74 crore E-way bills have been generated,” Pandey said.

The number of E-bills generated in September this year is 9.3% higher than the number of E-bills generated during the same month last year.

“These are affirmative signs of economic growth as the business activities are unlocking gradually and despite the adverse impact of Covid-19, there are indicators of economic recovery,” Revenue Secretary Pandey said in a statement sent to ETV Bharat.

The news about E-bill generation touching a record comes in the wake of another positive news as last month’s GST collection also surpassed the GST collection during the same month last year. In September this year, the GST collection was Rs 95,480 crore, which is 4% higher than the GST collection during the same month last year.

In a clear sign of economic activity returning to pre-COVID level, not only the E-bill generation touched an all-time high in the month of September but it also touched a record high for a single day on September 30.

“On September 30, 2020, almost 26.19 lakh e-way bills were generated which is the highest ever count so far in a single day,” Pandey said.

Prior to this, the highest ever single-day E-bill generation was recorded on February 29 this year when 25.19 lakh E-bills were generated.

Also Read: Temporary retention of GST cess pending reconciliation not diversion: Finance Ministry sources

What is an E-bill

E-Way or E-Bill is an electronic bill which is required for the transportation of goods. The E-bill is generated from the dedicated portal for this purpose.

Use of E-bill is compulsory for GST registred entity or individual if the value of the goods to be transported exceeds Rs 50,000.

When an E-Bill is generated through the portal, a unique E-Bill Number (EBN) is generated which becomes available to the supplier, transporter and recipient of the goods. It is designed to reduce the travel time of goods across states which was one of the principal objective of a nationwide common goods and service tax (GST).

In addition to providing convenience to taxpayers, it's an instrument for enforcement as a GST registered supplier will not be able to generate E-bills for transportation of goods if he has not filed GSTR-3B returns for previous two months.

Festive season to help in revival of economy

India’s winter festive season begins this month, when people spend money on buying new goods, vehicles and other accessories. The season comes as a big opportunity for marketers and financial institutions as demand for new products and goods touches a record during this time in the year.

Talking about a buoyant GST collection last month, Pandey said some major industrial states have shown very positive growth in GST collection which is indicative of the process of economic recovery being on track.

“With the festive season coming in the next month, we are much confident of better recovery in GST Collection,” said the top officer in the ministry of finance.

(Article by Krishnanand Tripathi)