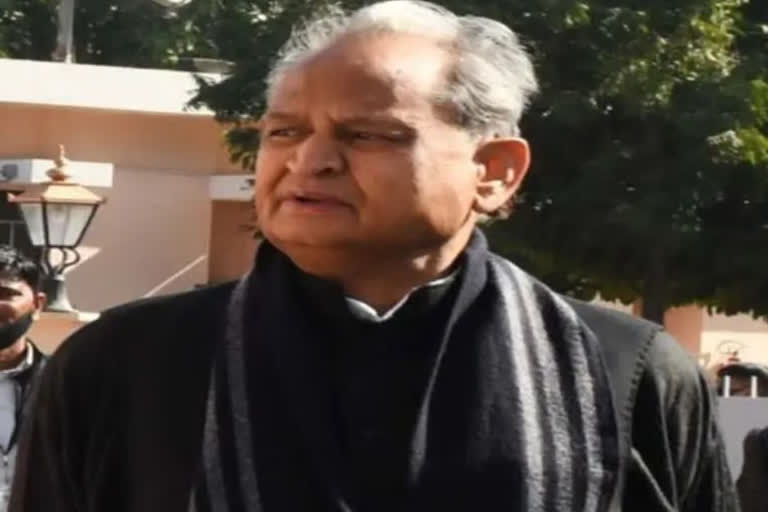

New Delhi: The Ashok Gehlot Government in Rajasthan announced the revival of the old pension scheme (OPS) from next year for all employees appointed on or after January 1, 2004, while presenting the Budget for the year 2022-23, on Wednesday. While the Rajasthan Chief Minister has fulfilled a major and long pending demand of the state government employees, the experts are of the opinion that this move can have significant repercussions on fiscal stability and even lead to making the State Government bankrupt in the future.

Speaking to ETV Bharat, economist, and CEO of Value Research, Dhirendra Kumar explained, "It is very substantial. There is a reason why National Pension System was implemented and eventually, it will be implemented in all states. This is a huge migration from defined benefits because going back to the old pension system means all the benefits will be stated and nobody has to contribute anything there. I think that it is going to put a strain on the state government's finances to the extent that in 10 years' time, the government will have to spend most of its taxes on salaries and pensions."

The aim to bring a new pension scheme (NPS) was to cut down the cost of pension payout. Under OPS, employees get a pension under a pre-determined formula which is half of the last drawn salary, in addition, to get the benefit of the revision of Dearness Relief (DR), twice a year. While the new scheme is based on contributions where an employee deposits 10 percent of the basic salary plus dearness allowance.

Also read: Rajasthan Govt's decision to revive old pension scheme puts BJP under pressure

It must be noted that in view of the discontinuation from April, the Rajasthan government has reduced the pension burden on the exchequer by budgeting to Rs 24,439 crore in FY23 from Rs 25,328 crore in the previous year. However, experts also believe that if this scheme would get implemented, the government could either have to cut on social sector expenditure or borrow more for paying for a higher pension bill under this scheme.

"This is something which is non-negotiable. We have to pay the salaries and pensions on time and that too every month. This is not a productive expenditure because the government is not borrowing to spend on infrastructure or any other thing that plays the catalytic role in the economy. This is something which can make the state government bankrupt," the economist further added.

This move may also create political pressure upon other states to implement the same. Amid the ongoing Assembly elections, Samajwadi Party has already promised to revive the old pension scheme if it returns to power in Uttar Pradesh. When asked about the matter, Kumar replied, "No it is going to be a very unwise move. Government is there for the welfare of the people and not just for the welfare of its own employees."

As the budget 2022-23 has projected a revenue deficit of Rs 23,488.56 crore and fiscal deficit of Rs 58,211.55 crore, which is 4.36 percent of GSDP, Gehlot didn't mention how much financial burden will the old pension scheme put upon the state finances.

Also read: Congress asks Centre to replicate Rajasthan Model, revive Old Pension Scheme