Jaipur: Cybercriminals are resorting to new ways to lure people and steal them of their hard-earned money. These days, cyber thugs are adopting a new strategy wherein people are defrauded in the name of credit card related offers. Skimmers put up fake Facebook pages of various well-known banks, and cyber thugs trick people into their web by offering them free credit cards and at the same time by promising them cashback and discounts.

Also read: 3.17 lakhs cybercrimes in India in just 18 months, says govt

Especially with the fuel price surging every now and then, cybercriminals are tempting unsuspecting customers by telling them that they can save up to 15% on petrol and diesel bills through credit cards. As a result, people are falling into the trap set up by cyber thugs.

According to cybersecurity expert Ayush Bhardwaj, the thugs having created similar Facebook pages of well-known banks, mention various offers which include giving credit card for free, no additional charges or annual fees, free movie tickets every month, 15% off on diesel and petrol bills and 15% discount on online shopping.

Also read: Dealing with cyber crimes: DOs and DON'Ts

Here are some ways how people are lured into the trap:

Youngsters mainly targeted by post sponsors

Cybersecurity expert Ayush Bhardwaj says that cyber thugs target youngsters through post sponsors via Facebook pages. Also, people already using credit card or those who search regarding credit cards are those who are mainly targeted. Under this strategy, people aged between 18 and 30 years are shown ads of various banks on their Facebook profile.

Scam calls seeking personal information

When a person applies seeking a credit card on a fake Facebook page or makes calls, immediately the customer is contacted and information about various credit cards and schemes associated with it are explained. In the process, they inform the customer to send their personal information which includes Aadhaar, PAN and other details, so that the new credit card could be issued immediately.

Private info sold on the deep web, QR code sent to the victim

Cyber thugs sell personal information obtained from individuals on the deep web. Later, SIM cards are purchased using the personal information of those individuals in a bid to carry out criminal activities. Apart from this, when an unsuspecting person is asked to scan a QR code sent on WhatsApp using a UPI application, transactions worth lakhs of rupees are withdrawn from their account.

Also read: Andhra CM launches virtual campaign on cyber crimes against women

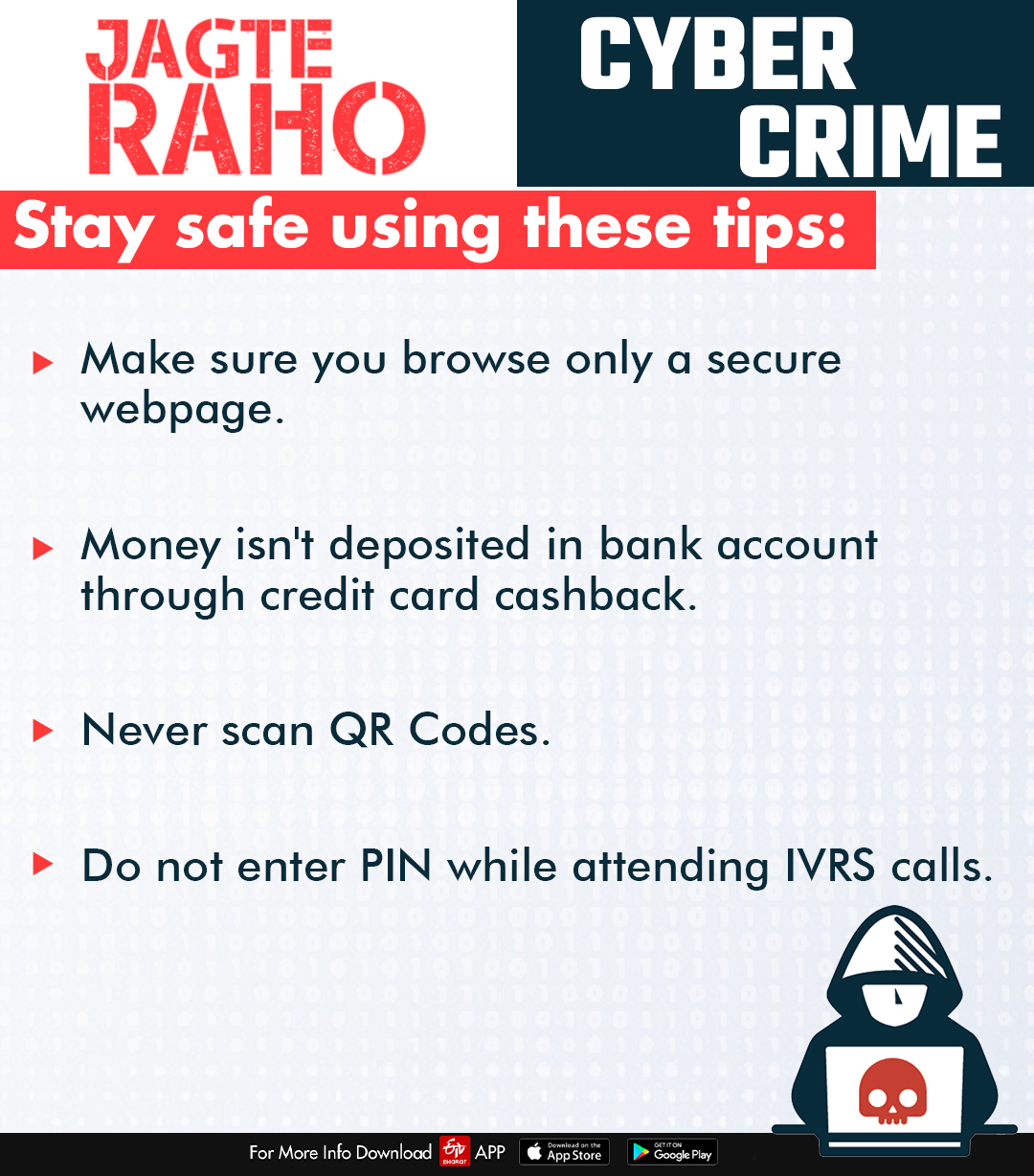

Use these tips to save yourself:

Make sure you access a verified page only:

Cybersecurity expert Ayush Bhardwaj states that people applying for credit cards online need to ensure that they are browsing only on a verified page. All Facebook pages of banks with blue ticks are verified, however, if any bank page does not have a blue tick, then avoid clicking on that page and refrain from sharing any kind of personal information.

Money isn't deposited in Bank A/c through Credit card cashback:

It is to be noted that cashback received through credit cards are never deposited in a person's account. Hence, beware and be alert if any person informs you about depositing credit card cashback to your bank account.

Do not scan any QR Code nor enter PIN while using IVRS calls:

Cybersecurity expert Ayush Bhardwaj has made it clear that in any instance, QR codes are not be scanned using any kind of UPI applications. He says that on scanning QR codes, money in a person's bank account is only withdrawn, instead of being deposited. Also, never should a bank pin be entered while attending IVRS calls.