New Delhi: Finance Minister Nirmala Sithraman's third major presser held at the National Media Centre in New Delhi today.

With a focus on completing construction of unfinished units, Government announces new measures to boost housing and facilitate home buyers. External Commercial Borrowing guidelines will be relaxed Encouraging Government Servants to buy houses.

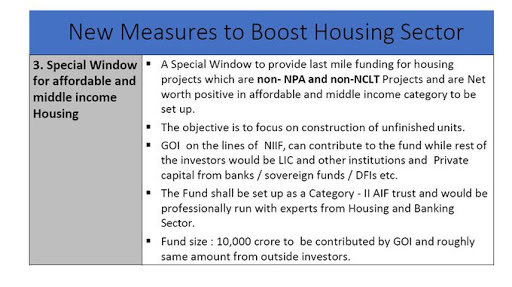

Announcing the measure, Finance Minister Nirmala Sitharaman said the government will contribute Rs 10,000 crore for the special window and roughly the same amount is expected from outside investors.

The stressed asset fund will benefit around 3.5 lakh homebuyers, Sitharaman said, adding that buyers stuck in bankruptcy-bound projects will get relief through the NCLT.

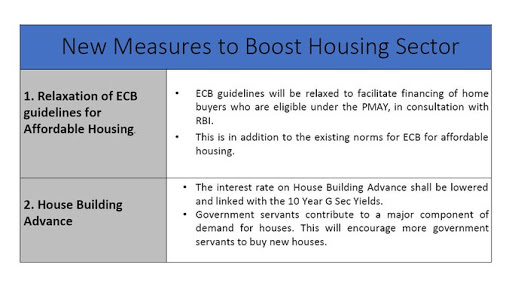

ECB guidelines will be relaxed to facilitate the financing of home buyers who are eligible under the PMAY, in consultation with RBI.

This is in addition to the existing norm,s for the ECB for affordable housing.

The interest rate on Housing Building Advance shall be lowered and linked with the 10 year G Sec Yields.

Government servants contribute to a major component of demand for Houses. this will encourage more Government servants to buy new houses.

A special Window to provide last mile Funding for housing projects which are non-NPA and non-NCLT projects and are Net worth positive in affordable and middle-income category to be set up.

The objective is to focus on the construction of unfinished units.

GOI on the lines of NIIf can contribute to the fund while rest of the investors would be LIC and other Institutions and Private capital from banks/ sovereign funds/ DFIs etc.

Read more: Jharkhand women stitching their way out of poverty with jute