New Delhi: Retail inflation dropped for the first time after six months in February, easing to 6.58 per cent as prices of vegetables and other kitchen items cooled, government data showed on Thursday.

The Consumer Price Index (CPI) based retail inflation, however, still continues to rule above the comfort level of the Reserve Bank of India.

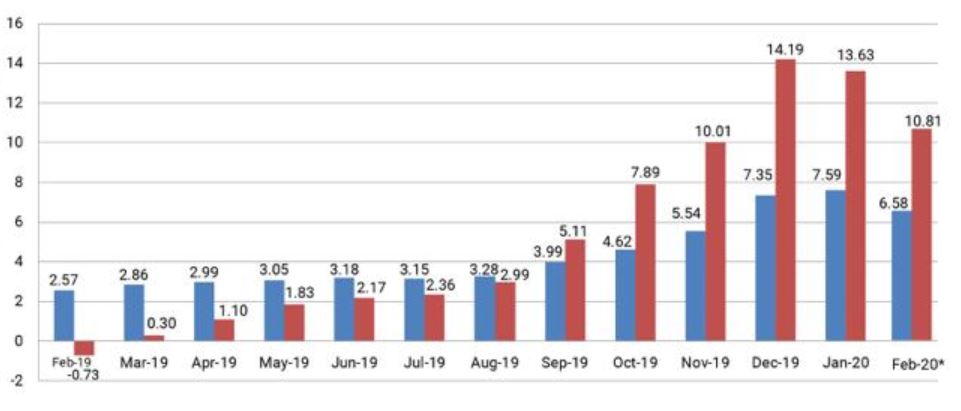

The retail inflation was 7.59 per cent in January this year and 2.57 per cent in February 2019.

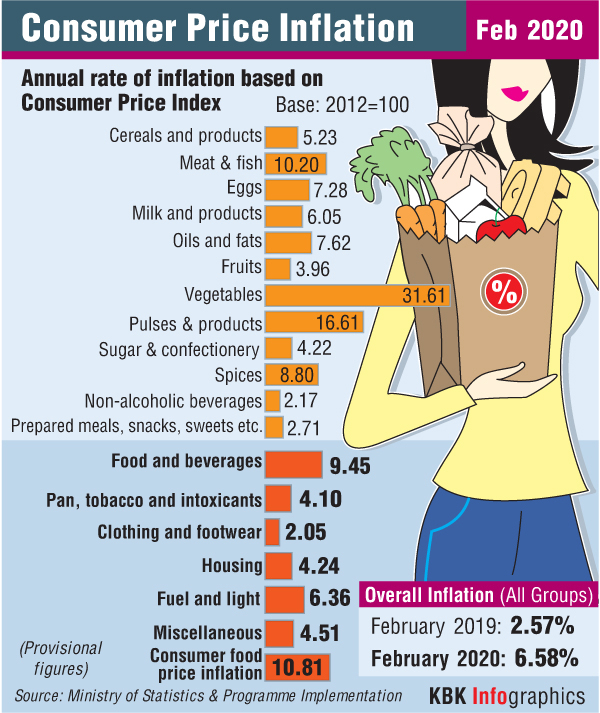

Inflation was 10.2 per cent in the meat and fish segment in February, compared to 10.5 per cent in the previous month.

The CPI-based inflation has been on the rise since August 2019, and it is for the first time it has moved southward since then.

Data showed inflation in vegetable prices cooled off significantly to 31.61 per cent from a high of 50.19 per cent in January. The rate of price rise was also slower in case of protein-rich items pulses and eggs.

The inflation in the food basket was 10.81 per cent in February 2020, lower from 13.63 per cent in the previous month, as per the CPI data released by the National Statistical Office (NSO).

However, the inflation in the 'fuel and light' segment almost doubled to 6.36 per cent in February over the preceding month.

The Reserve Bank of India (RBI) mainly factors in the retail inflation while deciding its bi-monthly monetary policy.

Read more: Delhi Airport adjudged best airport in the world

The government has mandated the central bank to keep inflation at around 4 per cent.

In its last meeting, the RBI had kept the key lending rate (repo) unchanged at 5.15 per cent amid hardening inflation and an uncertain global environment.

Commenting on the data, Rahul Gupta, Head of Research- Currency, Emkay Global Financial Services, said retail inflation for February has cooled due to moderation in food prices.

However, the figure remained elevated above the Monetary Policy Committee's target, he said.

"Due to the coronavirus uncertainty, we expect RBI to take pre-emptive measure anytime soon or at April's MPC policy and cut repo rate. If the virus spreads further very rapidly then we can expect a deeper cut of 50 bps by RBI," Gupta said.

The NSO data further revealed that the inflation was 10.37 per cent in the rural India and 11.51 per cent in the urban areas. In both cases, the rate of price rise was lower than January.

(PTI Report)