Hyderabad: On an average, retail prices rose by 5.54 per cent in November 2019 against 4.62 per cent recorded in October on the back of high price in vegetables that shot up to 33.99 per cent.

It is the highest inflation rate since July 2016 and is above the RBI’s medium-term target of 4 per cent.

It has also gone beyond the market expectations of 5.26 per cent causing concern to stakeholders and keeping the Reserve Bank of India (RBI) on edge.

Taking into account the farm output and domestic and global situation, RBI revised inflation projections upwards to 4.7-5.1 per cent for October-March 2019-20 and 3.8-4.0 per cent for April-September 2020-21; but, based on the actual inflation data these projections may go awry.

Is rising inflation new phenomenon?

Rising inflation is not new to our economy.

Prior to the Monetary Policy Framework Agreement (MPFA), India experienced a double-digit inflation regime since 2010. In fact, in June 2010, it recorded a high of 13.9 per cent.

Read more:Gold prices plummet Rs 766, silver also tumbles Rs 1,148

Under MPFA, RBI has to contain inflation below 6 per cent within a range of +/- 2 per cent over 4 per cent.

The first of its kind inflation targeting became effective from February 20, 2015 and remains valid till 31 June 2021. Inflation targeting policy will be reviewed by then.

Trends of Repo Rates

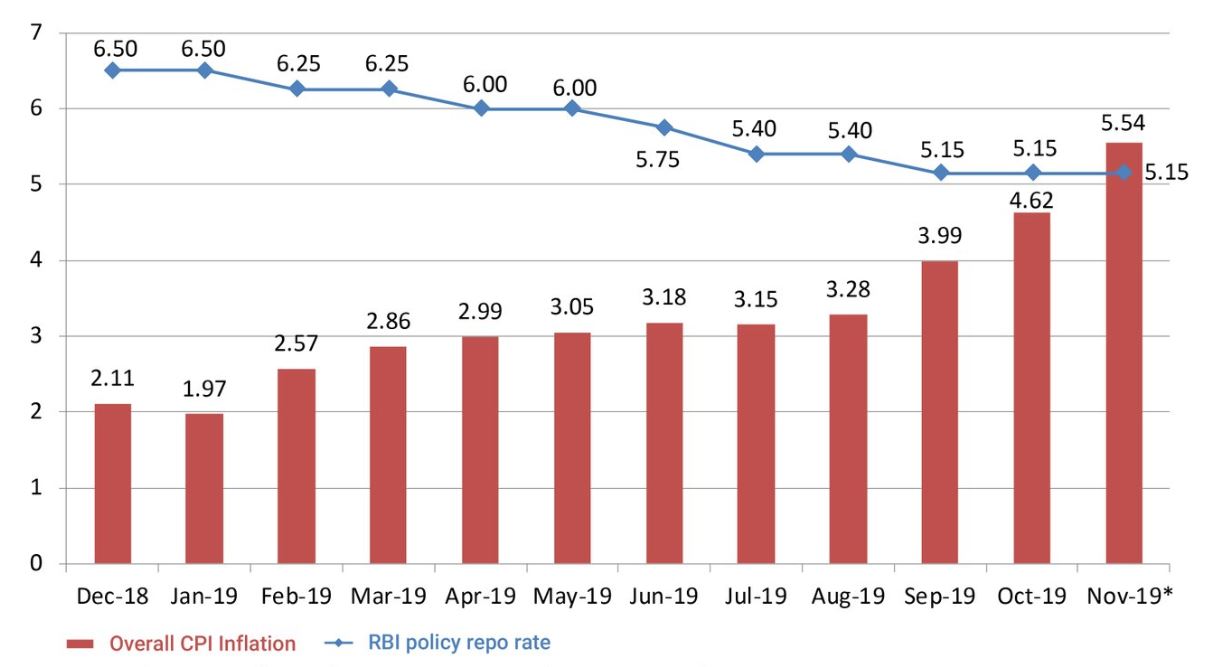

In the recent interest rate cycle, the Central Bank cut repo rate by 135 basis points and gradually brought it down to 5.15 per cent.

In February 2019, the repo rate was 6.5 per cent and inflation was 2.57 per cent.

During this period, the inflation climbed to 4.62 per cent hitting close to RBI target to 5.54 per cent in November 2019.

It should be noted that the Repo rate is the benchmark interest rate at which banks can borrow from RBI.

Since it is the reference interest rate around which deposit and lending rates of banks hover, this is considered as the key policy instrument for RBI to control money circulation and in turn, inflation (i.e. price rise).

After five back-to-back rate cuts, RBI opted to pause in December 2019 bi-monthly policy review.

Why RBI paused repo rate cuts?

Since repo rate cuts were not fully passed on by banks to borrowers in the form of softer lending rates, RBI is on a watch mode to ensure better transmission of policy rates to revive the economy.

Given that inflation rates are going up and US –Iran conflict may trigger a further price rise in global crude oil that will have ramifications on inflation in India, a more cautious move is expected from RBI in the coming monetary policy review meet in February.

Inflation Trajectory over Coming Months

In near term, repo rates may not abate.

However, as a result of reduction in repo rates in the previous year bank lending rates may go down which can hasten revival of economy and as a result relief is expected from high price rise.

Besides the effective rate cut transmission, better farm yields in coming months also will help RBI in controlling prices.

According to the Central Bank, despite unseasonal rains Rabi sowing improved and storage in main reservoirs, the main source of irrigation during Rabi season, was at 86 % of full reservoir level against 61 % in the same period a year ago.

In addition, the interest subvention of 2 % on MSME loans can spur credit growth to the sector.

The cumulative impact can improve growth sentiments and would rein in consumer inflation in early 2020-21.

(Article by Dr.K. Srinivasa Rao. He is an Adjunct Professor in National Institute of Insurance and Risk Management, Hyderabad. The views are his own.)