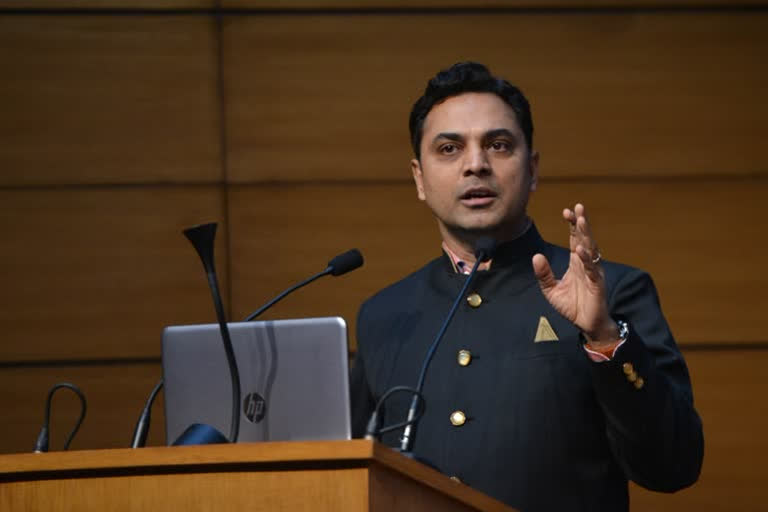

New Delhi: India's fundamentals demand a much better rating, Chief Economic Advisor Krishnamurthy Subramanian said on Thursday after Moody's downgraded the country's rating and S&P retained it at the lowest investment grade.

India's ability and willingness to repay debt is gold standard, he said making a case for ratings upgrade.

He took comfort in rating agencies acknowledging India's reforms, saying these are critical elements for higher growth next year.

On economic growth this year, he said it will depend on when recovery happens. It is uncertain if the recovery will happen in the second half of this year or next year, he said, adding the finance ministry was working on a large range of growth estimates for this year and a recovery in the second half or next year is also part of baseline expectation.

The finance ministry, he said, has evaluated pros and cons of options such as deficit monetisation. "We keep all options under consideration and will be evaluating them."

On privatisation policy, he said that banking will form part of the strategic sector and the government is working on to identify strategic and non-strategic sectors.

CEA said setting up a bad bank may not be a potent option to address the non-performing asset woes in the banking sector.

Read more: Include telemedicine as part of claim settlement of policy: IRDAI to insurers

"So when the bank has to sell that loan to ARC (asset reconstruction company) or a new institution that is created, in that case it has to take haircut. When it takes haircut that will impact the P&L (profit and loss). And that is one of the key aspect affecting the selling of loans.

"So till that particular aspect is not addressed creating a new structure may not be as potent in addressing the problem, Subramanian said.

Currently, banks sell their bad loans to ARCs as per the prudent norms of the Reserve Bank of India.

Subramanian said currently 28 ARCs are functional and their job is to take bad loans from banks and act as bad bank.

The idea of bad bank was also discussed in the meeting of the financial sector regulators FSDC earlier this month.

(PTI Report)