Hyderabad: In a move to widen tax base, the finance ministry on Thursday proposed to expand the scope of the statement of financial transactions (SFT) in order to record high-value expenses by individuals like jewellery purchases, business class/foreign travel or even electricity consumption.

SFT is mainly a record of financial transactions that are mandatory to be reported to the Income-Tax (I-T) department by financial institutions and companies.

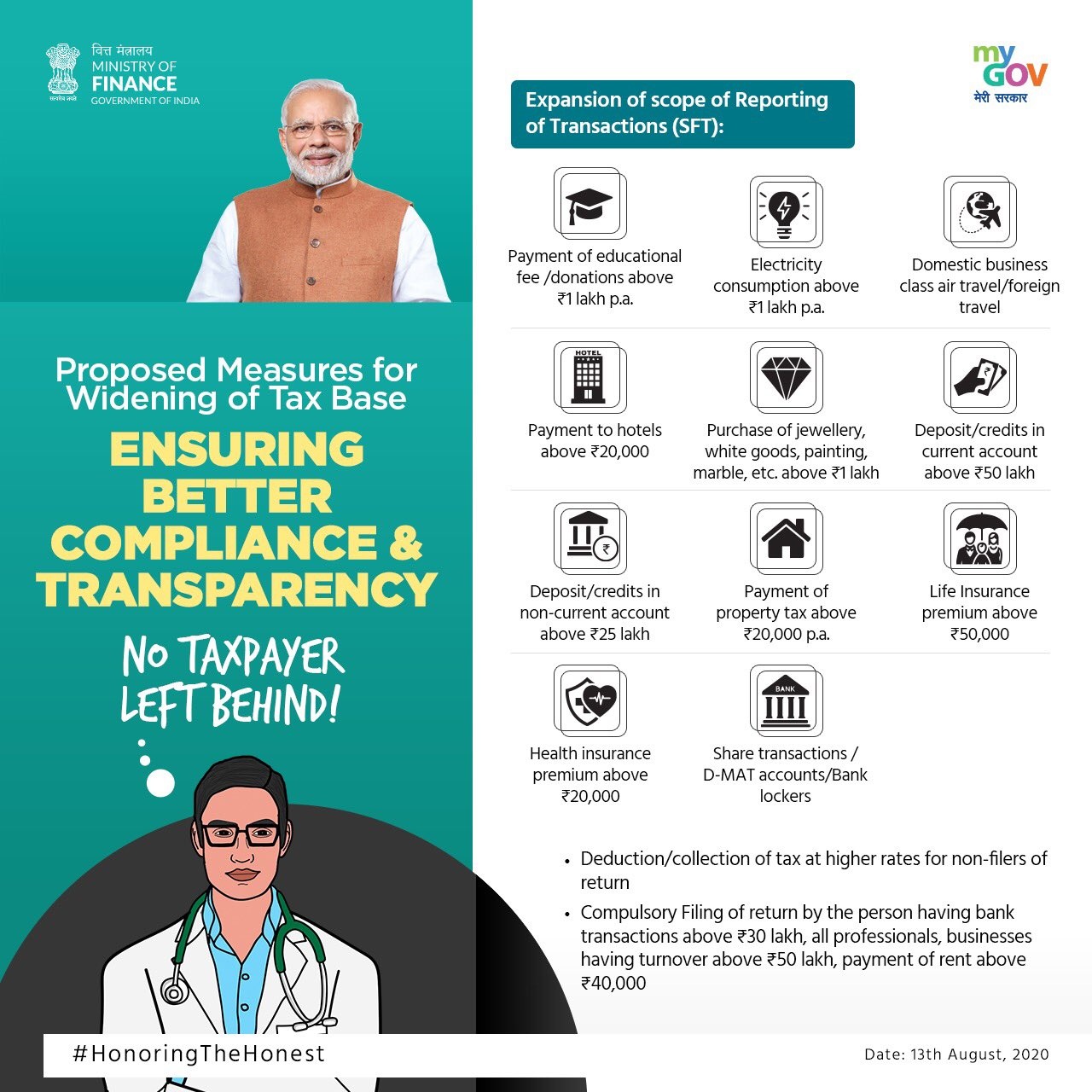

Currently, the reporting under SFT mainly includes cash transactions of high amount or big-ticket purchases of mutual funds, shares and bonds. But the government has now proposed to not only include more high-value transactions, but also reduced the threshold of existing transactions, in order to keep tax evasion in check.

The various transactions that are proposed to be reported to the Income-tax department include purchase of jewellery and white goods (electronic goods and appliances) above Rs 1 lakh, irrespective of whether you have made the payment in cash, card or any other digital mode. Purchases of paintings or marbles worth Rs 1 lakh or above might also be reported.

Read more:Keep it simple, compete on settling claims: IRDAI to insurers

For those who love to travel, all expenses made on foreign trips/business class travel are also proposed to be reported to the I-T department. Payment to hotels above Rs 20,000 may also make their way to the SFT recordings.

Also, if your electricity consumption in a year is above Rs 1 lakh, then it is proposed be reported in SFT by your power distribution company.

Apart from this, transactions like payment of property tax above Rs 20,000 per annum, life insurance premium exceeding Rs 50,000, share transactions in your demat account and deposits/credits above Rs 50 lakh in your current account are proposed to be included in SFT reporting.

The step would help the government spot mismatch between earnings and spending of an individual and take action against wilful tax evaders.

The expansion of SFT would, however, help honest taxpayers as it enables pre-filling of their income-tax returns (ITR). From this year, the format of taxpayers’ tax passbook, or the form 26AS, has been changed to include all transactions recorded in SFTs. Earlier, it only used to give information regarding tax deducted at source (TDS) and tax collected at source (TCS) relating to a PAN.

If the proposed transactions are included in SFT, and thereby in Form 26AS, then it would be like faceless hand-holding of taxpayers to e-file their income tax returns quickly and correctly.

(ETV Bharat Report)