New Delhi: In order to reduce the compliance burden of GST payers during the Covid-19 lockdown period, the Central Board of Indirect Taxes and Customs (CBIC) has rolled out an easy to use facility for taxpayers where they can file their nil GST return by simply sending a text message.

The measure that came into effect on Monday (June 8, 2020) will allow the filing of monthly GST return in GSTR-3B forms through SMS.

It means that the GST payers will not need to log in to GST Portal to file the GSTR-3B returns for inward supply or purchases made by them.

“This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise log into their account on the common portal and then file their returns every month,” said the CBIC in a statement.

The CBIC said the functionality of filing the Nil GSTR-3B return form through SMS has been made available on the GSTN portal with immediate effect.

GST payers can also track whether the Nil GSTR-3B return filed them by sending a SMS has been successful or not.

Users can log in to their GSTIN account and navigate to Services>Returns>Track Return Status and check whether it has been successfully filed or not.

Who should file GSTR-3B Return

GSTR-3B is a self declaration form to be filed by all the entities registered under the GST system even if there is no transactions to show. In such a situation, the person is required to file a Nil GST return. However, certain categories like composition dealers, input service distributors and non-resident taxable persons are exempt from it.

For every GSTN number, a separate GSTR-3B form is required to be filed every month and it cannot be revised.

A step-by-step guide how to file Nil GST return

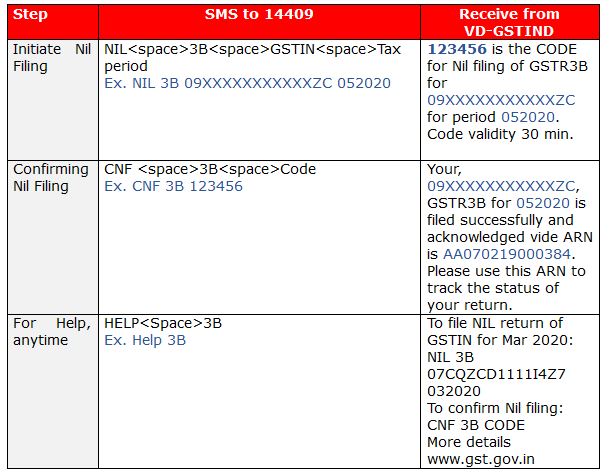

- In order to file the Nil GSTR-3B return, a GST registered payer need to write NIL, then give space, and then write 3B, give space, then write his GSTIN number, and then after a space, he is required to give the tax period in six digits of the month and year (MMYYYY).

- NIL<space>3B<space>GSTIN<space>Tax period, it will look like: ‘NIL 3B 09XXXXXXXXXXXZC 052020’, and then send this SMS to 14409.

- In response, the user will get a message having a six-digit code, which will be valid for half an hour. 123456 is the CODE for Nil filing of GSTR3B for09XXXXXXXXXXXZC for period 052020. Code validity 30 minutes.

How to confirm Nil GST Return filing through SMS

A GST payer can also confirm whether his Nil GST return was successfully filed or not by sending another SMS. The user needs to compose a message like this: CNF <space>3B<space>Code, here the user will write the six digit code that he will have received from GSTN Portal in response to his first SMS. It will look like: CNF 3B 123456, and send this message to the same number 14409.

The GSTN portal will send a SMS to user which should read like this: “Your, 09XXXXXXXXXXXZC, GSTR3B for 052020 is filed successfully and acknowledged vide ARN is AA070219000384. Please use this ARN to track the status of your return.”

However, if a GST payer wants to further confirm then he will have the option to log in to GSTN portal and Services>Returns>Track Return Status.

How to use automated GSTN help service through SMS

A GST payer can simply send six-letter message to avail anytime help facility of GSTN portal. He just needs to write HELP<Space>3B, which will look like this: ‘Help 3B’ and send the SMS to 14409 and in the return message he will get the format for filing and confirming Nil GSTR-3B returns.