New Delhi: The government has constituted a committee of officers to suggest measures to augment GST revenue collections and administration.

"The committee should consider a wide range of reforms so that a comprehensive list of suggestions may emerge," an official order said.

The terms of reference of the panel include making suggestions about systemic changes in goods and services tax (GST) including checks and balances to prevent misuse and measures to improve voluntary compliance.

Also, it has been tasked to give inputs on measures for the expansion of the tax base.

Policy measures and relevant changes needed in the law, improved compliance monitoring and anti-evasion measures using better data analytics and better administrative coordination also form part of its terms of reference, the order said.

"The committee shall submit its first report within 15 days to the GST Council Secretariat," it added.

Why was the panel formed?

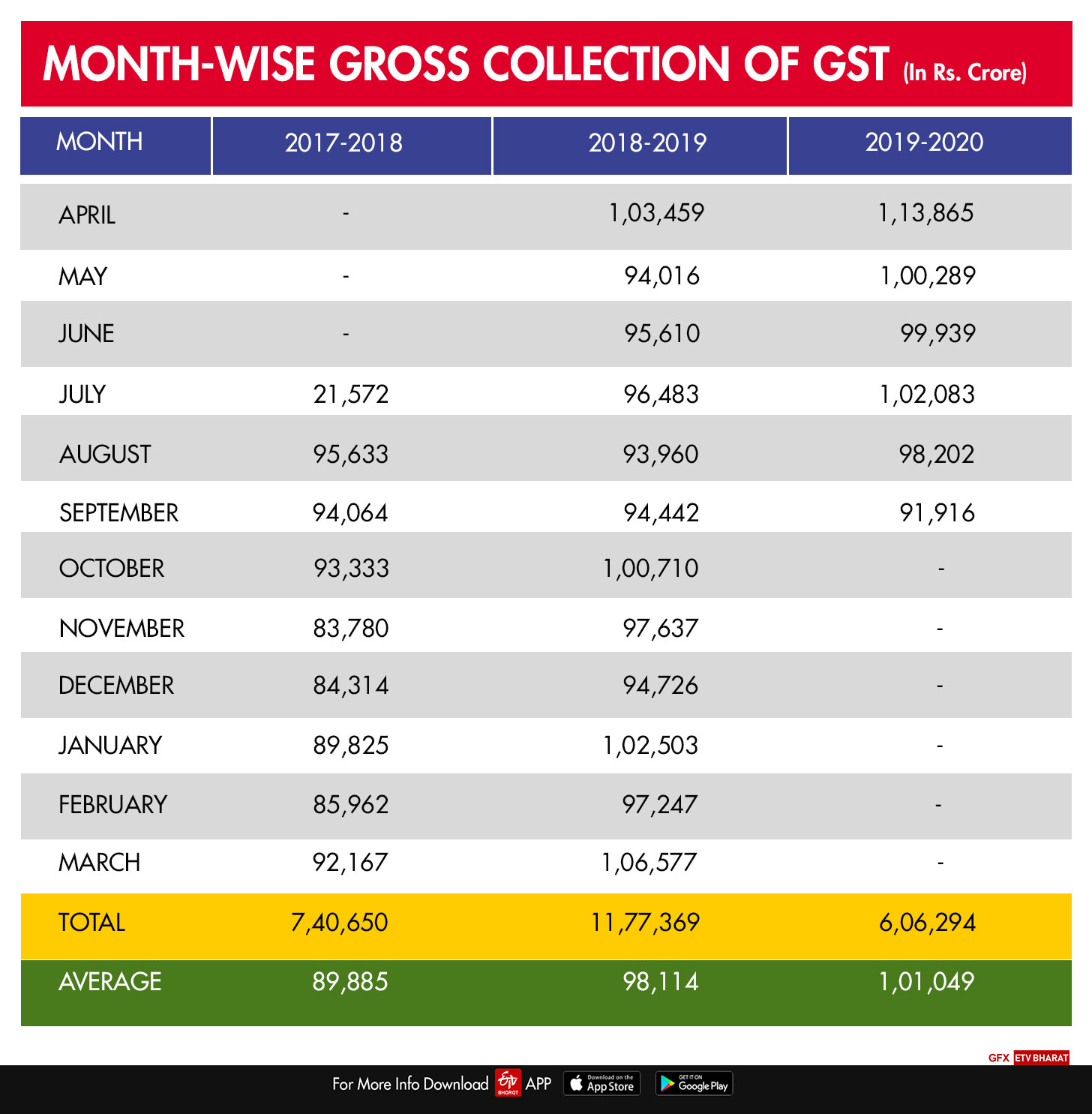

The GST collection in the first four months of FY 2019-20 stood around 1 lakh crore but in the month of September, the collection dropped sharply to a 19-month low of Rs 91,916 crore, reflecting weak consumer demand.

As per the experts, the GST is still a work in the progress and the current slowdown in the economy would affect tax collections in the coming months also.

Read more: Govt giving sector-specific solutions to fight slowdown: Finance Minister